Futures Slide Ahead Of Huge Earnings Week

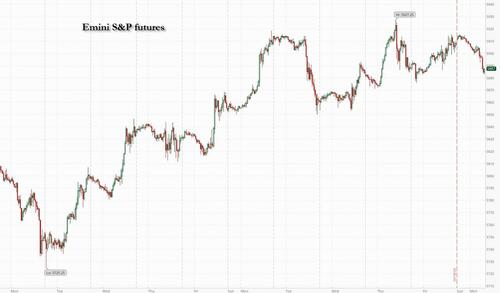

US stock futures drop to start the week, trading near session lows as investors looked to a busy week of company earnings for further signs on the strength of the economy. Oil climbed and gold touched another record on mounting tensions in the Middle East. As of 8:00am, S&P futures are down 0.3% after the index capped its longest run of weekly gains this year, while futures for the tech-heavy Nasdaq 100 fell 0.5% while Nasdaq futures slide 0.6%, with megacap tech stocks all mostly lower: TSLA -0.7%, AMZN -0.3%, AAPL -0.3% pre-market after last week’s furious rally. 10-year Treasury yields rise five four basis points to 4.13% and the dollar edged higher. Commodities are higher led by oil and base metals after a bigger-than-expected China LPR rate cut announcement. Over the weekend, BA achieved a tentative settlement of the strike; BA is up +3.8% pre-market. This week, the key catalyst will be PMIs on Thursday. On earnings, more than a fifth of the S&P 500 is due to report this week with Tesla Inc., Boeing Co., General Motors Co. and Coca-Cola Co. in the lineup. Approximately 40% of Industrials (including GE, LMT, MMM, BA, UPS, HON, UNP) and 30% of Materials companies will report. In addition, VRT (Wed pre-mkt; focus on data center), IBM and TXN will provide further color on tech and semis. Also keep an eye on DHR (Tue pre-mkt; housing), KO (Wed pre-mkt; consumer trends), TSLA (Wed aft-mkt; first Mag 7 earnings).

In premarket trading, Boeing rose 3% after union workers struck out a tentative agreement with the planemaker that raises pay by 35% over four years. The workers are set to vote on Wednesday. Kenvue jumped 8% after the Wall Street Journal reported activist investor Starboard Value has built a stake in consumer-products company, seeking changes that would boost the Tylenol maker’s stock price. Here are some other notable movers:

Humana (HUM) gains 4% as Cigna revives efforts to combine with its smaller rival, according to people familiar with the matter. The talks between the health insurers fell apart last year over price. Shares of Cigna (CI) are down 3%.

Piedmont Lithium (PLL) drops 5% after JPMorgan downgraded the stock to underweight as market price declines are set to eat into earnings despite management’s focus on cash efficiencies.

SolarEdge Technologies (SEDG) slip 2% after TD Cowen cut the stock to hold citing deteriorating demand in Europe.

Spirit Airlines (SAVE) jumps 38% after the carrier reached an agreement with U.S. Bank National Association to extend a deadline by which the airline must extend or refinance its 2025 bonds to maintain its credit-card processing agreement with the bank.

US stocks are unlikely to sustain their above-average performance of the past decade as investors turn to other assets including bonds for better returns, Goldman Sachs strategists said. This year’s 23% bounce has been concentrated in a handful of the biggest technology stocks.

“Optimism about a soft-landing abounds, but that narrative is much more relevant for the US,” said Daniel Murray, chief executive officer of EFG Asset Management in Switzerland. “The European macro backdrop is much more vulnerable, and that is weighing on investor sentiment towards European stocks.”

Speaking of Europe, the Stoxx 600 index dropped 0.5% with gains in energy shares unable to offset losses elsewhere as another busy earnings week is gaining momentum. European companies have so far delivered fewer positive earnings surprises than usual, Barclays strategists said at the end of last week. JDE Peet’s shares jumped after an investor said it would acquire Mondelez’s stake in the coffee producer. SGS and Intertek are among the biggest laggards in the index after RBC downgraded both firms. DNB Bank ASA will acquire all the shares of rival Swedish firm Carnegie Holding AB for about 12 billion kronor ($1.1 billion) in what is the latest step of banking consolidation in the Nordic market. JAB agreed to buy Mondelez’s 86 million shares in JDE Peet’s for €25.10 per share, according to a statement. Here are some of the other notable European movers:

