Futures Rise On Apple China Sales Rebound As Attention Turns Back To Inflation

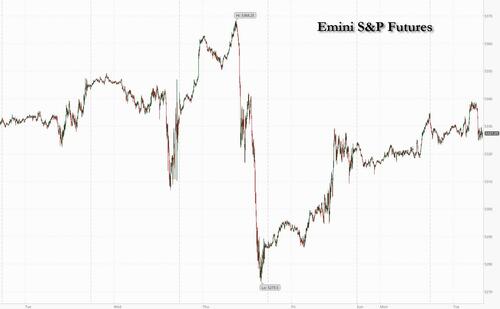

Stocks traded in a narrow range as markets reopened in the US and Europe with investors putting (a stronger than expected) Q1 earnings season in the history books, and looking to Friday’s core PCE print prints and central bank speakers for hints on the timing of interest-rate cuts. As of 7:45am, S&P futures climbed 0.1%, while Nasdaq futs gained 0.2% helped by premarket gains for Apple which added 2.4% after China shipments rebounded over 50%. Europe’s Stoxx 600 dipped 0.2%, trimming its gain in May to 3.2%. The Bloomberg dollar index dropped while treasuries erased small gains, with 10Y yields trading at 4.46% before a slate of short-term auctions including offers of 2Y and 5Y notes on Tuesday. Brent crude rose as tensions in the Middle East ratcheted higher. On the calendar, today we get the release of house price and confidence data, before we get reports on GDP on Thursday. The centerpiece then comes on Friday, with the publication of the PCE price index, the Fed’s favorite inflation gauge. Economists expect that to show the smallest advance so far this year for the measure.

In premarket trading, the most notable movers was Apple whose shares gained 2.2% after new figures showed an iPhone sales rebound in China last month, with shipments increasing 52% amid discounts from retail partners.

Oklo rose 10%, as the Sam Altman backed provider of nuclear fission reactors extended its recent gains.

Crowdstrike gains 2.1% as Morgan Stanley boosts its price target on the stock and names it as a top pick, predicting it could become the next cybersecurity company to surpass a $100b market capitalization.

DuPont de Nemours gains 1.2% as Citi lifts its rating on the chemicals company to buy from neutral, based on upside scope from recently announced business separation plans and on recovery potential in its electronics unit.

GameStop shares jump 24% as the video-game retailer extends Friday’s postmarket gains, which were triggered by the company raising almost $1 billion in a share sale.

Nvidia shares gain 2.3%, putting the chipmaker on track to extend its post-earnings rally for a third consecutive session.

Zscaler slips 0.5%, following a downgrade to equal-weight at Wells Fargo, which says the security software firm faces pressures from increased competition.

As traders return from the long weekend they’re alert for problems connected with the switch to “T+1” rule — whereby US equities will settle in one day rather than two. There are worries about potential teething issues, including that international investors may struggle to source dollars on time, global funds will move at different speeds to their assets, and everyone will have less time to fix errors.

Meanwhile, strong earnings from tech megacaps like Nvidia helped stocks erase April’s slump, even as US data and cautious fedspeak cooled market bets on the scope for policy easing this year. And in a busy week for data, traders are concentrating on the PCE deflator, the Fed’s preferred gauge of inflation, on Friday.

“We are very much on the inflation data watch for now,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “Stocks and risk will continue to be supported, but I don’t see change of leadership nor a broadening of the performance. Large-cap growth stocks will be leading.”

European stocks are lower; the Stoxx 600 is down 0.2% with underperforming sectors including healthcare and industrials. European miners may be active on Tuesday as copper, along with other base metals, gained ground after China stepped up efforts to rescue its property market and a weakening US dollar boosted the demand outlook. Consumer inflation expectations in the euro zone ticked lower in April, ECB data showed, as policymakers next meet on rates on June 6. On Monday, France’s Francois Villeroy de Galhau said the ECB shouldn’t exclude cutting rates in both June and July, though hawkish policymakers including Executive Board member Isabel Schnabel recently came out in opposition to back-to-back moves.

Earlier, Asian stocks rose in thin trading, driven by advances in Hong Kong, ahead of global inflation prints set to offer monetary policy clues. The MSCI Asia Pacific Index rose as much as 0.3%, overcoming a shaky start. Gains were also notable in Indonesia and Taiwan, while Japanese benchmarks dipped. Volumes on many key gauges were 15-20% below 30-day averages after US and UK markets were closed on Monday.

