Futures, Global Markets Tumble On Tariff Tiff, Gold Soars To New Record High

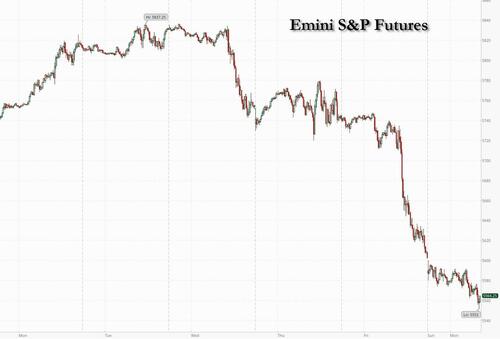

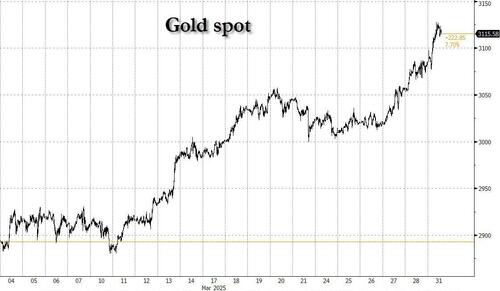

US equity futures and global markets tumbled on the last day of the worst quarter for US stocks in 23 years as the April 2 “liberation day” comes into sharp view. As of 8:00a, S&P futures are down 1.1% after Trump dented hopes he would limit the initial scope of levies set to be unveiled on Wednesday, telling reporters aboard Air Force One he plans to start with “all countries” leading to Goldman promptly slashing its S&P price target for the second time in weeks, now seeing the index dropping to 5300 in 3 months; Nasdaq futures tumbled 1.6% driven by heavy selling of the Mag 7 stocks (NVDA -3.2% and TSLA -4.1%). It wasn’t just the US: Europe’s Stoxx 600 slid 1.2% and Asian stocks suffered sharp losses, with the Japan’s Nikkei 225 index losing 4% and Taiwan’s stock index falling into a correction. Bond yields are 4-7bps lower; the USD was lower at first but has since rebounded . Commodities rise across the board: gold trading up 1.1% to a new record high of $3120, with base metals mostly higher, and Brent above $74. This week, all eyes are on April 1st (all studies related to trade policy will be completed) and April 2nd (reciprocal tariff announcement, sectorial tariffs such as pharma, semis and commodities, the resumption of 25% tariffs on USMCA-compliant goods). We will also receive ISMs and NFP this week.

In premarket trading, Tesla (TSLA) is leading losses among the Mag 7 ahead of President Trump’s deadline for a new set of sweeping global trade tariffs (Mag 7 movers: Tesla -6.0%, Nvidia -4.3%, Amazon -2.2%, Meta -2.5%, Microsoft -1.6%, Apple -0.8% and Alphabet -1.1%). Cryptocurrency-exposed stocks slip in premarket trading as Bitcoin slumps anew, with crypto traders flocking to the options market to hedge against further price declines. Canada Goose (GOOS) shares fall 5.3% in premarket trading on Monday as Barclays cuts the upscale parka retailer’s rating to underweight from equal-weight, citing challenging macro pressures. Here are the other notable premarket movers:

- Celsius Holdings (CELH) shares gain 1.0% after Truist Securities raised its recommendation to buy from hold, saying the company’s Alani Nu acquisition gives it an “extremely strong position” in the women’s segment of the US energy drink category.

- Sarepta Therapeutics (SRPT) shares drop 6.3% after RBC Capital Markets downgraded the drugmaker to sector perform from outperform, citing less confidence in the company’s gene therapy, Elevidys, for the treatment of Duchenne muscular dystrophy (DMD).

- United States Steel (X) shares are down 1.4%, after BMO Capital Markets downgraded the company to market perform from outperform.

- US-traded EHang (EH) shares jump 5.6% as the Chinese firm said it has been granted the first batch of air operator certificates for civilian autonomous aerial vehicles by China’s aviation regulator.

- Vaxcyte (PCVX) shares dropped 30% after reporting that its infant pneumococcal vaccine VAX-24 met phase 2 study immune response targets.

We had an eventful weekend with a slew of headlines from Washington: (i) a WSJ article suggested that the 20% tariff hike across-the-board is back on the table (here), along with Trump’s comments that he “couldn’t care less” if automakers raised prices due to new tariffs (CNBC); (ii) geopolitical tensions seem to rise with Russia (Trump said in an interview that he may put secondary tariffs on oil) and Iran (Iran rejected direct negotiation with the US; here). In addition, there was a concerning article on AI spending slowdown from The Information (here).

Trump also said he plans to start his reciprocal tariff push with “all countries,” tamping down speculation that he could limit the initial scope of levies set to be unveiled April 2. The president has said the tariffs will be “lenient,” but investors are on guard given the lack of specifics.

“It’s all about the tariff uncertainty,” Jefferies strategist Mohit Kumar said. “The negative scenario for the market would be that April 2 just marks the starting point of negotiation, and we have an extended period of negotiations where there is not much clarity on the tariff structure.”

