Boeing Offers 90 Million Shares & $5 Billion Depositary Shares To Boost Liquidity

Update:

Boeing’s money raise officially hit this AM. The offering: 90 million shares of common stock and $5 billion in depositary shares.

Goldman Sachs, BofA Securities, Citigroup, JPMorgan are leading the deal as joint bookrunning managers for both offerings.

Here are the offering details from Boeing:

The Boeing Company [NYSE: BA] (“Boeing” or the “Company”) announced today the launch of concurrent separate underwritten public offerings of (i) 90,000,000 shares of common stock, par value $5.00 per share (“Common Stock”) of the Company and (ii) $5 billion of depositary shares (“Depositary Shares”), each representing a 1/20th interest in a share of newly issued Series A Mandatory Convertible Preferred Stock, par value $1.00 per share (“Preferred Stock”), of the Company (together, the “Offerings”). Boeing expects to grant to the underwriters of the Offerings a 30-day option to purchase up to an additional (i) 13,500,000 shares of Common Stock and (ii) $750 million of Depositary Shares, solely to cover over-allotments, if any. Boeing intends to use the net proceeds from the Offerings for general corporate purposes, which may include, among other things, repayment of debt, additions to working capital, capital expenditures, and funding and investments in the Company’s subsidiaries.

Holders of the Depositary Shares will be entitled to a proportional fractional interest in the rights and preferences of the Preferred Stock, including conversion, dividend, liquidation and voting rights, subject to the provisions of a deposit agreement. The Preferred Stock is expected to have a liquidation preference of $1,000 per share. Unless earlier converted, each share of Preferred Stock will automatically convert, for settlement on or about October 15, 2027, into a variable number of shares of Common Stock based on the applicable conversion rate, and each Depositary Share will automatically convert into a number of shares of Common Stock equal to a proportionate fractional interest in such shares of Common Stock. The dividend rate, conversion terms and other terms of the Preferred Stock will be determined at the time of pricing of the offering of the Depositary Shares. Currently, there is no public market for the Depositary Shares or the Preferred Stock. Boeing intends to apply to list the Depositary Shares on the New York Stock Exchange under the symbol “BA.PRA.”

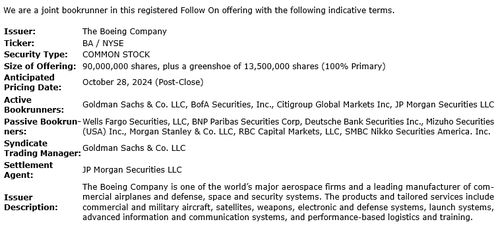

Goldman blasted an email to clients this AM: “We are a joint bookrunner in this registered Follow On offering with the following indicative terms.”

* * *

Boeing shares moved lower in premarket trading in New York after a Bloomberg report revealed a capital raise could take place as soon as Monday. This would prevent credit rating agencies from downgrading Boeing’s investment-grade credit rating to speculative territory amid dwindling cash reserves and a drawn-out strike.

Three sources familiar with the matter said the beleaguered airplane maker, plagued by a months-long strike, could raise as much as $15 billion, adding the amount could change depending on demand.

Boeing’s advisers have been lining up a funding deal for weeks.

These are dire times for Boeing…

Oct 1: Dilution Fears: Boeing Considers $10 Billion In New Shares As Strikes Strain Liquidity

Oct 15: Boeing Desperate For Liquidity, Files $25 Billion Shelf Registration

Oct 20: Boeing Explores Asset Sales In Potential Shrinking Of Corporate Footprint

The people noted that the transaction will likely consist of a combination of common shares and a mandatory convertible bond. About two weeks ago, the planemaker filed a $25 billion shelf registration.

At the time, Boeing wrote in the shelf filing: “This universal shelf registration provides flexibility for the company to seek a variety of capital options as needed to support the company’s balance sheet over a three-year period.”

The latest strike estimates from JPMorgan analysts indicate Boeing will lose $1.5 billion each month if workers stay off the production lines of commercial jets and continue picketing in the streets. Three major rating agencies have warned that the strikes could downgrade Boeing’s investment-grade credit rating to speculative territory, in other words, ‘junk.’

Last month, CFO Brian West told analysts at the Morgan Stanley conference that Boeing “will take any necessary actions” to preserve its investment grade rating and beef up its balance sheet.

“We are perfectly comfortable to supplement our liquidity position to support those two objectives,” West told investors when asked about future money raises.

Goldman analysts Noah Poponak and Anthony Valentini recently told clients:

“The company faces a balance sheet question, and has suggested raising capital is possible given the importance of the credit rating. We assume Boeing raises $12bn of equity before year-end, which matches the total maturities due in 2025 + 2026, and keeps the cash balance well north of $10bn in the near-to-medium-term while they ramp back up commercial deliveries and strive to resolve defense profitability.”

Bloomberg noted:

“Boeing needs the capital infusion to maintain its investment-grade rating and fund its eventual recovery from a crippling strike, now in its seventh week. The company is on pace to use around $4 billion in cash during the fourth quarter, which would bring its free-cash outflow to around $14 billion for the year. The planemaker expects to continue burning cash through the first half of next year as it restarts its airplane factories, including the assembly lines for its cash-cow 737 Max jetliner.”

In markets, Boeing shares are lower by about 1% in premarket trading…

At all costs, Boeing must protect its investment-grade rating.

Tyler Durden

Mon, 10/28/2024 – 07:20

Share This Article

Choose Your Platform: Facebook Twitter Linkedin