“For all intents and purposes, we haven’t started the week — things will pick up tonight when the US opens,” said Kyle Rodda, a senior market analyst at Capital.Com. “I suspect the next few days, all else being equal, will be driven by end-of-month flows and then that crucial PCE Index release.”

In FX, the Bloomberg Dollar Spot index traded lower versus most of its Group-of-10 peers amid month-end flows as markets in the UK and the US reopen after holidays. The Index slipped as much as 0.2% before paring most losses. The Swedish krona tops the G-10 FX pile, rising 0.4% versus the greenback.

EUR/USD up a third day, rises 0.2% to 1.0880; the move loses traction as leveraged offers around the day’s high act as a cap for now, a Europe-based trader says

The Swedish krona was the best performing G10 currency versus the dollar, climbing 0.5% to 10.5596; EUR/SEK fell 0.4% to 11.4829, lowest since April 10. Riksbank Governor Erik Thedeen said the threshold for a rate cut in June is “very high”

In rates, treasuries were mixed with front-end outperforming, following wider gains across the gilt curve after remarks by BOE’s Broadbent, who said disinflation is “getting there,” according to the Times. US 2-year yields are richer by around 2bp on the day while yields are marginally cheaper further out the curve, steepening 2s10s spread by 1.8bp vs Friday’s close. 10-year is little changed at 4.465%, trailing gilts by 2.5bp in the sector; gilts outperform after a survey said UK shop inflation was now back to ‘normal’ levels. UK 10-year yields fall 3bps to 4.23%. The US session also features two auctions, 2-year notes at 11:30am New York time and 5-year notes at 1pm; the WI on the 2-year yield is around 4.903% ahead of $69b sale, about 0.5bp cheaper than last month’s result; $70b 5-year note sale follows

In commodities, oil prices advance, with WTI rising 1.5% to trade around $78.90 as tensions in the Middle East ratcheted higher following the death of an Egyptian soldier during a clash with Israeli troops. Spot gold falls 0.3%.

Bitcoin fell as traders monitored transfers by wallets belonging to the failed Mt. Gox exchange, whose administrators have been stepping up efforts to return a $9 billion hoard of the largest digital asset to creditors.

Looking at today’s calendar, US economic data includes 1Q house price index, March FHFA house price index and S&P CoreLogic home prices (9am), May consumer confidence (10am) and Dallas Fed manufacturing activity (10:30am); Fed officials’ scheduled speeches include Kashkari (9:55am), Cook and Daly (1:05pm).

Market Snapshot

S&P 500 futures up 0.3% to 5,336.75

STOXX Europe 600 little changed at 522.51

MXAP little changed at 181.06

MXAPJ little changed at 566.63

Nikkei down 0.1% to 38,855.37

Topix little changed at 2,768.50

Hang Seng Index little changed at 18,821.16

Shanghai Composite down 0.5% to 3,109.57

Sensex little changed at 75,344.59

Australia S&P/ASX 200 down 0.3% to 7,766.71

Kospi little changed at 2,722.85

German 10Y yield little changed at 2.54%

Euro up 0.1% to $1.0873

Brent Futures up 0.2% to $83.30/bbl

Gold spot down 0.4% to $2,341.29

US Dollar Index down 0.11% to 104.48

Top Overnight News

The US stock market is finally as fast as it was about a hundred years ago. That was the last time share trades in New York settled in a single day, as they will from Tuesday under new Securities and Exchange Commission rules.

The European Central Bank should use quantitative-easing programs primarily in times of crisis as their costs might be more pronounced than other tools in its repertoire, according to Executive Board member Isabel Schnabel.

Inflation expectations of consumers in the euro zone edged lower in April, according to the European Central Bank — reinforcing plans to start lowering interest rates next week. Prices are seen advancing 2.9% over the next 12 months, down from 3% in March, the ECB said Tuesday in its monthly poll. That’s the lowest level since September 2021, it said.

The pound is nearing its strongest level in years against two of its major counterparts as traders ratchet up bets that the Bank of England will keep interest rates on hold for longer than peers.

China’s smartphone market saw a 2% growth in sales Q1. Sales of foldable phones +48% Y/Y. Huawei rose to the top spot for the first time in quarterly global shipments, surpassing Samsung, according to Counterpoint Research. China iPhone shipments jump 52% in April.