Depending on the scale of what’s announced, Bloomberg Economics sees scope for a 4% hit to US GDP over a two- to three-year period, alongside a 2.5% increase in prices.

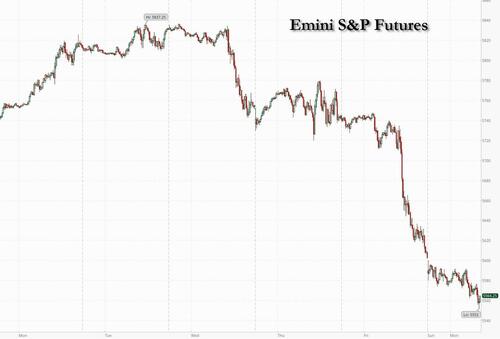

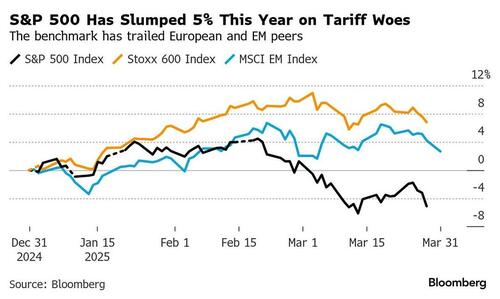

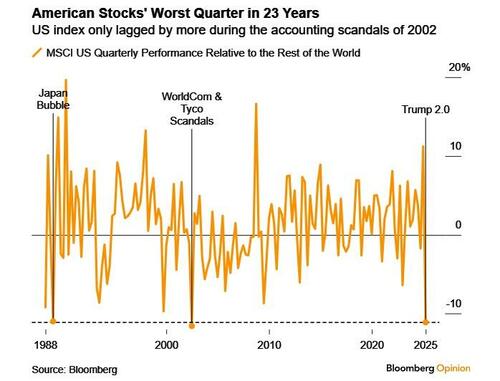

The risk that tariffs will hurt the global economy has propelled the S&P 500 to a 5.1% plunge in the first quarter, which would be the worst since 2022, and wiped about $5 trillion off the value of US equities since late February.

It gets worse: as Bloomberg’s John Authers notes, we are on the verge of closing the worst quarter for US stocks relative to the rest of the world since 2002!

The S&P 500 and the Nasdaq are both set to test mid-March lows — with the S&P’s mid-March low of about 5,500 points flagged by RBC Capital Markets strategist Lori Calvasina as a key support level. The March correction has been accompanied by an elevated count of swing days: As of Friday the S&P 500 moved more than 1% on 12 trading days in March, the highest reading since 2022.

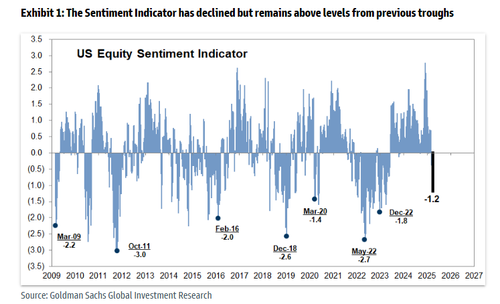

Goldman’s US Equity Sentiment Indicator of investor positioning declined further this week to -1.2, the lowest reading since April 2023, but remains above levels typically reached at the trough of other major drawdowns during the past 15 years.

Meanwhile, as we first noted overnight, Goldman’s David Kostin cut his S&P 500 target for a second time this month. He expects the benchmark to end the year around 5,700 points versus his previous estimate of 6,200, citing a higher recession risk and tariff-related uncertainty.

Trump’s reciprocal tariff push is set to begin on April 2. In comments reported by NBC News, the US president also threatened curbs on “all oil coming out of Russia.” Speculation is also increasing that the trade war will spur more interest-rate cuts at the Fed and the ECB/ Ten-year Treasuries dropped six basis points to about 4.18% on Monday, while Bund yields fell three basis points.

Treasuries are on track to outperform stocks this quarter for the first time since the pandemic onset in March 2020. Jamie Niven, senior portfolio manager at Candriam, said 10-year US rates may slide below 4% as early as this week. “What’s changed is that markets are now starting to price the downside in risk assets as a recession risk and therefore Treasures rally,” he added.

European stocks follow their Asia counterparts lower ahead of Trump’s deadline for a new set of sweeping global trade tariffs. The Stoxx 600 falls 1.2% with mining and travel & leisure equities led declines, while telecommunications and utilities shares are the biggest outperformers. Here are the biggest movers Monday:

- Grieg Seafood shares rise as much as 12%, their best day since last May, after the salmon producer said that Andreas Kvame has agreed with its board of directors to step down as CEO after 10 years

- The Stoxx 600 basic resources sector fell as much as 2.8% in London, to its lowest intraday level since September after US President Donald Trump said he plans to start his reciprocal tariff push with “all countries, tempering earlier expectations of limited levies.

