Quarterly Refunding: Treasury To Hold Debt Sales Steady For “At Least Several Quarters”

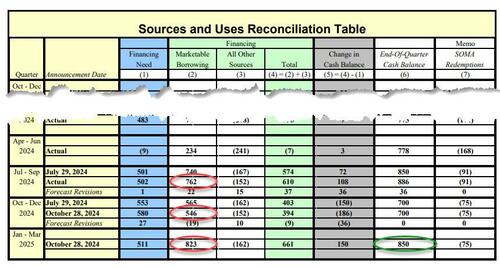

On Monday, the US Treasury published its debt sources and uses estimates for the coming quarter, it noted that it expects slightly less in calendar Q4 offset by a borrowing burst in Q1 2025, when the Treasury expects to issue $823 billion in debt , up from $546 billion in Q4, and a record nominal amount for that quarter.

Fast forward to today when this morning, the Treasury released its latest Quarterly Refunding Announcement, which unlike previous QRAs was a somewhat more subdued affair, with no notable surprises, after it left its quarterly auctions of longer-term debt unchanged as expected, and reiterated its guidance that sizes aren’t expected to be increased “for at least the next several quarters.”

The Treasury said it will sell $125 billion of securities at next week’s quarterly refunding auctions, in line with expectations. The gross issuance will refund approximately $116.4 billion of treasurys, and raise new cash from private investors of approximately $8.6 billion. The securities are:

A 3-year note in the amount of $58 billion, unchanged from last month and unchanged from the last refunding

A 10-year note in the amount of $42 billion, up $3 billion from last month and unchanged from the last refunding

A 30-year bond in the amount of $25 billion, also up $2 billion from last month and unchanged from the last refunding

With regard to Treasury Inflation Protected Securities, or TIPS, the department again made some modest increases as it works to maintain a stable share of these securities relative to overall debt outstanding. Specifically, it bumped the auction sizes of two TIPS issues: December’s 5-year re-opening and the new 10-year issue, which was a bit more than expected. According to the Treasury, it “believes it would be prudent to continue with incremental increases to TIPS auction sizes in order to maintain a stable share of TIPS as a percentage of total marketable debt outstanding.”

Over the November 2024 to January 2025 quarter, Treasury plans to maintain the November 10-year TIPS reopening auction size at $17 billion, increase the December 5-year TIPS reopening auction size by $1 billion to $22 billion, and increase the January 10-year TIPS new issue auction size by $1 billion to $20 billion.

The table below summarizes the sizes for the August to October 2024 quarter and the anticipated auction sizes for the November 2024 to January 2025 quarter, including next week’s 3/10/30Y refunding:

“Based on current projected borrowing needs, Treasury does not anticipate needing to increase nominal coupon or FRN auction sizes for at least the next several quarters,” the Treasury said in a statement, using the same language since May. FRN refers to floating-rate notes.

Additionally, the Treasury said that given current fiscal forecasts, it expects to maintain the offering sizes of benchmark bills through November and, in late-November, anticipates issuing one or two CMBs to meet its cash management needs at that time. Given projections for receipts associated with the mid-month corporate tax date, Treasury then expects to implement modest reductions to short-dated bill auction sizes during the month of December, just in time for the drain of the Reverse Repo facility. Thereafter, over the course of January 2025, Treasury anticipates increasing bill auction sizes based on expected fiscal outflows.

Given the massive increase in total US debt, and the relentless increase in US borrowing which has pushed interest expense on the debt to a record $1.1 trillion for the first time ever, a growing number of bond strategists had cautioned the Treasury might revise its guidance on holding auction sizes steady. Many dealers expected no change, however, given that current sizes – most at record highs – are likely to be sufficient for meeting the government’s funding needs until the second half of 2025, unless of course the next president unleashes a massive fiscal stimulus program… which they will.

Here even Bloomberg notes that since neither Trump nor Kamala have made deficit reduction a central element of their campaigns, raising longer-term debt sales is inevitable at some point, in the view of most dealers and economists. And that’s what the recent spike in yields may be reflecting: a return of the dreaded term premium, an imaginary concept which merely reflects the unknown surge in future debt issuance.

Indeed, recent auctions have sparked concerns about the size of issuance. The latest monthly auctions of 2- and 5-year securities, for example, drew higher-than-anticipated yields, showcasing such worries.

Over the three month period, the Treasury said it plans to use bills — which mature in up to a year — to address any seasonal or unexpected variations in borrowing needs. The department expects to implement “modest reductions” to short-dated bills in December before boosting them again in January.

Separately, several strategists had warned ahead of Wednesday’s announcement to take the Treasury’s new guidance with a grain of salt since it’s the final refunding for the Biden administration. Depending on who wins the Nov. 5 presidential election, there will almost certainly be changes in US debt management strategy, not to mention a new treasury secretary.

One thing that is certain is that whoever wins, will have to deal with operating under the constraint of the federal debt limit, which is scheduled to kick back in at the start of January at which point the US will resume draining the Treasury’s cash balance until another debt ceiling can kicking is approved. And so, until Congress re-suspends or boosts the ceiling, the Treasury will have to rely on a series of extraordinary measures, along with cuts to bill issuance and the cash balance, to make good on its spending obligations.

Meanwhile, in a separate statement from the Treasury Borrowing Advisory Commitee, arguably the most important unelected panel in the world after the Fed, composed of dealers, fund managers and other market participants, “emphasized the risk that debt limit constraints could hamper the efficient funding of the government at the lowest possible cost to the taxpayer.”

“Lack of resolution of the debt limit runs the risk of undermining the foundation of the US Treasury market,” the TBAC said adding that “these episodes can cause significant economic uncertainty, affect financial markets and impact US credit ratings.”

As noted above, the debt limit will resume just as the Treasury faces high seasonal borrowing pressures. On Monday, it advised that it faces a net borrowing requirement of some $823 billion in the three months through March — a record nominal amount for that quarter. The estimate assumes Congress will act in time to lift or set aside the debt limit.

One dynamic that could help the Treasury is a further slowdown, or end, to the Federal Reserve’s runoff of its Treasuries holdings. The Fed currently lets up to $25 billion mature a month without replacement — a dynamic that forces the Treasury to sell more to the public. The Fed holds its next policy meeting Nov. 6-7. However, with the repo market already on edge, many are worried that continued drains of systematic liquidity will only lead to another repo market crisis (see “What Is Going On With Swap Spreads?”: Goldman Warns All Hell About To Break Loose In Repo“).

In its quarterly survey of dealers ahead of the refunding, the department had asked whether it should consider adding to its current lineup of three TIPS maturities. The Treasury also asked the TBAC for thoughts on the use of digital technology in the Treasuries market, such as the potential benefits and costs of tokenizing Treasuries, and the use of blockchains.

“What effects might these trends have on recommended Treasury issuance” and trading in the secondary market, officials asked.

Wednesday’s statement also detailed a new schedule of buybacks for the November-to-early February period. The Treasury began buyback operations in May that are aimed to support market liquidity. In September, it also launched buybacks for cash management purposes.

The TBAC said that the new buyback program “continues to be modestly supportive of liquidity, including from cash management buybacks.”

Tyler Durden

Wed, 10/30/2024 – 10:29

Share This Article

Choose Your Platform: Facebook Twitter Linkedin