UBS Global Research raises 2024 year-end S&P500 target to 5600 (prev. target 5400, current 5304)

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with price action mostly rangebound in the absence of a lead from Wall St and as geopolitical uncertainty lingered following an Israeli strike on Rafah which killed dozens of Palestinians on Sunday. ASX 200 swung between gains and losses albeit in a thin range with sentiment not helped by soft retail sales. Nikkei 225 retreated after stalling beneath the 39,000 level as participants also digested the firm Services PPI data which accelerated by its fastest pace since 2015. Hang Seng and Shanghai Comp were somewhat varied as Hong Kong outperformed with Alibaba Health Information Technology front-running the gains post-earnings, while there was also notable strength in China’s major oil companies after the recent upside in underlying commodity prices. Conversely, the mainland lacks conviction with only brief support seen in property stocks following Shanghai’s latest measures to spur the flagging sector.

Top Asian News

China’s Politburo said preventing and defusing financial risks is linked to national security and people’s property security, while it added China must act to prevent and defuse financial risks, as well as promote high-quality financial development Furthermore, it stated financial risks are a major hurdle that must be overcome, according to state media.

Shanghai adjusted the minimum down payment ratio for first-home buyers to no less than 20% and for second-home buyers to no less than 30%, while it cut the lower limit for interest rates on first-home mortgages to LPR minus 45bps. Furthermore, Shanghai is to establish and improve the housing system, explore buying housing through state-owned platform companies and other entities, as well as optimise the supply of housing security.

Japanese Finance Minister Suzuki said it is important for currencies to move in a stable manner reflecting fundamentals. Suzuki added that a weak yen boosts exporters’ profits but increases the burden for consumers, while he is concerned more about the negative impact of a weak yen and is closely watching FX moves.

BoJ says its underlying inflation measure all fell below 2% in April.

Chinese President Xi has urged promoting high-quality and sufficient employment, according to state media.

China Politburo says China will promote the coordination and linkage of fiscal, monetary, investment, consumption, industrial, regional and other policies with employment policies, via state media.

European bourses, Stoxx 600 (U/C) are mixed and trade modestly on either side of the unchanged mark, continuing the tentative price action seen in APAC trade overnight. European sectors are mixed; Real Estate takes the top spot, benefitting from the relatively lower yield environment, whilst Travel & Leisure is weighed on by broader strength in crude prices. US Equity Futures (ES +0.3%, NQ +0.5%, RTY +0.5%) are indicative of a firmer open, after US markets were shut on Monday on account of Memorial Day. Apple (+1.6% pre-market) gains following reports that China iPhone shipments rose 52% in April.

Top European News

ECB Consumer Expectations Survey (Apr): 12-month inflation 2.9% (prev. 3.0%); 3-year ahead 2.4% (prev. 2.5%); growth outlook less negative and labour market seen stable

UK PM Sunak is to announce a GBP 2.4bln tax cut for pensioners in a bid to shore up the key Conservative ‘grey vote’ and stabilise the party’s chaotic start to the general election campaign, according to FT.

Statistics Norway Oil Investment Survey: Total investments in oil and gas activity in 2025, including pipeline transportation, are estimated at NOK 216 billion, +5.2% than estimated in the previous quarter.

UK Shadow Chancellor Reeves says Labour will not be matching the “Triple Lock Plus”

Central Banks

Fed’s Kashkari (non-voter) says inflation has moved sideways recently; need to wait and see and get more confidence on prices; should not rule anything out on policy path, via CNBC. Fed in good position because of strong labour market.No need to hurry to cut rates; the Fed could potentially even hike rates if inflation fails to come down further.

Fed’s Bowman (voter) would have supported either waiting to slow QT pace or more tapered slowing in balance sheet run-off, according to Reuters. ‘In my view’ bank reserves are not yet near ‘ample’ levels given the still-sizable take-up of ON-RRP. Important to keep reducing balance sheet size to reach ample reserves as soon as possible and while the economy is strong. Important to communicate any change to the run-off rate does not reflect a change in the Fed’s monetary policy stance. ‘Strongly’ supports the principle of balance sheet holdings primarily being composed of Treasuries. A longer-run balance sheet ’tilted slightly’ toward shorter maturities would allow flexibility in approach. In future, when the Fed conducts QE to restore market functioning or financial stability it should communicate that purchases will be temporary and unwound when market conditions have normalised. FOMC would have benefited from an earlier decision to taper and end QE in 2021; and would have allowed earlier rate hikes.