- Gerresheimer shares fall as much as 5.6%, most since Dec. 20, after KeyBanc Capital Markets cut its rating on the stock to sector weight from overweight

- Pets at Home shares plunge as much as 15%, the biggest drop in four months, after the midpoint of the retailer’s profit guidance for FY26 came in below expectations

- Établissements Maurel & Prom shares drop as much as 16%, the most since August 2023, after the oil company said a specific license granted by the US for its activities in Venezuela has been revoked, triggering a small price target cut from CIC Market Solutions

- Cancom shares decline as much as 16%, the most since November, after the German IT firm gave a tepid guidance for 2025, citing customers’ reluctance to make purchases in a volatile market environment

- Conduit Holdings shares fall as much as 9.1%, hitting the lowest level since October 2022, after the reinsurer said Chief Executive Officer Trevor Carvey will step down and warned it will reduce its return on equity guidance

- Reach shares fall as much as 7.7% in London after the publishing firm and owner of the Daily Mirror newspaper says Jim Mullen is stepping down from his role as CEO

- Wood Group shares fall as much as 39% after the oil-field services company said it expects to adjust its income statement and balance sheet after an independent review uncovered “material weaknesses” in the business

Earlier in the session, Asian stocks tumbled as traders braced for potential damage from tariffs threatened by US President Donald Trump that are set to be announced this week. The MSCI Asia Pacific Index fell 2.2%, putting it on track for its steepest loss in a month. Stock markets across Asia declined, with benchmarks in Japan and Taiwan sliding more than 4% to lead the selloff. Thai shares fell after trading reopened following an earthquake. Singapore, India, Indonesia and Malaysia were closed for holidays. The regional selloff came as investors turned their attention to a planned April 2 announcement of US reciprocal tariffs that Trump said will cover “all countries,” stoking concerns over a global trade war. Economic data Friday showing a plunge in US consumer sentiment and weak spending added to concerns. Chipmakers TSMC and Samsung Electronics were among the biggest drags on the MSCI regional gauge Monday, along with Chinese internet firms Tencent and Alibaba. Taiwan’s equity benchmark entered a technical correction, while Korean stocks slid as the nation resumed short-selling following a 17-month ban on the practice.

In rates, treasuries are richer by 5bp-6bp across maturities in early US session after gapping higher at the Asia open amid slumping equity markets globally. 10-year TSY yield near 4.19% is down ~6bp, outperforming bunds and gilts in the sector by 2.5bp and 1bp. As intermediate sectors led the move, 5s30s spread reached new multi-month wides above 67bp. Fed-dated OIS contracts price in additional easing this year, around 80bp vs 71bp at Friday’s close. Goldman Sachs projected the Fed will cut in July, September and November; its previous forecast was for two cuts this year and one in 2026. Morgan Stanley late Friday recommended being outright long 7-year Treasuries or TY futures to hedge risk-aversion. Treasury auctions resume next week with 3-, 10- and 30-year debt sales

In FX, the Bloomberg Dollar Spot Index is little changed. USD/JPY fell as much as 0.8% to 148.70, the lowest since March 21, before erasing almost all losses and trading at 149.4. “USD/JPY will take its cue from global equity markets this week,” Commonwealth Bank of Australia strategists including Kristina Clifton wrote in a note. “Risks are tilted to a sharp drop in global equities and a weaker USD/JPY.” The Euro also rose initially only to slide after inflation data in Germany missed expectations.

In commodities, spot gold climbs $35 to top a record $3,115 an ounce after it set another record. Bitcoin falls to around the $81,000 level. Oil prices advance with WTI up 0.5% at $69.70 a barrel having topped $70 at one stage as the market weighed Trump’s mixed remarks about the threat of fresh penalties on Russian crude.

Looking ahead, the US economic calendar includes March MNI Chicago PMI (9:45am, several minutes earlier for subscribers) and Dallas Fed manufacturing activity (10:30am). Fed speaker slate empty for Monday. Barkin, Kugler, Jefferson, Cook, Powell, Barr and Waller have events scheduled later this week.

Market Snapshot

- S&P 500 mini -0.9%,

- Nasdaq 100 mini -1.3%,

- Russell 2000 mini -1%

- Stoxx Europe 600 -1.1%,

- DAX -1.1%,

- CAC 40 -1.2%

- 10-year Treasury yield -5 basis points at 4.2%

- VIX +2.2 points at 23.8

- Bloomberg Dollar Index little changed at 1272.06,

- euro -0.1% at $1.0814

- WTI crude +0.8% at $69.9/barrel

Top Overnight News

- President Trump is scheduled to sign executive orders at 13:00EDT/18:00BST and at 17:30EDT/22:30BST on Monday.

- US President Trump wouldn’t rule out seeking a third term and said there are ways to do it, according to NBC. However, it was later reported that President Trump commented that he does not want to talk about a third term now.

- White House reportedly plans to kill the funding in a new budget for a Boeing (BA)-built rocket designed for NASA to take astronauts to the moon and beyond, while terminating Boeing’s Space Launch System could reportedly free up billions of dollars which SpaceX officials said could be reallocated for NASA’s Mars efforts, according to WSJ.

- Some large cloud customers are reportedly slowing down their spending on AI services through cloud providers such as Microsoft (MSFT), Google (GOOG) and Amazon (AMZN) as prices of AI drop, according to The Information.

