Goldilocks JOLT Shows Unexpected Increase In Jobs Openings, Hires And Quits

One month ago when the December JOLTS report came out, we were surprised to see just how bad the jobs market was in the first month of the Trump admin (as 556K job openings unexpectedly disappeared), a shocking contrast to the stellar labor market under Trump’s senile and dementia-addled predecessor. If anything, it was the clear early signal that a recession (or “detox” in the words of Bessent) was coming to the US, something we flagged at the time, and which has since been confirmed by both the president and the market, and sent stocks tumbling.

Perhaps tumbling a bit too much, though, because according to the latest JOLTS report published moments ago, job openings in the US rose by 232K to 7.740 million from a downward revised 7.508 million, a big beat to consensus estimates of an unchanged print of 7.6 million January job openings. Still, the number was down by 728,000 over the past year

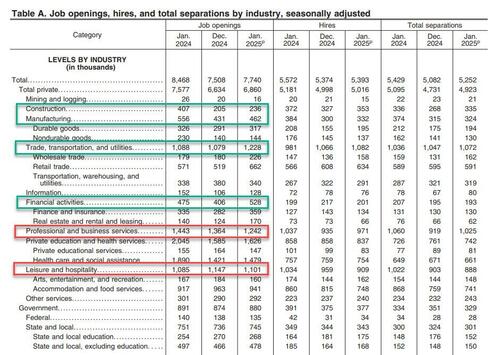

According to the BLS, the number of job openings increased in real estate and rental and leasing (+46,000); job openings also jumped in Trade and transportation (+149K), Financial Activities (122K), Construction (+31K), Manufacturing (+31K). Job openings declined for professional and business services (down 122K) and Leisure and Hospitality (down 46k).

Yet there is a reason to doubt this particular set of numbers – just as there was reason to doubt every set of numbers from Biden – because according to the January report, the number of Federal Government job openings was essentially flat both sequentially and YoY.

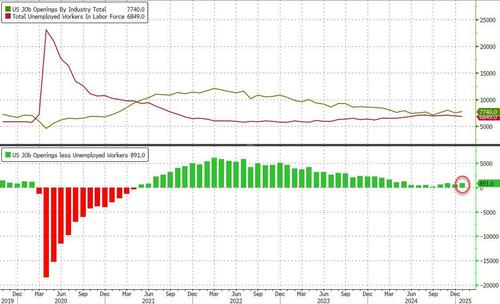

In the context of the broader jobs report, in November the number of job openings was only 714K more than the number of unemployed workers (which the BLS reported was 6.886 million), down from last month’s 1.03 million and one of the lowest differentials since the covid crash.

Said otherwise, in January the number of job openings to unemployed rose modestly to 1.1, the highest since last May if on the low end of the pre-covid range in 2018-2019.

While the job openings data was an upside surprise and a modest reversal of last month’s surprise plunge, what was perhaps even more surprising is that at a time when the labor market is reportedly slowing fast, both the number of hires and quits picked up. To wit, in January, hires rose by about 19K to 5.393 million, while the number of quits soared by 171K to 3.266 million from 3.095 million, a solid glimmer of hope in a labor force as more are once again optimistic they can find a higher paying job elsewhere, and so they quit.

So how to make sense of this sudden collapse in the labor market? Well, it’s possible that after “shocking” the market last month when we saw the biggest drop in job openings in over a year, Trump got the tap on the shoulder that the US market should probably not collapse under his watch, even if he can (still) blame Biden, and so he sent a memo to the BLS to make sure that the numbers aren’t in freefall, but dropping more gradually. Then again, with markets now focused almost exclusively on the global trade wars which they are convinced (at least for now) will be far more negative for the US than anyone else, no amount of pig lipstick on hard data will offset the fact that the global trade war has become the Elephant Bear in the china shop, and until there is some clarity on that front expect most if not all rallies to be sold.

Tyler Durden

Tue, 03/11/2025 – 10:58

Share This Article

Choose Your Platform: Facebook Twitter Linkedin