“Buy Everything”: S&P Hits All Time High As Nvidia Passes $3 Trillion

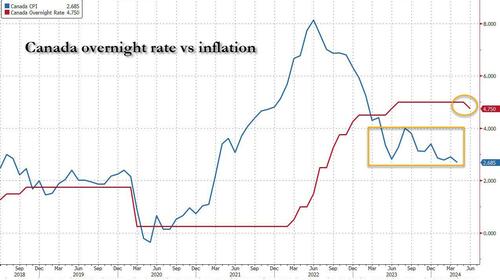

Remember when “developed world” central banks pretended their inflation target was 2%? Well, that lie died a miserable death today – and will do so again for good measure tomorrow – after the BOC cut rates for the first time in 4 years, and less than a year after its last rate hike, from 5.0% to 4.75% even as Canada’s inflation remains a very sticky 2.7%.

And just to underscore the death of the 2% inflation target, tomorrow the ECB will also cut rates for the first time since March 2016 (and 8 months after the last rate hike), even though core Eurozone CPI remains 3%.

Of course, despite all the posturing, the Fed won’t be far behind especially once it becomes clear that the myth of strong US job growth was just a mirage (as explained yesterday), and either in July or September, the Fed will join the party despite core US inflation stuck at a blistering 2.8%.

G7 central banks (today BOC, tomorrow ECB, soon Fed) cutting rates with global core inflation lingering well above %.

Goodbye 2% inflation target.

— zerohedge (@zerohedge) June 5, 2024

It was this long overdue realization that the G7 central banks have officially raised their inflation target by about 1% that helped pushed bond yields to fresh two month lows, and down more some 35bps in just the past week, down for a 5th straight day…

… as financial conditions have eased dramatically (see chart of Goldman Financial Conditions Index below), undoing any jawboned tightening the Fed tried to inject into the market in recent months: indeed, the latest rate pricing shows a sharp dovish shift in the Fed cut narrative for Sept, rising to 80% vs 45% just one week ago. As Goldman’s trader notes, CTAs will become a focus if yields keep moving lower…

And with the tidal wave of easing about to be unleashed by all central banks, it is no surprise that the S&P just hit a new all time high of 5,350, up a whopping 30% from the October lows.

Superficially, there was some intraday variation, with some sectors red (hilariously, energy, which is supposed to power this new AI renaissance continues to get dumped)…

… yet looking below the surface, those hoping that one day… soon… perhaps… the market will broaden out will be disappointed: while the S&P is up 13% YTD, the “Mag 7″” is up 30%, while the S&P493 is up just 6.5%.

And when we talk about the Magnificent 7, we mean really just Magnificent 1: Nvidia is now up a ridiculous145% in just the past 5 months…

… and moments ago NVDA’s market cap rose above $3 trillion, up more than $140 billion today alone, having risen more than $100 billion on 4 of the past 9 trading days…

… but also briefly topped Apple’s $3.005 trillion, and this pace of insane meltup – which will require every tech company buying AI chips for the next several decades to justify the valuation – will make NVDA the world’s biggest company some time tomorrow!

And as we boldly go into yet another absolutely massive asset bubble, one where three companies alone have a market cap of $9 trillion, it is not surprising that cryptos – those assets that sniff out fiat destruction ahead of most – are surging, with bitcoin also on the verge of another record high and trading above $71,000 with ethereum also finally breaking out higher…

… but gold is also starting to move after the recent profit taking, and is up a solid $27 today and fast approaching it own all-time highs.

In fact, the only commodity that is not exploding higher is oil, which instead if getting crushed to boost Biden’s approval rating; indeed, oil will not be allowed to spike until the election… after which all hell will finally break loose.

Tyler Durden

Wed, 06/05/2024 – 20:03

Share This Article

Choose Your Platform: Facebook Twitter Linkedin