- Trump is considering a more expansive tariff policy, one that could see a 20% duty imposed on all imports (along with additional sectoral tariffs). WSJ

- Trump is considering a bailout package for American farmers to shelter the domestic agricultural industry from his destructive tariff campaign. NYT

- Peter Navarro says Trump’s tariffs could generate ~$600B in revenue annually for the Treasury (or $6T over 10 years) in what would amount to one of the largest tax hikes in the history of the country. WaPo

- Goldman reduced its S&P 500 3-month and 12-month return forecasts to -5% and +6% (previously +0% and +16%). Based on market prices at the end of last week, these suggest S&P 500 index levels of roughly 5300 and 5900, respectively. The bank now sees a 12-month recession probability of 35%; the increase from the previous 20% estimate reflects a lower growth baseline, the sharp recent deterioration in household and business confidence, and statements from White House officials indicating greater willingness to tolerate near-term economic weakness in pursuit of their policies.

- China’s manufacturing activity expanded at the fastest pace in a year in March, a factory survey showed on Monday, with new orders boosting production, giving the world’s No. 2 economy some reprieve as it deals with an intensifying U.S. trade war. Manufacturing came in at 50.5 (vs. 50.2 in Feb and above the Street’s 50.4 forecast) and non-manufacturing at 50.8 (vs. 50.4 in Feb and above the Street’s 50.6 forecast). RTRS

- China will be hit significantly harder this time around by Trump’s trade war compared to his first term. RTRS

- The BOJ will slow purchases of super-long bonds to ¥405 billion in the second quarter, its first reduction in more than a year. BBG

- AI spending is set to slow as companies utilize lower-cost and more efficient models from the likes of DeepSeek and others to drive expenses lower. The Information

- UK PM Keir Starmer had a “productive” call with Trump as the government hopes to carve out exemptions from US tariffs. Elsewhere, UK Home Secretary Yvette Cooper told Sky News she refused to rule out retaliating to US tariffs on cars and steel. BBG

A more detailed look at global markets courtesy of Newsquawk

Top Asian News

Top European News

Tariffs/Trade

UPDATES FROM THE US

- US President Trump said he will hit essentially all countries that they’re talking about with tariffs this week and commented that there will be a deal on TikTok before the deadline, according to Reuters.

- US President Trump is said to be pushing senior advisers to go bigger on tariff policy as they prepare for ‘Liberation Day’ on April 2nd and reportedly revived the idea of a flat universal tariff single rate on most imports, according to Washington Post. It was also noted that the option viewed as most likely, publicly outlined by Treasury Secretary Bessent this month, would set tariffs on products from the 15% of countries the administration deems the worst US trading partners which account for almost 90% of imports.

- US President Trump’s closest allies including Vice President Vance, Chief of Staff Wiles and cabinet officials have privately indicated they are unsure exactly what President Trump will do during the April 2nd announcement of global tariffs, according to Politico.

- US President Trump’s recent 25% auto tariff announcement made no mention of USMCA trade deal side letters shielding Canada and Mexico from potential auto tariffs which showed Canada and Mexico were each granted annual duty-free import quotas of 2.6mln cars and unlimited light trucks if Trump imposed global tariffs.

- US President Trump’s Trade Adviser Navarro said auto tariffs will raise about USD 100bln and the other tariffs are to raise about USD 600bln a year, according to a Fox interview.

- US White House has reportedly discussed providing support to farmers as the President escalates the trade war, according to NYT.

UPDATES FROM OTHER NATIONS

- Canada said it fully expects the US to honour the 2018 tariff pledges and it reserves the right to take retaliatory measures, while Mexico is evaluating the legal implications of the agreement on Trump’s ‘Section 232’ auto tariff probe.

- UK PM Starmer spoke with US President Trump on Sunday evening in which they discussed productive negotiations between their respective teams on a UK-US economic prosperity deal and agreed that these will continue at pace this week. It was also reported that UK Home Secretary Cooper refused to rule out retaliating to US tariffs on cars and steel, according to Bloomberg.

- French Ministry of Foreign Trade said France and Europe will defend their businesses, consumers and values, while it added that US interference in the inclusion policies of French companies is unacceptable. Thereafter, the French Commerce Minister reiterated that France would implement reciprocal tariffs if the US goes ahead with its tariff measures this week. Hoping to avoid a trade war.

- German Chancellor Scholz said they stand by Canada’s side and that Canada is not a state that belongs to anyone else, while he added that Europe’s goal is cooperation but the EU will respond as one if the US leaves them with no choice such as with tariffs on steel and aluminium.