Fed’s Mester (voter) said would be preferable for FOMC statements to use more words to describe the current assessment of the economy and how that influences the outlook, as well as risks to that outlook, according to Reuters. Scenario analysis should also be incorporated as a standard part of Fed communications. Would like the Fed to publish an anonymised matrix of economic and policy projections so market participants can see the linkage between each participant’s outlook and their view of appropriate policy associated with that outlook. Expect the Fed will consider communications as part of its next monetary policy framework review.

BoE Deputy Governor Broadbent rejected claims that the monetary policy committee acted too slowly and hit back at critics who have accused it of failing to control inflation, according to The Times.

ECB’s Lane said keeping rates overly restrictive for too long could push inflation below target in the medium-term which would require corrective action that could even mean having to descend below neutral, while they think inflation over the coming months will bounce around at the current level and then will see another phase of disinflation bringing them back to the target later next year, according to Reuters. It was separately reported that ECB’s Lane said policymakers needed to keep rates in restrictive territory this year to ensure inflation kept easing, according to FT.

ECB’s Rehn said inflation is converging to their 2% target in a sustained way and the time is thus ripe in June to ease the monetary policy stance and start cutting rates, while he added this assumes the disinflationary trend will continue and there will be no further setbacks in the geopolitical situation and energy prices.

ECB’s Villeroy said they have significant room for rate cuts with the Deposit Facility rate at 4% and barring a surprise, a rate cut in June is a done deal, while Villeroy added that he doesn’t say they should commit already on July but they should keep their freedom on the timing and pace.

ECB’s Schnabel said QE could have weakened the transmission of monetary policy during the recent tightening cycle, according to Reuters.

RBNZ activated debt-to-income restrictions which will create limits on the amount of high-DTI lending banks can make and will include an allowance for banks to do 20% of their lending outside of our specified limits, while banks must comply with new restrictions from July 1st.

BoJ Monetary Affairs Department Director-General Masaki said changes in wages in real terms will move to positive territory on a Y/Y basis and need to keep an eye on energy prices and forex moves, according to Reuters.

FX

DXY is relatively flat/contained trade thus far with the index currently within a 104.41-56 band and as such is in close proximity to its 200 DMA at 104.37.

Modest strength in the EUR which was relatively unreactive to upticks in German Wholesale Prices and to the the ECB SCE which saw the inflation view revised lower; EUR/USD trades within a 1.0855-79 range, and off best levels.

GBP is flat vs the USD and modestly softer against the EUR. Cable sits in a 1.2764-83 parameter after briefly topping yesterday’s 1.2777 high.

JPY is slightly softer vs the USD and losing against the EUR, AUD, and GBP despite the hotter-than-expected Japanese Services PPI overnight and the currency jawboning by Finance Minister Suzuki overnight. USD/JPY currently just shy of 157.00.

Upward bias across antipodeans following the overnight rebound in commodities. The Kiwi narrowly outperforms in a continuation of last week’s hawkish hold by the RBNZ.

PBoC set USD/CNY mid-point at 7.1101 vs exp. 7.2402 (prev. 7.1091).

Fixed Income

USTs are modestly firmer but with action relatively sparse and overall rangebound into a particularly busy week highlighted by PCE on Friday; docket for today is sparse, but focus will be on US 2yr & 5yr supply. Currently trading within a tight 108-28+ to 108-22 range.

Bunds are contained after lifting to a 130.52 peak on Monday, a high driven by remarks from ECB’s Lane who in a Dublin speech/FT interview outlined that the ECB is “barring major surprises” ready to begin easing. The ECB SCE saw saw lower inflation views at both the one- & three-year ahead timeframes, an update which was enough to lift Bunds to a 130.43 peak for today vs current 130.32.

Gilts are outperforming as the UK catches up to Monday’s EGB move, with UK-specifics light except for reports via the FT which note that Sunak is to announce a GBP 2.4bln tax cut for pensioners, a development which seemingly hasn’t had any bearing on Gilts given opposition Labour is well ahead in the polls. Gilts are holding above 97.00, just off the 97.14 session high.

