“Energy Transition Failing”: Hedge Funds Mount Climate Short Bets On Green Tech Stocks

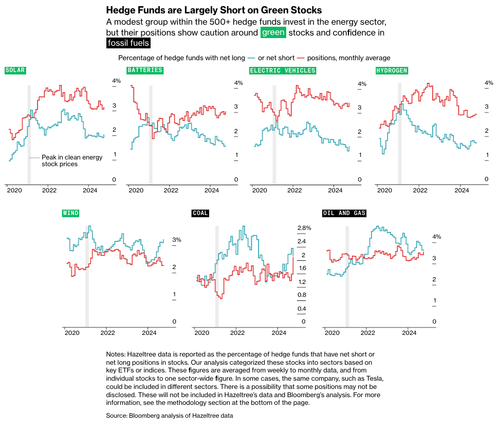

A new Bloomberg analysis of 500 hedge funds tracked by Hazeltree, a data compiler in the alternative investment industry, finds an increasing number of Wall Street hedge funds are, on average, net short batteries, solar, electric vehicles, and hydrogen companies compared to those long green companies.

Data also shows that more funds are net long fossil fuels than shorting oil, natural gas, and coal. This comes despite the Western world and China deploying hundreds of billions of dollars in green stimuli packages to support these industries. Yet, considering some green industries are not sustainable in the short run, some speculative green tech firms have already imploded.

Wall Street quickly realized in 2023 that clean energy and green tech investments wouldn’t deliver the fast returns they had banked on. Many were blinded by government and MSM’s climate crisis propaganda, pouring money into green companies that never had a chance in a high-interest-rate environment.

The Bloomberg analysis provides a glimpse into misguided investments by much of Wall Street. Now, funds are primarily net short green tech while long fossil fuels.

Readers were provided numerous notes on the worsening green energy bubble meltdown last year:

Green Energy Meltdown To Continue Next Year, Bloomberg Survey Finds

There Is A Financial Crisis Brewing In Offshore Wind Energy

US Clean Energy Stocks Have Lost $30 Billion In Value In The Last 6 Months

And the continuation into 2024:

ESG Bubble Further Deflates As CEOs Ditch Green Lingo On Earnings Calls

Another Green Energy Company Declares Bankruptcy, Thank Biden’s Tariffs

Solar Firm Lumio Files For Bankruptcy After ‘Sharp Decline In Demand’

In markets, since peaking in 2021, the S&P Global Clean Energy Index has slid 60%, while the S&P Global Oil Index has jumped 70%.

Impax Asset Management, a clean-energy transition fund that once had $50 billion valuation, has seen its value collapse by over half since 2021.

Here’s more from Bloomberg:

Beyond the tougher macro-economic backdrop that green investors have had to contend with over the past few years — with higher interest rates upending capital-intensive projects like offshore wind farms, and limiting funding for emerging technologies — there continues to be a hostile political backdrop. Investment managers who remain full-throated in their embrace of green, sustainable or ESG (environmental, social and governance) strategies regularly have to defend themselves against US Republicans enraged by what they see as a “woke,” anti-capitalist conspiracy.

Then there’s the other, more consequential political risk. Most of the hedge fund managers Bloomberg interviewed pointed to an increasingly hostile geopolitical environment, with obstacles such as tariff wars leaving them unwilling to invest in classic green bets such as EVs or solar power. In fact, with much of the supply chain for green technology now depending on China, the risk of a full-blown trade war targeting its products has become a direct threat to the financial appeal of clean energy, they said.

“The energy transition is failing, and will fail,” Barry Norris, the founder and chief investment officer of UK hedge fund Argonaut Capital Partners LLP, told Bloomberg, adding fossil fuel will remain the top energy source for years to come.

All hope isn’t lost. From the beginning, we’ve told readers that the real green trade lies in nuclear energy: “Buy Uranium: Is This The Beginning Of The Next ESG Craze.”

Tyler Durden

Mon, 10/21/2024 – 08:45

Share This Article

Choose Your Platform: Facebook Twitter Linkedin