Forvia shares rise as much as 10% after the car parts manufacturer reported third quarter sales that beat estimates. Analysts say the print is encouraging after September’s guidance cut

European miners are outperforming the broader market on Monday as iron ore and base metals rose after Chinese banks cut their benchmark lending rates; gold-related shares also rise

Hensoldt shares rise as much as 5.7%, the most intraday since mid July, after Bank of America upgraded the German defense electronics manufacturer to buy, citing an appealing valuation

Yellow Cake rises as much as 3.9% as Citi starts coverage with a buy recommendation, saying the stock is a “unique vehicle” for exposure to physical uranium

PureTech Health shares rise as much as 4.4% in London after its portfolio company Seaport Therapeutics closed a $225m Series B financing round that was oversubscribed

Future rallies as much as 6.4% on Monday, following a 19% slump for the media company’s shares on Friday after it announced that CEO Jon Steinberg plans to step down

Getinge shares drop as much as 3.1% after Nordea downgrades its recommendation on the stock to sell following the Swedish health-care firm’s third-quarter earnings that missed expectations

SGS and Intertek both fall after being respectively downgraded to underperform sector perform at RBC, being more cautious on the testing, inspection and certification (TIC) sector into 2025

Munich Re shares decline as much as 2.7% to be the worst performer in the Stoxx 600 Insurance Index, after Jefferies downgraded the reinsurer to hold from buy, seeing limited further upside

Midwich shares fall as much as 18% to a 2017 low, as the IT services company warns that a deterioration of market conditions is expected to persist for the rest of the year

REC Silicon shares fall as much as 24%, the most since February, after the Norwegian silicon manufacturer said its testing of ultra-high purity polysilicon material has been delayed

Earlier in the session, Asian stocks failed to hold on to their initial gains on Monday, dragged down by losses in Hong Kong-listed Chinese shares. The MSCI Asia Pacific Index fell as much as 0.6%, with financials and consumer discretionary sectors being the worst performers. Equities in India and most Southeast Asian markets also edged lower. While Chinese stocks onshore managed to eke out a small gain after banks cut their benchmark lending rates, the Hang Seng China Enterprises Index — a gauge of the nation’s shares listed in Hong Kong — slid almost 2%. The divergence in performance on Monday underscores a shift in investor preference in favor of Chinese equities traded on the mainland, which are seen benefiting more from Beijing’s policy support measures.

In FX, the Bloomberg Dollar Spot Index rose 0.2%. There was a spike of demand for the dollar last week which is likely to be linked to the US election, according strategists at JPMorgan. CFTC data showed non-commercial market players including hedge funds, asset managers and others cut aggregate bearish bets on the dollar to some $1.4 billion as of Oct. 15. That’s the least negative on the US currency since traders turned short in August, according to data compiled by Bloomberg.

In rates, treasuries trade lower into early US session, following losses in European rates as supply pressure weighs. The rebound in oil futures, up 2.2%, also adds to upside pressure on Treasury yields as investors monitor risk to supplies from Middle East warfare. 10-year Treasury yields are up 5 bps to 4.13%. Bunds are underperforming their US and UK peers, with German 10-year yields rising 5 bps to 2.23%.

In commodities, oil rebounded from last week’s 8% rout; Brent crude traded above $74 per barrel, rising almost 2% on the session. In the Middle East, Israel is discussing its attack on Iran after a Hezbollah drone exploded near Prime Minister Benjamin Netanyahu’s private home at the weekend. Investors are also boosting gold holdings ahead of what’s expected to be a tight US presidential election. Spot gold has picked up where it left off on Friday, rising $15 to another record high.

Looking at today’s calendar, the lone item of note is the September Leading index at 10am. Fed members scheduled to speak include Logan (8:55am), Kashkari (1pm), Schmid (5:05pm) and Daly (6:40pm).