- Brazil’s President Lula said he will negotiate on tariffs before retaliating, according to Bloomberg. It was also reported that Brazil’s Finance Minister Haddad said the country is in a privileged position to withstand the trade war with the commodity exporter’s links to China, the US and the EU to shield it from protectionism, according to FT.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were pressured heading into month- and quarter-end amid tariff concerns as Trump’s April 2nd Liberation Day drew closer, while geopolitical risks lingered after US President Trump voiced anger towards Russian President Putin for comments about Ukrainian President Zelensky and Trump also threatened to bomb Iran if a nuclear deal can’t be reached. ASX 200 declined with all sectors in the red and underperformance in the mining, resources and materials sectors, while participants also await tomorrow’s RBA rate decision where the central bank is widely expected to remain on hold and with the focus to turn to if there is any change to the cautious message regarding future rate cuts. Nikkei 225 suffered heavy losses and slipped beneath the 36,000 level amid the tariff concerns and with notable weakness seen in tech stocks, while the selling is also exacerbated heading into fiscal year-end and amid yen strength. Hang Seng and Shanghai Comp conformed to the downbeat risk tone after failing to sustain the early resilience seen in the mainland following encouraging Chinese PMI data and reports that China’s Finance Ministry is to inject USD 69bln into four large Chinese banks, while there was also a slew of earnings releases including from most of the big 4 banks.

Top Asian News

- China’s Commerce Minister held talks on Friday with the visiting EU Trade and Economic Security Commissioner.

- China unveiled a plan to ramp up high-standard farmland development to ensure food security.

- China’s Finance Ministry will inject USD 69bln into four of the nation’s largest state banks via their share placements with the Finance Ministry to be the top investor in planned private placements by Bank of Communications, Bank of China, Postal Savings Bank of China Ltd. and China Construction Bank Corp. to raise up to a combined CNY 520bln or around USD 72bln through additional offerings of mainland-traded stocks, according to filings on Sunday. It was later reported that China will issue CNY 500bln in special treasury bonds this year to support bank capital replenishment, according to the Finance Ministry.

- PBoC said it punished two internet users who spread rate-cut rumours to gain attention and attract online followers, according to Bloomberg.

- Chinese state media said the CK Hutchison (1 HK) port deal does not conform to business logic and involves major national interests, while it added that selling the port is equal to handing a knife to the opponent and the Co. should carefully handle deals that may harm national interests.

- South Korean Finance Minister Choi said the government will submit a KRW 10tln supplementary budget to respond to wildfires and slumping growth.

- South Korean, Japanese and Chinese trade ministers agreed to strengthen cooperation on stabilising the supply chain and enhancing predictability in a trade environment, while they also agreed to closely cooperate on a trilateral free trade agreement and promote regional trade.

European bourses began the week on the backfoot into month & quarter end, the looming April 2nd ‘Liberation Day’, and ongoing geopolitics; Euro Stoxx 50 -1.5%. Sectors in the region are broadly in the red, Basic Resources lag with Autos a close second. Basic Resources have failed to lift amid demand/growth concerns, despite gold prices surging to USD 3,100/oz for the first time. Chinese PMIs inched higher, though CapEco sees slower Chinese GDP growth in Q1.

Top European News

- Dutch pension funds are set to invest EUR 100bln into risky assets boosting Europe’s defence efforts, according to FT citing APG Asset Management’s chief executive.

- US President Trump had an informal meeting with Finland’s President Stubb and said they look forward to strengthening the partnership between the US and Finland which includes the purchase and development of a large number of badly needed icebreakers for the US.

- ECB’s Lagarde says Europe must take better control of its own destiny. Almost at the inflation target.

- ECB’s Panetta says fight against inflation cannot be considered to be over; must monitor all factors that could hinder a return to the 2% target.

- Germany’s CDU/CSU and SPD have reportedly agreed to demand that the EU withdraws funds and suspend voting rights from countries that violate key principles, via Politico citing a draft; Politico frames this as a “thinly veiled reference to Viktor Orbán”.

- French RN official Le Pen has received an electoral ban, judges yet to state if the ban is to be implemented immediately or not.

- BoE PRA proposes increasing the FSCS deposit protection limit to GBP 110k (current 85k). If taken forward, the new limit would apply to firms that fail from 1 December 2025.

FX

- DXY has been on either side of the unchanged mark throughout the morning, began on a softer footing but the USD managed to claw back some losses vs. most peers to a 104.06 high for the index. As it stands, it is just below the mark and marginally into the red but comfortably clear of the session’s 103.74 base.

- The main focus has of course been the tariff agenda, with EUR initially firmer despite this but succumbed into the red when the USD picked up and has remained there since. Limited reaction to the morning’s state CPIs from Germany or Italian metrics. EUR/USD at the mid-point of a 1.0806-1.0849 band.

- USD/JPY retreated below the 149.00 handle by haven flows given the pressure seen in APAC trade, the Nikkei 225 entered correction territory. Went as low as 148.71 overnight, to the lowest since March 21st when 148.58 printed.

- Sterling flat with UK-specific newsflow light aside from UK PM Starmer speaking with US President Trump on Sunday evening. Cable at the bottom-end of a 1.2923 to 1.2972 band.

- Antipodeans softer given the broad risk-off price action and despite encouraging Chinese official PMIs. AUD also awaits the RBA with just a 17% implied probability of a 25bps cut currently. AUD/USD at a 0.6254 session low.

- PBoC set USD/CNY mid-point at 7.1782 vs exp. 7.2593 (Prev. 7.1752).

