ECB Cuts Rates As Expected, Euro Tumbles After Reference To “Restrictive Policy” Is Dropped

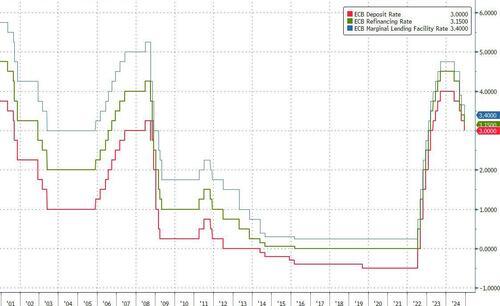

As expected, the ECB cut rates by the bare minimum 25bps, avoiding a 50bps cut which some had penciled in and said is required at a time when Europe’s economy is in freefall even though inflation remains sticky. The ECB’s fourth rate cut of this easing cycle pushed the Deposit rate to 3.0% from 3.25%, and also trimmed the Refi Rate and Lending Facility rate to 3.15% and 3.40% respectively.

While the decision was inline, there were some big changes to the ECB’s policy language. Gone are the references to restrictive policy settings and inflation returning to the target. Reading between the lines here, the ECB judges it’s basically there.

NEW LANGUAGE:

The Governing Council is determined to ensure that inflation stabilises sustainably at its 2% medium-term target. It will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance. In particular, the Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.

OLD LANGUAGE

The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim. The Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction.

The biggest highlight is that the ECB dropped the term “it will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim”. That reflects the fact that at 3.0%, even for the most hawkish members of the committee, the policy rate is considered to be neutral rather than restrictive. According to UBS, “this isn’t in itself a dovish signal, rather it’s a statement of fact. Policy isn’t considered to be restrictive so the reference has to go.”

Most important message from ECB in the decision statement:

The hawkish bias of policy restrictiveness is removed. There is no cues about a potential jumbo cut or where they land (terminal rate), but importantly, the hawkish bias is removed

btw, it was a 25bp rate cut

— Piet Haines Christiansen (@pietphc) December 12, 2024

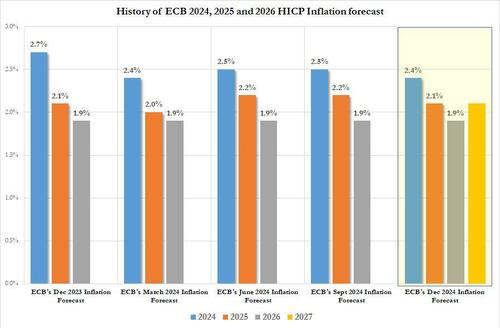

The ECB also downgraded the inflation section, which now has the line: “The disinflation process is well on track.” However, that’s tempered by the fact the inflation forecasts are still sending the same signal. Inflation averages above target in 2025 and is well above target on core, at 2.3% (which is unchanged from September’s forecast).

The ECB maintained in the statement the warning on wage growth: “[Inflation] remains high, mostly because wages and prices in certain sectors are still adjusting to the past inflation surge with a substantial delay.”

Some more details from the report:

STANCE:

- Governing Council is not pre-committing to a particular rate path.

- Will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance.

- Monetary policy remains restrictive

ECONOMY:

- Staff now expect a slower economic recovery than in the September projections

- The gradually fading effects of restrictive monetary policy should support a pick-up in domestic demand

The ECB also downgrade its economic forecasts:

HICP INFLATION:

- 2024: 2.4% (prev. 2.5%),

- 2025: 2.1% (prev. 2.2%).

- 2026: 1.9% (prev. 1.9%),

- 2027: 2.1%

HICP CORE INFLATION (EX-ENERGY & FOOD):

- 2024: 2.9% (prev. 2.9%),

- 2025: 2.3% (prev. 2.3%),

- 2026: 1.9% (prev. 2.0%), 2027: 1.9%.

GDP:

- 2024: 0.7% (prev. 0.8%),

- 2025: 1.1% (prev. 1.3%),

- 2026: 1.4% (prev. 1.5%), 2027: 1.3%

According to UBS, the ECB’s commentary was “disappointing” with the refusal to acknowledge the economic challenges in the Eurozone or give any indication the markets are pricing correctly. The ECB said it was not pre-committing to any particular rate path. It said it was determined that inflation should stabilise sustainably at the 2% target. It said inflation had slowed, but remains high overall.

Commenting on the rate cut, DB’s European chief economist Mark Wall said that “this ECB easing cycle has further to go. The ECB delivered the fourth quarter-point rate cut of this easing cycle at the December meeting and the second back-to-back cut. More importantly, the door has been opened more clearly to further cuts. The ECB continued to describe current financing conditions as tight but dropped the reference to needing to keep policy sufficiently restrictive for as long as necessary. This combination signals an easing bias. For a market that has been pricing the chances of a sub-neutral terminal rate in 2025 today’s ECB decision will feel like an endorsement.”

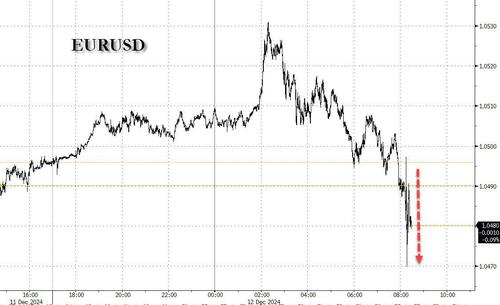

The euro fell to a fresh day low of $1.0470 and it’s down to the ECB dropping the ‘restrictive policy’ part from its statement. That doesn’t mean however that policy language is outright dovish. Moves in euro area bonds are muted.

There was also a relatively choppy reaction in EGBs with Bund Mar‘25 slipping from 135.76 to 135.64 before paring and then lifting to 135.84 over the course of three minutes. Here is the latest ECB Pricing expectations:

- Jan‘25 -27bps

- Mar’25-63bps

- End-2025-125bps

And now we turn attention to Lagarde’s presser.

Tyler Durden

Thu, 12/12/2024 – 08:36

Share This Article

Choose Your Platform: Facebook Twitter Linkedin