Microsoft Surges After AI/Cloud Growth Accelerates; But CapEx Slowed

On the heels of Microsoft’s decision to walk away from discussions to lease new server farm space and slow construction on land it already owns, all eyes are on the giant tech company’s fiscal third-quarter earnings tonight for any signs of slowing on data center spending plans when it reports Wednesday.

“We believe that the Azure results and guidance as well as Microsoft’s commentary on capex are going to be the keys to the quarter,” wrote Kirk Materne, an analyst at Evercore ISI.

Investors watch these expenses closely for a glimpse of long-term cloud and AI demand expectations from the world’s largest software maker.

So, what’s the score?

MSFT beat on EVERYTHING…

Microsoft beat on the top line with Q3 revenues of $70.07 Billion (well above the $68.48 billion consensus) and the bottom line (EPS $3.46 vs $3.22 consensus)

-

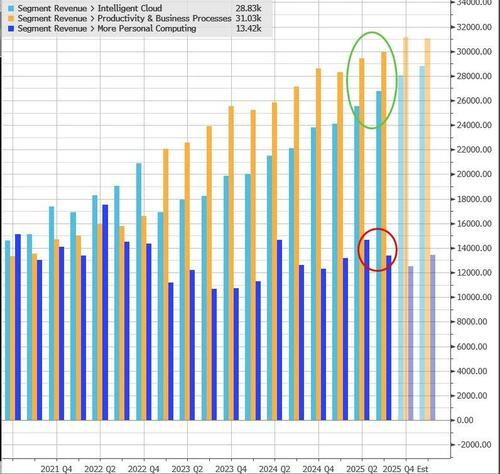

Microsoft Cloud revenue $42.4 billion, estimate $42.22 billion

-

Intelligent Cloud revenue $26.8 billion, estimate $25.99 billion

-

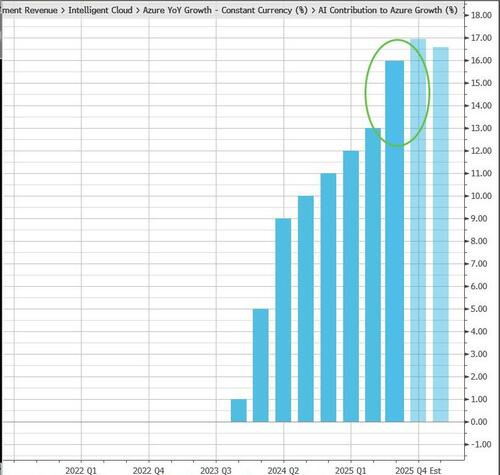

Azure and other cloud services revenue Ex-FX +33%, estimate +31%

-

Productivity and Business Processes revenue $29.9 billion, estimate $29.65 billion

-

More Personal Computing revenue $13.4 billion, estimate $12.67 billion

Cloud revenue surged more than expected with revenues of $42.4 billion (above the $42.22 billion consensus),

“We delivered a strong quarter with Microsoft Cloud revenue of $42.4 billion, up 20% (up 22% in constant currency) year-over-year driven by continued demand for our differentiated offerings,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

Azure & Other Cloud revenue (es-FX) up 35% (better than the 31% consensus).

…AI growth making up 16ppts of that 35% (exp 15.6ppts)…

“Cloud and AI are the essential inputs for every business to expand output, reduce costs, and accelerate growth,” said Satya Nadella, chairman and chief executive officer of Microsoft.

“From AI infra and platforms to apps, we are innovating across the stack to deliver for our customers.”

Operating income was also a solid beat: $32.00 billion, estimate $30.31 billion

But after 10 consecutive quarters of increased spending for artificial intelligence, the company has put on the brakes.

While top-line capital expenditure was $16.75 billion vs. $10.95 billion y/y (above the $16.28 billion consensus)

But, in the first three months of 2025, Microsoft spent $21.4 billion on Capital expenditures including assets acquired under finance leases, down more than $1 billion from the previous quarter (and below the $22.56 billion consensus).

The company is still on track to spend more than $80 billion on capital expenses in the current fiscal year, which ends in June. But, as The NY Times notes, the pullback, though slight, is an indication that the tech industry’s appetite for spending on A.I. is not limitless.

As a result of all this, MSFT shares are soaring after hours…

…and we can’t help but wonder if someone ‘knew’ about this ‘early’ given the moves in the market in the last minutes before the bell.

All eyes now on the call for any signals of a reduction in CapEx (expected at $88 billion for the fiscal year ending in June and $100 billion for the following fiscal year).

Tyler Durden

Wed, 04/30/2025 – 16:18

Share This Article

Choose Your Platform: Facebook Twitter Linkedin