Fixed Income

- Firmer given the macro risk tone. USTs bid by over 10 ticks but just off the earlier 111-22+ peak, having ground higher from a 111-09 open which is also the session low. If the move continues, then resistance comes in at 111-25 from 11th March before the figure and then 112-01 from 4th March; the latter is the YTD high.

- Amidst this, yields are lower across the curve and the 10yr is below 4.20% with 4.17%, 4.15% and then the 4.10% YTD low from 4th March. Fed pricing has moved dovishly, the odds of a cut in May over 20% with 80bps of easing seen by end-2025. As a point of comparison, around this time on Friday (pre-PCE) roughly 63bps was implied by end-2025.

- Bunds on the front-foot, given the above, hit a 129.59 peak before paring off best into and retreating further to a 129.04 session low on the first few German State CPIs coming in hot. However, the skew of all the states was in-line/mixed vs the prior readings which allowed Bunds to lift back to the midpoint of the day’s range.

- Gilts gapped higher by 37 ticks and then extended to a 92.10 peak as the tone sullied. Specifics for the UK light aside from the discussed Starmer-Trump call, though Home Secretary Cooper refused to rule out retaliation to US tariffs on autos and steel.

- JGBs came under some modest pressure as the BoJ adjusted its purchase plan for the next quarter while OATs were unphased by Le Pen being found guilty as we continue to await details and whether she will be banned from the 2027 Presidential election.

- BoJ cuts the purchase size across all main tranches (incl. the super-long) in its quarterly plan, frequency maintained.

Commodities

- Crude benchmarks are firmer despite the broad risk off tone. Strength which comes from geopolitics. Recent reports that US President Trump threatened to bomb Iran if a nuclear deal can’t be reached, while he also warned of secondary tariffs on Russian oil but later stated that he is not putting on oil sanctions right now.

- WTI May currently trades in a USD 68.81-70.10/bbl while its Brent counterpart resides in a USD 72.28-73.51/bbl parameter at the time of writing.

- Gas is firmer following APAC weakness, whilst the end of the heating season has reduced demand, shifting market focus to inventory refilling for next winter.

- Metals diverge with precious counterparts leading, base peers in the red. XAU at a fresh record high on the open and has since extended to a USD 3128/oz peak, benefitting from the risk tone. Base metals unsurprisingly dented by latest tariff updates, though encouraging Chinese PMIs have perhaps limited the losses.

- Slovak gas importer SPP says Gazprom is to substantially increase gas supplies to Slovakia through TurkStream from April; adds, “we will not have a problem filling storage this year”.

- Oman’s OSP for May calculated at USD 72.51/bbl (77.63/bbl in April), via GME data cited by Reuters.

- US is to revoke authorisations to foreign partners of Venezuela’s PDVSA that allowed them to export oil, according to sources cited by Reuters.

Geopolitics: Middle East

- IDF began ground activity in an area inside Rafah to expand the security zone in southern Gaza, while Israel reportedly sent a counter-proposal on the Gaza deal, according to Bloomberg.

- Hamas political chief Khalil Al-Hayya said Hamas agreed to a ceasefire proposal they received two days ago, while he stated that Hamas will not disarm as long as the Israeli occupation exists.

- US President Trump said US and Iranian officials are talking, while he threatened a “bombing” and secondary tariffs on Iran if Tehran does not make a deal on a nuclear program with the US, according to an NBC interview. It was separately reported that Iran said it rejected direct US talks in a reply to Trump’s letter, while Iranian sources cited by Tehran Times stated the Iranian army has built up missile bases and prepared them for launch after recent Trump threats, according to Asharq News.

- Iran’s Supreme Leader Khamenei says US will receive a blow if they act on US President Trump’s threats.

Geopolitics: Ukraine

- US President Trump said he plans to speak with Russian President Putin this week and warned he will put 25%-50% secondary tariffs on all Russian oil if they are unable to make a deal on Ukraine. Trump also said he was very angry when Putin criticised Ukrainian Zelensky’s credibility and noted that Putin’s comments on Zelensky were not going in the right direction. Furthermore, Trump separately commented that Zelensky wants to back out of the critical minerals deal.

- Ukrainian President Zelensky said it is impossible to ignore nearly daily mass Russian drone attacks and Ukraine expects a strong response to these attacks from the US, Europe and others. Zelensky added that Ukraine is maintaining active measures on the front line and inside Russia to ensure no Russian troops can enter the Sumy and Kharkiv regions.

- Ukraine was reported on Sunday morning to have destroyed 65 out of 111 drones launched by Russia.

- There are reportedly serious preparations underway for Ukrainian President Zelensky to run for the presidency a second time and he is said to have tasked his team with organising a vote after a full ceasefire, aiming for summer 2025, according to The Economist. It was separately reported that Kyiv is to seek more US investments in talks over an economic deal.

- Russian Defence Ministry said Ukraine has continued attacks against Russian energy infrastructure in violation of the limited ceasefire agreement and attacked power grids in the Belgorod region leaving 9,000 residents without power. Russia’s Defence Ministry also said it has completed the liberation of the town of Zaporizhzhia in Ukraine’s Donetsk region, while it was also reported that Russian forces took control of Veselivka in Ukraine’s Sumy region.

