GameStop Shares Double After ‘Roaring Kitty’ Posts $180 Million Bet

Shares of GameStop Corp. jumped as much as 100% in early premarket trading in New York after the Reddit account affiliated with ‘meme’ stock trader Keith Gill, aka Roaring Kitty, posted an image of what appears to be a massive position in the struggling video game retailer.

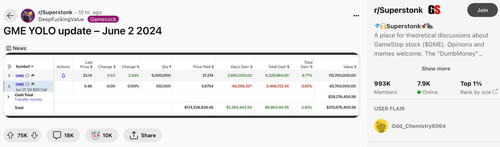

The Reddit account “DeepFuckingValue,” also Gill’s, posted a screenshot of what appears to be his brokerage account late Sunday night. It shows five million GME shares with a cost basis of around $21.27 per share. On line two, he bought 120,000 call options worth $65.7 million, expiring on June 21.

Bloomberg, MarketWatch, and other financial media outlets all emphasized Gill’s position could not be verified.

GME shares jumped as much as 103% in premarket trading. As of 0600 ET, shares are up 70%, around the $39 handle.

On X, Gill, using his Roaring Kitty account, posted an image of a UNO reverse. In the game, players use the card to change the card-pickup direction. As of early Monday, the post garnered nearly 6 million views.

— Roaring Kitty (@TheRoaringKitty) June 3, 2024

Last Wednesday, the company revealed it had raised $933 million by cashing in on the first rally earlier last month, also ignited by Gill. The company said it completed its previously disclosed offering for 45 million shares and will use the proceeds for possible acquisitions and investments.

Besides GME, AMC Entertainment Holdings is up 25% in premarket trading to the mid-point of the $5 handle. During the meme stock frenzy, the struggling movie theater chain also closed an at-the-market equity offering last month.

Goldman’s Retail Sentiment basket shows the first wave of meme stock buying early last month, with gains evaporating in just a few short trading days.

After the Covid mania, Reddit traders should’ve just bought big tech.

Gill’s pump of GME, combined with the subsequent equity offering by the struggling company, raises concerns.

Tyler Durden

Mon, 06/03/2024 – 06:55

Share This Article

Choose Your Platform: Facebook Twitter Linkedin