Crypto Regulatory Pivot Accelerates: FDIC Releases 790 Pages Of Letters; SEC Dials Down Oversight, Reassigns Lawyers

That’s quite a pivot…

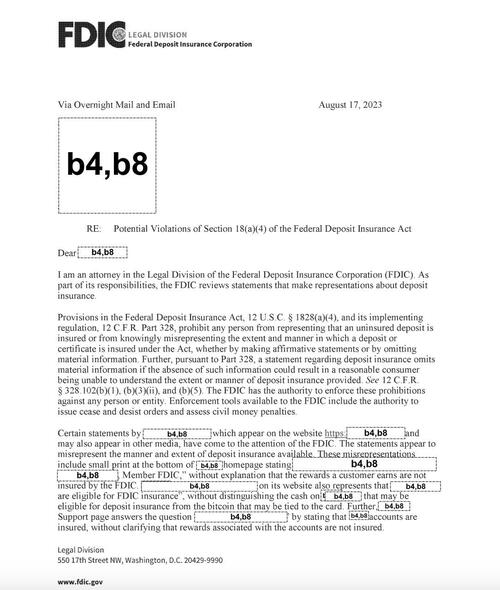

The Federal Deposit Insurance Corporation (FDIC), the regulatory body overseeing banks in the United States, has released 790 pages of additional correspondence related to firms offering crypto services to clients.

According to the FDIC, the documents show requests from banks and other institutions to offer crypto services to clients were almost always met with resistance, delays, constant requests for more information and pause letters.

As CoinTelegraph’s Vince Quill reports, the newly revealed document tranche included previously released correspondence from 24 banking firms and additional correspondence from other firms that requested permission to offer crypto-related services.

“Looking forward, we are actively reevaluating our supervisory approach to crypto-related activities,” FDIC Acting Chairman Travis Hill wrote, marking a seismic shift in the government agency’s stance toward the crypto industry.

Additional FDIC document relating to crypto services. Source: FDIC

FDIC exposed in Freedom of Information Act request

Coinbase filed two Freedom of Information Act (FOIA) requests for FDIC documents related to the debanking of crypto firms under Operation Chokepoint 2.0 in October 2024.

One of the requests sought documentation relating to a 15% cap on bank deposits from crypto-related companies.

A US court released the initial tranche of FDIC documents in December 2024, which included several heavily redacted pause letters sent to banks offering crypto services or products to clients.

Following the public release of the documents, US Judge Ana Reyes chastised the FDIC for the heavy redactions and ordered the agency to produce more transparent documents.

The FDIC “cannot simply blanket redact everything that is not an article or preposition,” Judge Reyes wrote in a Dec. 12 order, which characterized the redactions as a “lack of good-faith effort.”

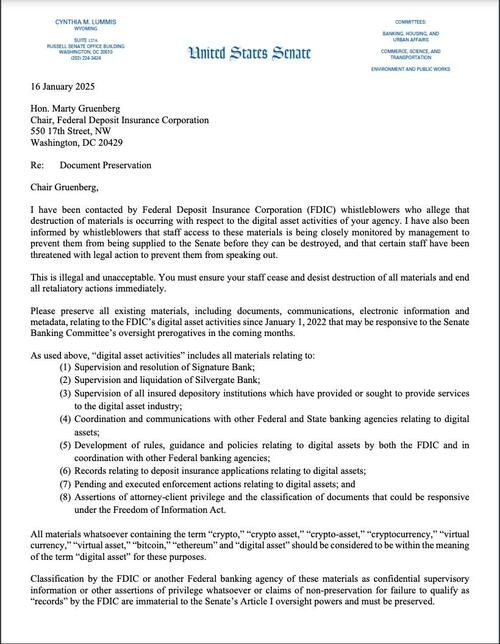

Senator Lummis’ letter to the FDIC instructing them to preserve records related to crypto enforcement. Source: Senator Cynthia Lummis

Wyoming Senator Cynthia Lummis accused the FDIC of destroying documents related to Operation Chokepoint 2.0 in January 2025 and instructed the agency to preserve all records relating to “digital asset activities” from 2022 onward.

Senator Lummis also threatened to make criminal referrals to the US Department of Justice if the destruction of evidence by FDIC employees was discovered by the Senate Banking Committee.

At the same time, Decrypt reports that the U.S. Securities and Exchange Commission (SEC) is cutting back its specialized crypto enforcement unit, reassigning more than 50 lawyers and staff members focused on regulating digital assets as a changing landscape under President Donald Trump takes root.

Several members of the crypto unit have been shifted to different departments within the agency, according to a Tuesday report by The New York Times, which cited several anonymous sources.

At least one senior lawyer was removed from the enforcement division altogether – a move some insiders described as an “unfair demotion,” per the report.

The crypto unit overhaul is part of the Trump administration’s efforts to curtail government intervention in digital assets. Trump has vowed to curb regulatory oversight in the crypto sector since his Presidential campaign and make the U.S. a global leader in digital assets.

SEC Commissioner Hester Peirce, who long ago earned the nickname “Crypto Mom,” has laid out how the watchdog will regulate the digital asset industry with its new crypto task force—and did so in a letter that blasted the previous administration’s approach. Peirce, who was announced as the new task force’s boss last month, wrote Tuesday that the SEC would take a while to get on track and regulate a fast-moving and arcane industry. “It took us a long time to get into this mess, and it is going to…

While the SEC has not yet responded to requests for comments from Decrypt on the restructuring, Commissioner Hester Peirce, who now leads the agency’s newly formed crypto task force, has signaled a significant shift in the agency’s priorities.

Peirce, a longtime advocate for clearer crypto guidelines, blasted the SEC’s past regulatory approach in a statement Tuesday, calling it “marked by legal imprecision and commercial impracticality.”

Known affectionately by those within the industry as “Crypto Mom,” Peirce likened the agency’s past treatment of digital assets to “a car careening down the road” and vowed to introduce a more balanced framework.

The staff reassignment also raises questions about ongoing SEC lawsuits against major crypto firms, including crypto giant Coinbase. The SEC sued the exchange in 2023, alleging it operated as an unregistered securities platform.

That case became a litmus test for former Chair Gary Gensler’s assertion that most cryptos should be classified as securities.

During Gensler’s tenure, multiple industry leaders shot back, accusing the SEC of attempting to “unlawfully kill” the crypto industry while refusing to provide clear regulatory guidelines.

On Thursday, the U.S. Securities and Exchange Commission expedited approval for the Bitwise Bitcoin and Ethereum ETF, allowing it to be listed and traded on NYSE Arca. Bitwise’s hybrid ETF will offer investors direct exposure to Bitcoin (BTC) and Ethereum (ETH) in a single fund with Coinbase’s custody business to oversee the fund’s holdings.

“I really want to interpret this as a sign the new SEC will be faster, but no way to know really,” Bloomberg senior ETF analyst Eric Balchunas wrote on X,…

The SEC’s overhaul is just one piece of the Trump administration’s broader effort to rewrite the rulebook on crypto.

Last month, the agency scrapped Staff Accounting Bulletin No. 121 (SAB121), a controversial policy that forced firms to treat customer-held crypto as a liability.

Critics, including Peirce, said the rule unfairly burdened banks and kept them from embracing digital assets.

In one of his first executive orders, the President established a presidential working group on crypto policy and outright banned the creation of a central bank digital currency (CBDC)—a clear rejection of a government-issued “digital dollar.”

Tyler Durden

Wed, 02/05/2025 – 14:20

Share This Article

Choose Your Platform: Facebook Twitter Linkedin