Market Snapshot

S&P 500 futures little changed at 5,903.25

STOXX Europe 600 little changed at 525.17

MXAP down 0.5% to 190.51

MXAPJ down 0.4% to 608.41

Nikkei little changed at 38,954.60

Topix down 0.3% to 2,679.91

Hang Seng Index down 1.6% to 20,478.46

Shanghai Composite up 0.2% to 3,268.11

Sensex up 0.2% to 81,378.37

Australia S&P/ASX 200 up 0.7% to 8,344.39

Kospi up 0.4% to 2,604.92

Brent Futures up 1.0% to $73.81/bbl

Gold spot up 0.4% to $2,731.75

German 10Y yield up 4.3 bps at 2.23%

Euro down 0.1% to $1.0851

Brent Futures up 1.0% to $73.80/bbl

US Dollar Index up 0.15% to 103.65

Top Overnight News

China unveiled some of its biggest cuts to benchmark lending rates in years as the government stepped up efforts to reboot the economy and hit its year-end target of about 5 per cent GDP growth. The PBOC said on Monday that the country’s one-year loan prime rate would be reduced to 3.1 per cent from 3.35 per cent, the biggest reduction on record, and the five-year LPR would be cut to 3.6 per cent from 3.85 per cent. FT

More than 20 Chinese listed companies have announced plans to tap special central bank lending for share purchases, according to exchange filings, days after the PBOC kicked off the $42 billion funding scheme. The PBOC launched the relending program on Friday, allowing listed companies or their major shareholders to borrow cheaply to fund share buybacks or holding increases. The scheme is worth 300 billion yuan ($42.24 billion) initially. RETRS

Saudi Aramco is “fairly bullish” on China’s oil demand especially in light of the government’s stimulus package which aims to boost growth, the head of the state-owned oil giant said on Monday. RTRS

UK gov’t preparing bond markets for GBP80B in extra borrowing over the next 5 years (a formal announcement is set to arrive on 10/30), a sum investors say can be absorbed without sparking a Lizz Truss-like panic so long as specific details are provided. London Times

Israel extended its bombing campaign in Lebanon, targeting financial institutions it says help fund Hezbollah. PM Benjamin Netanyahu met with top aides to discuss the next attack on Iran after a Hezbollah drone exploded near his home. BBG

US banks are considering aggressive cuts to interest payments for corporate depositors as they seek to protect their profit margins after the Federal Reserve cut benchmark lending rates. FT

Harris continued her blistering fundraising streak in Sept, with her campaign and allied committees raising more than $359M last month (vs. $160M for Trump). NYT

Boeing has reached a tentative deal with its striking union workers that would increase compensation by 35% over four years (which is up from its original offer of 25%), with a union vote scheduled for Wednesday. WSJ

Jefferies is the subject of a WSJ profile article detailing the aggressive headcount expansion undertaken by the firm over the last several years as it looks to become a top 5 investment bank by revenue (Jefferies is holding an analyst meeting Monday). WSJ

A more detailed look at global markets courtesy of Newsquawk

Top Asian News

European bourses, Stoxx 600 (U/C) began the session with a slight negative bias, and generally opened just below the unchanged mark. Stocks attempted to tilt higher soon after the cash open, but have since dipped off best levels to display a generally negative picture in Europe. European sectors are mixed and with the breadth of the market fairly narrow. Energy takes the top spot, alongside Basic Resources. Insurance is found at the foot of the pile. US Equity Futures (ES U/C, NQ -0.2%, RTY +0.2%) are mixed, with very slight underperformance in the NQ. Catalysts today have been light and the docket ahead remains thin.

Top European News

ECB’s Holzmann said on Friday they are on track to getting inflation under control and that the rate decision in December will depend on the data.

ECB’s Villeroy said they are on a good way to defeating inflation which is good news and there may be some temporary rebounds in the coming months although this would be due to technical effects, while he added that there will probably be more rate cuts and they will decide depending on the data.

ECB’s Vasle said that back-to-back rate cuts are no indication of future ECB action, according to the FT.

ECB’s Simkus says if disinflation becomes entrenched, rates could go below the natural level.

ECB’s Kazaks says inflation is continuing to decline whilst the economy is weak; rates will continue to decline as inflation declines. ECB rate cuts cannot bring sustainable growth. Rates are still inhibiting economic growth.

S&P affirmed the UK’s rating at AA; Outlook Stable, while Fitch affirmed Sweden at AAA: Outlook Stable, affirmed Sweden at AAA; Outlook Stable and affirmed Italy at BBB: Outlook revised to Positive from Stable.

