GDP Vs GDI Why The Huge Discrepancy And Which Is The Better Measure Of The Economy?

Authored by Mike Shedlock via MishTalk.com,

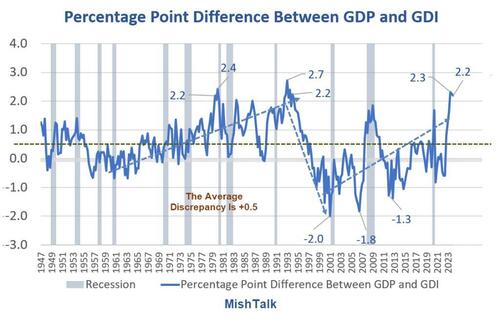

Gross Domestic Product (GDP) and Gross Domestic Income (GDI) are two measures of the same thing. But the difference is now over two percentage points, the third largest in history.

GDP and GDI data from BEA, calculation and chart by Mish

Discrepancy Notes

When GDP is greater than GDI the numbers are positive. When GDI is greater than GDP the numbers are negative.

Last quarter the discrepancy was 2.3 percentage points and this quarter 2.2 percentage points. Only twice in history has the discrepancy been higher.

The average discrepancy is +0.5. This suggests a tendency to overstate GDP relative to GDI.

There is no discernable pattern other than a tendency to revert to the mean, eventually, with long trends in one direction or the other.

Real GDP and GDI in Billions of Dollars

Chart Notes

Gross Domestic Product (GDP) and Gross Domestic Income (GDI) are two measures of the same thing. Product produced should match sales and income. They do over time, but this is a large ongoing discrepancy.

Real Final Sales is the bottom line estimate of GDP. The difference between GDP and Real Final Sales is inventory adjustment which nets to zero over time.

Real means Inflation adjusted using the GDP deflator as calculated by the BEA as the adjustment.

In dollar terms, the discrepancy is the largest ever. However, percentage comparisons are a better measure which is why I created a new chart today to show the percentage point differences.

Reversion to the Mean

There is a strong tendency to revery to the mean. However, reversion to the mean does not imply GDP will fall. GDI could overshoot to catch up.

However, based on where the economy is right now, I would expect GDI to drop with GDP dropping more on a relative basis.

More Soft Economic Data, Q1 GDP Revised Lower, Q4 GDI Significantly Lower

Earlier today, I reported More Soft Economic Data, Q1 GDP Revised Lower, Q4 GDI Significantly Lower

Significant Negative Revisions

2024 Q1 GDP went from 1.6 percent to 1.3 percent.

Based on updated data from the Bureau of Labor Statistics Quarterly Census of Employment and Wages program, Wages and salaries are now estimated to have increased $58.5 billion in the fourth quarter, a downward revision of $73.0 billion.

Real gross domestic income is now estimated to have increased 3.6 percent in the fourth quarter, a downward revision of 1.2 percentage points from the previously published estimate of 4.8 percent.

Regarding the first bullet point, I calculated revised GDP at 1.2509 percent which the BEA rounded to 1.3.

Is GDP or GDI a Better Measure?

The Philadelphia Fed prefers GDI over GDP but it prefers a blend (not an average) which it calls GDPplus even more. Note that GDPE = GDP and GDPI = GDI in the discussion below.

The GDPplus Working Paper is mostly geekish math, but there are some readable snips.

Aggregate real output is surely the most fundamental and important concept in macroeconomic theory. Surprisingly, however, significant uncertainty still surrounds its measurement. In the U.S., in particular, two often-divergent GDP estimates exist, a widely-used

expenditure-side version, GDPE [GDP], and a much less widely-used income-side version, GDPI [GDI].

Nalewaik (2010) and Fixler and Nalewaik (2009) make clear that, at the very least, GDPI deserves serious attention and may even have properties in certain respects superior to those of GDPE. That is, if forced to choose between GDPE and GDPI , a surprisingly strong case exists for GDPI . But of course one is not forced to choose between GDPE and GDPI , and a GDP estimate based on both GDPE and GDPI may be superior to either one alone. In this paper we propose and implement a framework for obtaining such a blended estimate.

Tyler Durden

Sun, 06/02/2024 – 09:20

Share This Article

Choose Your Platform: Facebook Twitter Linkedin