Italy sells EUR 4.5bln vs exp. EUR 3.75-4.5bln 3.20% 2026 & 0.00% 2024 BTP Short Term and EUR 1.5bln vs exp. 1.0-1.5bln 0.10% 2033 I/L.

Germany sells EUR 0.846bln vs exp. EUR 1bln 2.30% 2033 Green Bund and EUR 0.986bln vs exp. EUR 1bln 2.10% 2029 Green:

Commodities

WTI and Brent are both holding on to the prior day’s gains but with a discrepancy in terms of intraday price changes amid the lack of WTI settlement yesterday as US markets were closed on account of Memorial Day. The complex was lifted amid heightened geopolitical escalations, following recent Israeli strikes on Rafah. Brent August in a USD 82.76-83.11/bbl intraday parameter.

Precious metals are weaker across the board despite the softer Dollar, with no obvious reason for the weakness aside from the pullback in precious metals. XAU sits within a USD 2,340.79-2,356.44/oz parameter.

Firmer across the board with base metals rebounding; desks are citing positive sentiment underpinned by the announcement of China’s USD 47.5bln chip fund.

UBS expects OPEC+ to extend current production cuts for at least another three months; says oil remains a valid geopolitical hedge – sees Brent USD 87/bbl by year-end

Geopolitics – Middle East

Israeli tanks have reached Rafah city centre, according to Reuters witnesses

“Israeli media: Leaders of Israeli opposition parties will discuss tomorrow the formation of an alternative government and the ouster of Netanyahu”, according to Sky News Arabia.

Ambrey says it is aware of incident 54NM southwest of Yemen’s Hodeidah, according to advisory.

Israeli PM Netanyahu said something went tragically wrong regarding the Israeli air strike on Rafah and it will be investigated, while Israel’s government said initial reports are that Rafah civilians died from a fire that broke out after an Israeli strike on Hamas chiefs.

Israeli PM Netanyahu reportedly intends to dissolve the War Council so that he does not have to include Ben-Gvir and Smotrich in it, according to the Israel Broadcasting Corporation.

Israel is waiting to hear Hamas’s stance before deciding on re-joining hostage talks, according to Times of Israel.

Palestinian media reported intensive Israeli shelling in the vicinity of the Emirati hospital west of Rafah in the southern Gaza Strip, according to Al Arabiya.

Pro-Iranian militias in Iraq claimed responsibility for launching three drones at military targets in Eilat, while Israel said three drones launched from Iraq were intercepted.

White House noted devastating images following the Israeli strike in Rafah on Sunday, while it is actively engaging the IDF and partners on the ground to assess what happened. Furthermore, the White House said Israel must take every precaution possible to protect civilians.

French President Macron said he is outraged by the Israeli strikes that have killed many displaced persons in Rafah and called for these operations to stop.

EU’s Borrell said he is horrified by news out of Rafah regarding Israeli airstrikes killing dozens of displaced persons including small children and condemned this in the strongest terms, while he called for attacks to stop immediately. EU Borrell also stated that he has the green light from EU ministers to reactivate the Rafah border mission.

UN Secretary-General Guterres said they condemned Israel’s practices that led to the killing of dozens of innocent people seeking shelter from the conflict and called for the terror to stop, according to Reuters.

An Egyptian soldier was killed in a clash with Israeli troops at a crossing on Monday, according to Bloomberg.

Yemen’s Houthis said they launched attacks on three ships in the Indian Ocean and Red Sea, while Houthis also stated that they targeted two US destroyers in the Red Sea, according to Reuters.

IAEA report stated that Director General Grossi deeply regrets that Iran has not reversed its decision to bar several experienced inspectors, while it noted that outstanding safeguard issues including uranium traces at undeclared sites remain unresolved. It also stated that according to the IAEA’s definition, Iran’s stock of uranium enriched up to 20% is theoretically enough to produce a nuclear bomb if enriched further, according to Reuters.

Geopolitics – Other

Ukrainian President Zelensky will visit Belgium on Tuesday to sign the latest in a string of security accords with Western allies, according to the Belgian PM’s office cited by Reuters.

Ukrainian commander said French military instructors are to visit Ukrainian training centres, according to Reuters.

Russia’s Foreign Ministry said Russia will respond to the restriction on Russian diplomats’ movement in Poland, according to TASS.