FX

USD is broadly stronger vs. peers; for now, the index is below Friday’s 103.80 peak which coincides with the 200DMA.

EUR a touch softer vs. the USD after what has been a bruising run for the pair as of late, given a dovish ECB repricing, more hawkish Fed pricing and markets leaning towards a potential Trump presidency. EUR/USD hit resistance at its 200DMA at 1.0871 and has since drifted to a low at 1.0847.

GBP is softer against the USD and to a lesser extent the EUR. Docket ahead is quiet, but a slew of BoE speakers are due throughout the week. For now, Cable is tucked within Friday’s 1.3008-71 range.

JPY is softer vs. the USD. However, USD/JPY remains sub-150 after venturing as high as 150.31 last week.

Antipodeans are both softer vs. the broadly firmer USD in quiet newsflow. AUD/USD has failed to sustain a move above the 0.67 mark and has since slipped below its 100DMA at 0.6695 and Friday’s 0.6692 trough.

PBoC set USD/CNY mid-point at 7.0982 vs exp. 7.0990 (prev. 7.1274).

Fixed Income

USTs are modestly lower but holding at a 112-00 trough which equals last Thursday’s base with support at 111-31 and 111-29+ below that.

Bunds are softer despite experiencing a modest tick higher to a 134.18 session peak on cool German producer price metrics for September. The upside ultimately proved fleeting, with Bunds slipping to a current trough of 133.61. ECB speak today has had little impact on prices.

Gilts gapped lower at the open and continued to extend losses, in tandem with weakness seen across the complex. Gilts are currently trading at a session trough of 97.61.

Commodities

Crude oil is modestly firmer with geopolitical tensions remaining in full focus as we await a response from Israel following Iran’s attacks; elsewhere, over the weekend, tensions have been exacerbated by a reported drone attack on the (empty) residence of Israel PM Netanyahu. Brent’Dec currently towards the upper end of a USD 72.80-73.99/bbl range.

Gold is in the green, gleaning support from the above geopolitical tensions. At a USD 2733/oz peak, which marks yet another ATH for the yellow metal.

Base metals are firmer owing to the move higher seen in mainland China on the back of the (widely expected) PBoC LPR cut with the metals also seeing strength in APAC hours owing to the tone from Friday.

Saudi Aramco’s CEO said the world must accelerate the development of new energy sources and lower carbon technologies that can compete on price and performance, while he added that they are fairly bullish on China and oil demand, as well as see some more demand for jet fuel and NAPTHA, especially for crude to chemical projects.

IEA’s Birol said more than 25% of global energy demand growth is to come from SE Asia in the next 10 years.

Shell (SHEL LN) said there was an oil leak from a pipeline at Shell Energy and Chemicals Park in Singapore and it activated emergency response specialists to help manage the situation.

Turkmenistan signed a deal with Iraq to supply 20mln cubic metres of gas daily.

Geopolitics: Middle East

Israeli PM Netanyahu said a drone attack which targeted his home in northern Israel was a “grave mistake”, while he and his family were not at their house when the drone attack struck on Saturday and there were no casualties.

Israeli PM Netanyahu spoke with former US President Trump and told him that Israel considers the issues the US administration raises but will make decisions based on its national interests.

Israel’s military said it attacked Hezbollah’s intelligence HQ and weapons storage facilities in the southern suburbs of Beirut on Saturday. It was also reported that Israel conducted a fresh raid on the southern suburbs of Beirut on Sunday, as well as targeted the city of Tyre and the towns of Bir al-Salasil and Homine al-Fawqa in southern Lebanon.

Israeli military spokesperson had warned on Sunday that they would conduct targeted strikes on sites belonging to Hezbollah’s financial arm across Lebanon and urged Lebanese residents to evacuate areas near those facilities, while it was later reported that Israeli strikes hit branches of Hezbollah-linked bank in Beirut and Beqaa Valley, according to Times of Israel.

Hezbollah announced it conducted a rocket barrage at Beit Hillel base, while it was separately reported that Iraqi armed factions announced the targeting of an Israeli military site in the Golan with drones.

