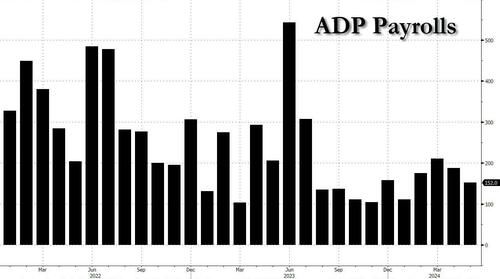

ADP Payrolls Unexpectedly Tumble To Lowest Since January As Wage Growth Continues Slowing

Extending the recent trend of unexpectedly weak labor market indicators, moments ago ADP reported that in May, the US added just 152K Private Payrolls, a 36K drop from the March (downward revised) number of 188K (originally 192K) to the lowest number since the 111K reported in January…

… and far below the median consensus of 175k.

Under the hood, unlike last month when practically everything was solid, there were multiple weak spots, with manufacturing and mining jobs seeing a sharp drop in jobs in the goods-producing category, coupled with further job losses in highly paid information and professional services. Meanwhile, the biggest gains were once again in the lowest paid education/health services. Additionally, there were job losses in the Pacific West and among small companies (between 20 and 49 workers).

Confirming the slowdown, ADP’s chief economist Nela Richardson, said that “Job gains and pay growth are slowing going into the second half of the year,” adding that “the labor market is solid, but we’re monitoring notable pockets of weakness tied to both producers and consumers.”

Wage growth continue to slow for Job-Changers, who saw a 7.8% increase in pay in May, down from 8.0% in April, while Job-Stayers’ wage growth remained unchanged at 5.00% for the 3rd month.

Finally, as a reminder ADP headline data had under-estmated the BLS magical print for eight straight months until today’s report saw a modest beat, which comes two days ahead of Friday’s BLS data.

And as we now wait for Friday’s jobs report and next week’s FOMC decision and Powell presser, the market’s reaction was an extension of the dovish sentiment observed, which sent yields to session lows just above 4.30%, which is odd since there has traditonally been very little signaling power from ADP for Friday’s more significant nonfarm payrolls number. And yet the market is starting to think that Friday we get a big downside surprise, one which may put September or even July rate cuts back on the table.

Tyler Durden

Wed, 06/05/2024 – 09:06

Share This Article

Choose Your Platform: Facebook Twitter Linkedin