17 Indicators Of Global Recession Are Clanging

Authored by Charles Hugh Smith via OfTwoMinds blog,

The smart money is selling, of course, for the clanging indicators are the dinner bell announcing the banquet of consequences has been served, and Nemesis doesn’t want the meal to get cold.

Correspondent Wilson R. Logan kindly shared his list of 17 indicators of globally synchronized recession. In my view, each is an alarm bell clanging loudly. As Wilson put it, “recessions have vey clear indicators. We’ve all known it was coming and we’ve all had a long time to think about it.”

For context, recall that the global economy is a tightly bound, highly integrated system, which means disruptions in one subsystem quickly ripple though the entire system. Disruptions tend to amplify one another, creating a cascading effect much like an avalanche: everything looks perfectly stable until the entire mountainside gives way.

This isn’t presented as a complete list of indicators; there are a multitude of others. But this is certainly a comprehensive start.

Here are Logan’s 17 indicators of global recession:

1) Tighter credit conditions. Banks see the recession coming and start to build a cash cushion, hoard liquidity, de-risk portfolios (the lessons of Bear Sterns).

2) Increasing REPO fails.

3) Volatility in the Japanese Bills market.

4) Near Term Forward Spread inversion.

5) Swap Spread Compression.

6) Term SOFR & EURIBOR calendar spread inversion.

7) 2-10 yield curve inversion.

8) Hours worked, total compensation falling.

9) Falling oil prices.

10) Factory gate prices falling.

11) ISM survey negative sentiment.

12) UofM consumer sentiment survey negative.

13) Increasing credit card debt.

14) Contango in the WTI Futures curve.

15) Falling value of loans to non-financial corporations (NFCs) (see 1).

16) Diverging GDP & GNI.

17) Labor hoarding.

(CHS note: for example, in Japan, if you want to quit your wretched, low-pay, abusive-boss job, you have to find a replacement first: ‘They refused to let me go’: Japanese workers turn to resignation agencies to quit jobs.)

Thank you, Wilson, for sharing your comprehensive list of global recession indicators. For additional context, let’s turn to two charts.

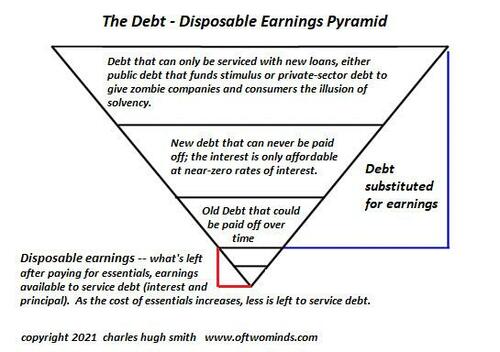

The first is my inverted pyramid of debt and disposable earnings. This relationship between the cost of servicing debt and how much money is left after paying essential expenses (food, utilities, shelter, etc. or the costs of production) is scale-invariant, meaning it works the same for individuals, households, small businesses, global corporations and nation-states.

If the earnings left after paying essential expenses declines while the debt and cost of servicing the debt rise, the entity goes bust and collapses in a heap. For households, as inflation stripmines the purchasing power of their earnings, they increasingly turn to debt to fill the gap between the cash that’s available to spend and what they desire to spend.

When interest rates are falling or near-zero, adding debt appears sustainable. But should interest rates rise, the debt quickly become untenable.

So-called Zombie Corporations have one neat trick to stay alive despite their decaying financials: they roll over their higher-interest debt into a larger, lower-interest debt. Since the sum needed to service the debt remains the same, they can go on their merry way until the next refinancing replenishes their cash-burn.

This is all very jolly until banks refuse to loan them more money, and interest rates rise. Again, this is scale-invariant: as long as the consumer can tap another credit card, the corporation can roll over its debt at lower rates, nations can sell more Treasury bonds, then all is well.

But once credit tightens and rates rise, the dynamic reverses, and bankruptcy is the only “solution” left. Insolvency and writing off all debt is a solution for the borrower/debtor, of course, but a catastrophe for the lender / investor, who receives pennies on the dollar, the rest being a complete and total loss of assets / wealth.

Next, let’s turn to the “impossible,” i.e. bubbles popping with extreme prejudice. How do we know a bubble is a bubble? If the deflation of the bubble is declared “impossible.” For example, today’s global Everything Bubble. Yes, yes, the Everything Bubble cannot possibly pop with extreme prejudice, it will expand forever because (insert Fed Put, AI, Martian Central Bank quatloos, etc.).

History has a peculiar, disconcerting disregard for “likes,” opinions and projections of infinite growth, and so it’s clear that all bubbles pop. Bubbles pop with an eerie symmetry, falling at roughly the same time scale and rate as their ascent. Thus we can project the collapse of the Everything Bubble with some certitude.

Or we can dismiss the 17 indicators clanging loudly and base our confidence on eternal expansion of everything on the Fed Put, AI, or Martian Central Bank quatloos. Pretty much anything will do; all that matters is that a permanently high plateau of overvaluation and financial fantasy is presented as inevitable.

The smart money is selling, of course, for the clanging indicators are the dinner bell announcing the banquet of consequences has been served, and Nemesis doesn’t want the meal to get cold.

* * *

Tyler Durden

Tue, 10/22/2024 – 06:30

Share This Article

Choose Your Platform: Facebook Twitter Linkedin