Israel gave the White House its demands for ending the war in Lebanon, while US President Biden’s envoy Amos Hochstein will visit Beirut on Monday to discuss a possible diplomatic solution with Lebanese officials, according to Axios. The report noted one Israeli demand is that IDF be allowed to engage in “active enforcement” to ensure Hezbollah doesn’t rearm and Israel also demands its air force have freedom of operation in Lebanese airspace, although a US official said it is highly unlikely Lebanon and the international community would agree to Israel’s conditions.

Iran’s Supreme Leader said Hamas leader Sinwar’s death will not halt the axis of resistance and Hamas will live on.

Iranian Foreign Minister Araghchi alluded to the US and warned that anyone who knows how and when Israel will attack Iran will be held accountable, according to Reuters.

US House Speaker Johnson said on Sunday that there would be a classified briefing related to leaked US intelligence on Israel-Iran, according to Reuters.

US Defence Secretary Austin said he would like to see Israel scale back on some of its strikes in and around Beirut, while he raised the issue about UNIFIL security with Israel’s Defence Minister Gallant. Furthermore, Austin reviewed the US defence posture and said he is relieved that PM Netanyahu is safe, while he said he couldn’t confirm reports that North Korean troops are in Russia and readying for combat in the Ukraine war, according to Reuters.

UN peacekeeping force UNIFIL said an Israeli army bulldozer demolished a watchtower and fence surrounding the UN site in southern Lebanon on Sunday, according to Reuters.

G7 defence ministers reaffirmed the importance of supporting UNIFIL and the Lebanese armed forces in their role of ensuring the stability and security of Lebanon, while they called on Iran to refrain from providing support to Hamas, Hezbollah, Houthis and other non-state actors. Furthermore, they called on Houthis to immediately cease their escalatory measures that increase regional instability and immediately release the vessel Galaxy Leader and its crew.

Geopolitics: Other

Russia’s Kremlin say informal meeting between Putin and UAE president went on until midnight. “North Korea is our close neighbour, our partner and we are developing relations in all areas”. Kremlin do not comment on claims that North Korea is sending troops to Russia. “Ties with North Korea are not directed against other countries”.

Ukrainian President Zelensky thanked countries that ‘do not close their eyes’ to North Korean involvement in Ukraine’s war with Russia and seeks a normal, honest and strong reaction from them, according to Reuters.

Russian Foreign Minister Lavrov said recent statements by US President Biden on being ready for nuclear talks with Russia without preconditions are deception and he does not see signs at this moment that Moscow and Washington will return to talks on equal terms after the US presidential election, according to RIA.

G7 defence ministers expressed deep concern at China’s support to Russia which is enabling Russia to maintain its illegal war in Ukraine, while the defence ministers said they support Ukraine on its irreversible path to full Euro-Atlantic integration including NATO membership.

North Korean Foreign Minister said the new US-led sanctions monitoring team is unlawful, according to KCNA.

US Event Calendar

10:00: Sept. Leading Index, est. -0.3%, prior -0.2%

Central Bank Speakers

08:55: Fed’s Logan Speaks at SIFMA Annual Meeting

13:00: Fed’s Kashkari Participates in Townhall Event

17:05: Fed’s Schmid Speaks on Economic and Monetary Policy Outlook

18:40: Fed’s Daly Speaks in Moderated Discussion

DB’s Jim Reid concludes the overnight wrap

It doesn’t feel like its going to be the most exciting week ahead of us. Although with earnings season now in full throttle and with a seemingly extremely tight US election just two weeks tomorrow there is undoubtedly plenty to think about and react to.

Having said the election is tight, over the last two weeks the probability markets have been shifting back towards Trump. PredictIt has moved from a 45% probability of a Trump win on September 20th to 56% this morning. At the start of October a Republicans sweep was a 28% probability on Polymarket.com but that’s now shifted to a 42% chance. A Democrats sweep has fallen from 21% to 14%. Outside of the tax and spending implications, Mr Trump last week said that “the most beautiful word in the dictionary is tariff”. So that should have reminded markets that he is serious on this matter if he gets elected. In terms of fiscal, you’ll remember from last week that our US economists believe that the deficit will be between around 7 to 9% from 2026-2028 whatever political configuration we have in the White House.