China’s Foreign Ministry said US lawmakers paid a visit to Taiwan despite China’s strong opposition and it urged them to stop playing the Taiwan card and stop using excuses to interfere in China’s internal affairs, while it also lodged stern representations against the visit, according to Reuters.

China and the US held talks on maritime issues and exchanged views on May 24th, while they will continue negotiations to avoid a misunderstanding and agreed to manage maritime risks, according to China’s Foreign Ministry. Furthermore, China and the US agreed to maintain dialogue and China urged the US to refrain from intervening in maritime disputes between China and its neighbours, while it added the US should refrain from ganging up to ‘use the sea to control China’ and should immediately stop supporting and condoning ‘Taiwan independence’ forces.

China Maritime Safety Authority said China is to conduct military exercises in the Yellow Sea between May 28th and June 3rd and will conduct sea rocket launches in the Yellow Sea on May 28th-31st, according to Reuters.

North Korea launched a rocket carrying a spy satellite which exploded in the first stage of the launch. South Korea and Japan condemned North Korea’s launch, while the US said North Korea’s launch is a brazen violation of UN Security Council resolutions and raises tensions. Furthermore, the launch was said to have involved technologies directly involved in North Korea’s ICBM program and the US is assessing the situation but noted that the launch did not pose an immediate threat, according to Reuters.

US Event Calendar

09:00: March S&P CS Composite-20 YoY, est. 7.30%, prior 7.29%

09:00: March S&P/CS 20 City MoM SA, est. 0.30%, prior 0.61%

09:00: March FHFA House Price Index MoM, est. 0.5%, prior 1.2%

09:00: 1Q House Price Purchase Index QoQ, prior 1.5%

10:00: May Conf. Board Present Situation, prior 142.9

10:00: May Conf. Board Expectations, prior 66.4

10:00: May Conf. Board Consumer Confidenc, est. 96.0, prior 97.0

10:30: May Dallas Fed Manf. Activity, est. -12.5, prior -14.5

Central Bank Speakers

00:55: Fed’s Mester Speaks at Bank of Japan Event

00:55: Fed’s Bowman Speaks at Bank of Japan

09:55: Fed’s Kashkari Gives Panel Remarks

13:05: Fed’s Cook, Daly Speak on AI

DB’s Jim Reid concludes the overnight wrap

Good evening from a wet New York where I’ve just landed. So an early edition for you today and hopefully I’ll be asleep for part 2 of my Sunday night sleep by the time you read this. Given it was a holiday in both the US and the UK yesterday we’ll still preview the week ahead this morning and briefly review last week even if the rest of the world was trading yesterday.

In fact in the absence of the US and the UK the week has started off positively as the ECB speakers yesterday leaned dovishly with French Governing Council member de Galhau suggesting they shouldn’t rule out back to back June/July cuts. Chief Economist Lane was also slightly dovish in an interview with the FT although didn’t provide any additional hopes to the July cut narrative. Finland’s Olli Rehn also supported a cut next week in comments yesterday. Overall European bonds yields rallied 3-6bps across the curve and the number of basis points of cuts priced in for December 2024 increased from 58bps (a low for the year) on Friday to 61bps. A slightly softer than expected German IFO probably helped as well. European equities were up nearly half a percent to start the week.

Asian equity markets rallied 0.5% to 1.5% yesterday but are a little more subdued in early trading this morning with most either side of the flatline with the exception of the Hang Seng which is +0.8% in very early trading. S&P 500 (+0.12%) and NASDAQ 100 (+0.21%) futures are slightly higher after yesterday’s holiday.

Early morning data showed that Japan’s services PPI advanced +2.8% y/y in April (v/s +2.3% expected), recording its fastest rise in nine years and higher than the revised +2.4% gain in March. Elsewhere, retail sales in Australia rebounded +0.1% m/m in April but less than Bloomberg’s forecast for a +0.2% advance. This followed a -0.4% fall last month and a YoY rate just over 1% that has only really been lower during Covid in recent times. So a very soft consumption story in Australia at the moment.

In the energy space, Brent crude (+0.04%) prices have steadied this morning after rebounding more than +1.0% yesterday from more than three-month lows ahead of the online OPEC+ meeting on June 2.