- Moscow and Washington started talks on rare earth metals and projects in Russia, according to RIA citing Russian Sovereign Wealth Fund chief Dmitriev.

- Russia’s Defence Ministry says Ukraine continues attacks on Russia’s energy infrastructure, according to IFAX.

Geopolitics: Other

- US Defence Secretary Hegseth said Japan is an indispensable partner in deterring China and the US will sustain a robust presence in the Indo-Pacific, while he added the US military needs expanded access to Japan’s southwest islands and has started upgrading its military command in Japan. Furthermore, Japan’s Defence Minister said they have agreed with the US to accelerate efforts to jointly air-to-air missiles and will look at the possibility of joint production of SM6 surface-to-air missiles.

- Chinese military said it conducted a routine patrol in the South China Sea on Friday, while it added the Philippines has frequently enlisted foreign countries to organise so-called joint patrols and created destabilising factors in the South China Sea.

- Greenland’s PM said that he wants to make it clear the US won’t get control of Greenland.

US Event Calendar

- 9:45 am: Mar MNI Chicago PMI, est. 45, prior 45.5

- 10:30 am: Mar Dallas Fed Manf. Activity, est. -5, prior -8.3

DB’s Jim Reid concludes the overnight wrap

Welcome to the last day of March ahead of the hotly anticipated “Liberation Day” on Wednesday. Asian equity markets are sinking as the fear of what it may contain continues to build. The Nikkei for example is -4.04% overnight as I type.

A couple of weeks ago, I referred to what I considered to be a rather insightful podcast featuring US Treasury Secretary Scott Bessent on the “All-In” podcast (link here). He outlined his ideologies and, in my view, committed the administration to potentially transformative policies. Shortly thereafter, US Commerce Secretary Howard Lutnick appeared on the same podcast and presented perhaps an even more radical perspective on the potential policy direction.

I think these are valuable podcasts to listen to and have helped convince me that this administration is serious about radical change. For those short on time, we uploaded the transcripts to Google NotebookLM and generated approximately 1,000-word summaries of each. This served as a useful test case for AI and hopefully provides informative summaries.

Also this morning we’ve published the next publication in our new Deutsche Bank Research Institute looking at how Germany’s shrinking auto industry could be the key for expanding the defence capacity. It contains lots of fascinating stats about the spare capacity in autos and what is likely to be needed in defence alongside policy recommendations.

Moving back to this week, outside of “liberation day” and 25% tariffs on imported autos commencing on Thursday, it’s also a big week for macro with all roads leading to Friday’s payrolls and a speech by Powell. Before that, the main highlights are: today’s German CPI; tomorrow’s US manufacturing ISM, US auto sales, US JOLTS, China’s manufacturing PMI, Japan’s Tankan, Eurozone CPI, the RBA rate decision, and a speech from Lagarde; Wednesday’s ADP report; Thursday’s US ISM services, China’s services PMI, Eurozone PPI, and the ECB account of the March meeting; all before the big end to the week on Friday.

In terms of what to expect from “Liberation Day” on Wednesday, the bid-offer is huge. As our US economists laid out last week (see “A little reciprocity goes a long way”) reciprocal tariffs could add roughly 4 (best case) to 14ppts (worst case) to the overall US tariff rate relative to its 2024 level of 2.5%. The hit to 2025 real US GDP growth could be as little as -25bps to as high as -120bps. For core PCE inflation, reciprocal tariffs could add anywhere from a couple of basis points to potentially 1.2ppts. Importantly, these impacts are additional to the risks to growth and inflation from previously announced tariff actions.

Our economists calculate that the trade actions taken to date (if they remain in place through year end) imply an overall US tariff rate of roughly 10.5%, which is the highest since WWII. The Trump Administration’s auto tariffs (see “Auto tariffs rev up inflation, pump brakes on growth”) could push the US tariff rate as high as another couple of percentage points higher depending on the implementation details. So the starting point before “liberation day” is 10.5-12.5%. As such by the end of this week we could be looking at a aggregate US tariff rate of (very roughly) between 15 and 25%.

Over the weekend, Mr Trump told NBC that he “couldn’t care less” if automakers had to raise prices in the US as it would force Americans to buy US made cars. The 25% tariffs are due to come into force on Thursday. So its becoming ever clearer that this administration is serious about bringing massive change to economic policy. If and where their pain threshold is in terms of markets and the economy is the next most important question. The rhetoric from the administration at the moment seems to suggest its high but there is an extraordinary amount of uncertainty at the moment.

The pain isn’t showing up in the hard data at the moment and in terms of US payrolls on Friday there’s only likely to be a small impact, DB forecasts +150k for both headline and private against +151k and +140k respectively last time. Incorporated in that is a roughly 20k drag from federal layoffs which have been complicated by court actions against them. DB expect the unemployment rate to just round up to 4.2% from 4.1% last time. Before that it will be interesting to see if the US manufacturing ISM (Tuesday) and services (Thursday) show any sentiment hit.