Staying on debt we do have the IMF and World Bank annual meetings in Washington from today and across the rest of the week. There is expected to be a focus on the unsustainability of global debt in these meetings but that is probably more of a medium-term concern rather than anything markets will latch on to this week. There are plenty of central bankers speaking at the various Washington events but in particular watch out for ECB President Lagarde and BoE’s Governor Bailey (both tomorrow). Ahead of that, today sees quite a bit of Fedspeak. There is also the BRICS summit held in Kazan, Russia from tomorrow to Thursday hosted by Putin. China’s President Xi and India’s Prime Minister Modi are expected to attend.

In terms of data, the main highlight is probably the round of global flash PMIs (Thursday). Walking through the data day-by-day, the other highlights are German PPI, French retail sales and the US leading index today, the US Phili Fed tomorrow, US existing home sales, the Beige book, Eurozone consumer confidence and the Bank of Canada meeting on Wednesday, US initial jobless claims on Thursday, and US durable goods, Tokyo CPI, and the German Ifo on Friday. Recent strikes and storms will likely distort US claims and durable goods so it will be tough to get a clean data read at the moment. The Beige book may give us a bit more insight into current economic momentum.

In corporate earnings, the main highlights are SAP (today), Texas Instruments, GE, and GM (tomorrow), and Tesla, IBM, and Boeing (Wednesday). We list others in the day-by-day calendar at the end.

This morning, Asian equity markets are mostly trading higher. The Shanghai Composite (+0.82%), and the KOSPI (+0.67%) are leading the gains with the Nikkei (+0.33%) also higher. The Hang Seng is -0.55%, with US equity futures and US Treasuries pretty flat.

Focusing in on China, the PBOC has reduced the one-year loan prime rate (LPR) by 25 basis points to 3.10% from 3.35%, and the five-year LPR by the same margin to 3.6% from 3.85%. This is at the upper end of the 20-25bps of cuts expected with the consensus going for 20bps.

In the commodities market, gold continues its march higher (+0.33%) and to a fresh record high of $2,731 amid reports of Israel contemplating retaliation against Iran following Tehran’s recent missile attacks. Tensions have escalated further with news of a Hezbollah drone explosion near Prime Minister Benjamin Netanyahu’s residence on Saturday. The family weren’t home at the time but questions are being asked about how the drone was able to penetrate the defence systems and also what the response will be. Against that backdrop, Brent crude prices have slightly rebounded, trading +0.45% higher at $73.39/bbl.

Looking back at last week now and markets continued to advance, as the combination of strong US data, solid earnings, and another ECB rate cut buoyed investors. In particular, the S&P 500 posted a 6th consecutive weekly advance for the first time in 2024, and the latest weekly gain means it’s still experiencing its strongest performance at this point in the year since 1997. In terms of the details, the S&P 500 was up +0.85% over the week (+0.40% Friday), whilst small-cap stocks did particularly well, with the Russell 2000 up +1.87% (-0.21% Friday). It was a similar story in other countries, with Europe’s STOXX 600 up +0.58% for the week (vs. +0.21% Friday). However, emerging market equities lost ground for a second week running, with the MSCI EM Index down -0.38%, despite a +1.76% rebound on Friday led by Chinese stocks.

That strength was evident across multiple asset classes. For instance, in credit there were several milestones, with US IG credit spreads falling to just 79bps on Thursday, which was their tightest level since 2005, before rising +2bps on Friday. Similarly, Euro IG credit spreads ended the week at just 105bps, their tightest since February 2022. That spread tightening also happened among sovereign bonds, with the gap between the 10yr Italian yield over bunds down -11.9bps last week to 118bps, which is their tightest level since November 2021.

Among sovereign bonds themselves, there was also a modest rally last week, with yields on 10yr Treasuries down -1.7bps (-0.8bps Friday) to 4.08%. And those on 10yr bunds came down by a larger -8.3bps (-2.6bps Friday) to 2.18% helped by the back-to-back cut by the ECB. Bonds were also helped by a noticeable decline in commodity prices, and Brent crude fell by -7.57% over the week to $73.06/bbl. But even as oil prices fell, gold prices climbed to another all-time high on Friday of $2,721/oz, having risen by +2.44% last week (+1.08% Friday).

Tyler Durden

Mon, 10/21/2024 – 08:17

Share This Article

Choose Your Platform: Facebook Twitter Linkedin