Before that, all roads this week point towards the April US core PCE print on Friday which in MoM terms is expected to edge down from +0.32% to +0.26%. You don’t need me to tell you how well scrutinised this data will be and how important it is to the Fed. As part of the same release, personal income (+0.4% forecast vs. +0.5% previously) and consumption (+0.2% vs. +0.8%) will likely come in a little softer. Back to inflation, and the preliminary May CPIs are out in Germany tomorrow, and in France, Italy and the Eurozone on Friday. Our European economists see this coming in at + 2.55% (+2.4% in April) for headline and +2.84% (+2.66% April) for core inflation. See their full preview here. At the start of 2024, euro area inflation avoided the sizeable upside surprises we saw in the US, but the last print in April did see core inflation slightly stronger than expected. I t would be a tall order for the data to derail the strongly signaled ECB cut next week but it could have important implications for the ECB’s signal beyond this. We will also have the latest inflation expectations from the ECB consumer expectations survey for April today. Our economists’ own dbDIG survey (see here) suggests that median medium-term expectations are likely to stay stable at 2.5%. Finally on inflation, Tokyo CPI is also out on Friday.

Elsewhere, in the US we have consumer confidence today, the Fed Beige Book tomorrow, the second reading of GDP and the Trade Balance on Thursday with the Chicago PMI alongside the personal spending and income report (alongside core PCE) on Friday. In China, May’s PMIs on Friday will be the highlight. You can see the full day-by-day week ahead at the end including all the main central bank speakers highlighted too.

In what is a busy busy year for elections, this week we have the South African election tomorrow (DB primer here), the last leg of the Indian elections on Saturday and the Mexican equivalent on Sunday. Note it’s also less than two weeks until the European Parliamentary elections. DB has a great primer here.

It might seem like ancient history by now, but when it came to last week, markets lost some momentum after strong data cast doubt on the chance of rate cuts. In particular, the flash PMIs for May came in stronger-than-expected on both sides of the Atlantic, with the US composite PMI up to a two-year high, whilst the Euro Area number hit a one-year high. Moreover, that positive data was cemented by a fall in the US initial jobless claims, along with an upward revision in the University of Michigan’s final consumer sentiment index. That strength has been evident in other indicators, and the Atlanta Fed’s GDPNow Index is pointing to US Q2 growth at an annualised +3.5% pace.

Much as the positive data was welcome, it also led to a fresh reassessment about how rapidly central banks would be able to cut rates. For instance, the amount of cuts priced in by the Fed’s December meeting came down by -10.7bps over the week to 33bps. And for the ECB, it fell by -8.3bps to 58bps, which was the fewest so far this year. This trend was further exacerbated by the minutes from the latest Fed meeting, which leant in a hawkish direction. In fact, it said that “ Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.” So that helped to crystallise concerns about more restrictive monetary policy.

This backdrop meant that sovereign bonds struggled globally. Yields on 2yr Treasuries (+12.2bps) saw their largest rise in 6 weeks (+1.1bps Friday) while 10yr yields were up +4.4bps over the week (-1.2bps Friday) to 4.47%. Similarly in Europe, yields on 10yr bunds were up +6.8bps (-1.2bps Friday), and in the UK there was an even larger selloff after the April inflation print surprised on the upside. That meant yields on 10yr gilts were up +13.4bps for the week (+0.2bps Friday) and the 2yr yield was up by +18.7bps (-0.4bps Friday). Finally in Japan, there was a significant milestone as yields on 10yr JGBs surpassed the 1% mark in trading for the first time since 2012. By the end of the week, they’d risen by +5.6bps (+0.3bps Friday). Obviously European bonds have started the week on a firmer footing which perhaps reflects the uncertainty with the back and forth on rate expectations at the moment. Albeit it’s a low volatility back and forth.

The prospect of higher rates for longer (last week at least) caused a mixed week for risk assets. The S&P 500 was essentially flat on the week (+0.03%), though a +0.70% recovery on Friday helped it just post a 5th consecutive weekly gain. There were contrasting moves within this, with a strong earnings report from Nvidia helping the Magnificent 7 (+2.91%, and +1.63% in Friday) and the NASDAQ (+1.41%, and +1.10% on Friday) up to new record highs by the close on Friday. However, most sectors outside of tech lost ground, with the Dow Jones index down -2.33% on the week (+0.01% on Friday). Meanwhile in Europe, the STOXX 600 fell -0.45% last week (-0.19% Friday).

Tyler Durden

Tue, 05/28/2024 – 08:08

Share This Article

Choose Your Platform: Facebook Twitter Linkedin