Tomorrow sees two special congressional elections in Florida to fill the seats of Matt Gaetz and Michael Waltz in the US House of Representatives. These are Republican strongholds but some polling has suggested it could be close. The Republicans will still control the House regardless but only have the narrowest of majorities so these are important elections in terms of breathing space for their agenda.

In geopolitics, the focus will be on a meeting of NATO foreign ministers on April 3-4. Its the first time they’ve met since Trump’s inauguration. So they’ll have plenty to discuss

Staying on this theme, over the weekend, Trump suggested he was angry at Putin over his recent comments that Zelenskiy should be replaced as a price for peace negotiations. Mr Trump used slightly stronger language according to NBC. Trump said that if Russia was to blame for there being no peace deal he’s prepared to put secondary sanctions on Russian oil.

Asian equity markets are facing intense selling pressure as March sees its final hours there. The Nikkei (-4.04%) is the biggest underperformer with the KOSPI (-2.94%), Hang Seng (-1.74%) and S&P/ASX 200 (-1.54%) all sharply lower. Elsewhere, mainland Chinese stocks are holding in a bit better with the CSI (-0.99%) and the Shanghai Composite (-0.97%) outperforming. S&P 500 (-0.65%) and NASDAQ 100 (-1.17%) futures are lower with Euro Stoxx futures (-0.66%). 10yr USTs are -4.4bps lower at 4.21% as I type.

Coming back to China, the official manufacturing activity expanded at its fastest pace in a year, coming in at 50.5 in March (v/s 50.4 expected), picking up slightly from 50.2. The increase was more apparent with the non-manufacturing PMI data, which grew 50.8 in March, (v/s 50.6 expected) and accelerating from the 50.4 seen the month before. This saw the Chinese composite PMI advance to 51.4 in March from 51.1 in February.

Elsewhere, Japan’s industrial production grew at the fastest clip in nearly a year, as factory output increased by +2.5% y/y in February (v/s +2.0% expected) following a -1.1% decline the previous month. Retail sales growth slowed significantly to +1.4% year-over-year in February, falling short of the anticipated +2.5% and considerably lower than January’s revised +4.4% increase.

Recapping last week now, the announcement of US auto tariffs and the prospect of retaliation meant investors grew increasingly concerned about stagflation. The impact was clear across different asset classes, and the US 1yr inflation swap moved up +20.9bps over the week to a two-year high of 3.16%, reaching levels last seen when the Fed were still hiking rates. But although tariff fears played a key role, those inflation concerns got a further boost from a strong PCE inflation report, which is the measure the Fed officially targets. It showed core PCE was up +0.4% in February (vs. +0.3% expected), which pushed the year-on-year rate up to +2.8% (vs. +2.7% expected). Shortly after, the University of Michigan’s survey also showed long-term inflation expectations hitting a 32-year high, with 5-10 year expectations coming in at 4.1% on the final print, two-tenths above the preliminary reading. So all that meant investors became increasingly focused on inflation, and gold prices moved up +2.00% last week (+0.87% Friday) to a record high of $3,083/oz.

The downbeat newsflow meant equities lost ground across the world, and the S&P 500 gave up its initial gains at the start of the week to close -1.53% lower (-1.97% Friday). The Magnificent 7 posted a 6th consecutive weekly decline for the first time since May 2022, falling another -2.41% last week (-3.48% Friday) and leaving the index -20.5% below its December peak. European equities also slumped, with the STOXX 600 down -1.38% (-0.77% Friday). That just about extended the run of STOXX 600 outperforming the S&P 500 to 9 consecutive weeks, the longest such streak since 1999. Meanwhile in Japan, the Nikkei fell -1.48% (-1.80% Friday), cementing its position as one of the worst-performing major indices this year, with a -6.95% decline YTD.

US Treasuries had struggled for much of the week, but the risk-off move on Friday reversed those losses. A -11.6bps decline on Friday left 10yr Treasury yield unchanged on the week at 4.25%. Front-end real yields saw large declines, with the 2yr real yield falling -19.1bps to 0.64%, their lowest since August 2022 when the fed funds rate was 200bps lower than currently. Over in Europe bonds saw a late surge on Friday, with 10yr bund yields falling -4.6bps to 2.72% (-3.8bps over the week). This was helped by soft inflation readings from France and Spain, which saw flash CPI prints for March coming in beneath expectations, with France at +0.9% on the EU-harmonised measure, whilst Spain was at +2.2%. So that led to optimism that the Euro Area number on April 1 would be weaker than expected, which cemented the view that the ECB would cut rates again at their next meeting in April.

Finally, the one asset class that saw a decent performance was commodities last week. However, that further exacerbated the inflation concerns mentioned above, particularly with further tariffs in the pipeline as well. That included fresh gains for oil, with Brent crude up +1.80% (-0.69% Friday) to $73.46/bbl, whilst copper prices were up +0.45% in their 4th consecutive weekly gain having hit a new record high on Wednesday.

Tyler Durden

Mon, 03/31/2025 – 08:27

Share This Article

Choose Your Platform: Facebook Twitter Linkedin