Goldman: “China Doesn’t Move Needle For Boeing Right Now”

Update (1442ET):

Goldman analysts Noah Poponak and others reacted to Bloomberg’s report earlier this morning regarding China’s suspension of Boeing jet deliveries amid the deepening trade war between the U.S. and China.

“We think the impact to Boeing is very small because China had already stopped taking Boeing deliveries and stopped ordering Boeing aircraft during the last Trump administration, such that there is no real reduction to implement,” Poponak wrote in a note to clients in the late afternoon hours of the cash session.

The analyst continued:

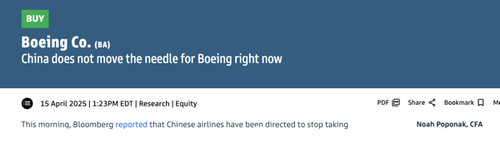

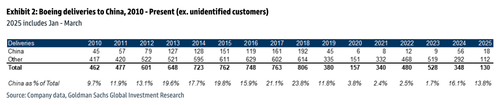

Per company data, customers from China have only ordered 28 aircraft since 1/1/2018 (ex. unidentified customers), and China is 2% of Boeing’s large backlog that is sold out through 2030 with other customers. China was in the built but not delivered inventory balance, but the majority of that has now been delivered with around only 25 737-8 MAX aircraft (produced prior to 2023) left designated to the country. Boeing has previously stated that it can build a multi-year delivery skyline assuming China is not taking airplanes over at least a medium-term window, while it operates in a long-term secular growth market where all other regions have substantial growth and replacement needs.

“We are buy-rated on the stock,” he added.

He explained that China was once a “meaningful portion of Boeing’s total order and delivery activity,” but not since President Trump’s first term, which resulted in the first trade war round with Beijing.

The activity chart data shows Boeing’s order activity with China plummeted after 2016.

Boeing deliveries to China, 2010 to present day.

Trump will likely need to sprinkle some Max jets and 777s in any trade deal when he renegotiates with Beijing.

* * *

Days after Juneyao Airlines postponed the delivery of a widebody jet from Boeing, Beijing has escalated its trade war response—quietly ordering all Chinese carriers to suspend further Boeing deliveries, according to Bloomberg, citing people familiar with the situation. The move marks a broadening of non-tariff retaliation amid a deepening tit-for-tar trade war between the U.S. and China.

Here’s more color from the report:

China has ordered its airlines not to take any further deliveries of Boeing Co., according to people familiar with the matter.

. . .

Beijing has also asked that Chinese carriers halt any purchases of aircraft-related equipment and parts from U.S. companies, the people said, asking not to be identified discussing matters that are private.

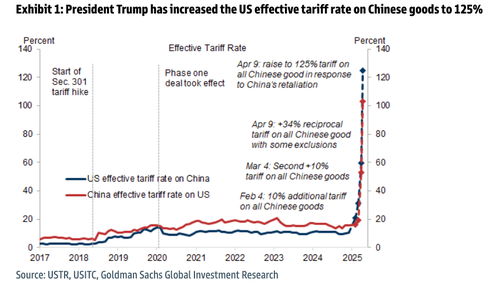

The order came after China unveiled retaliatory tariffs of 125% on American goods this past weekend, the people said.

. . .

The Chinese government is also considering ways to provide assistance to airlines that lease Boeing jets and are facing higher costs, the people said.

. . .

Delivery paperwork and payment on some of these jets may have been completed before the reciprocal tariffs announced by China on April 11 took effect on April 12, and those planes may be allowed to enter China on a case-by-case basis, some of the people said.

Last week, Beijing hiked its effective tariff rate on US goods to 125%, countering President Trump’s 145% tariff rate.

Beijing also shifted to non-tariff retaliation, limiting Hollywood film imports, slowing rare earth export shipments, and weakening the yuan.

The Bloomberg report sent Boeing shares down roughly 3.5% in New York trading. The stock is down 10% year-to-date (as of Monday’s close) and hovering near Covid-era lows, still showing no signs of a meaningful recovery.

Let’s not forget that China’s non-tariff countermeasures may also include:

-

Export Controls and Quotas

-

Currency Devaluation

-

Boycotts (State-Inspired)

-

Licensing & Certification Hurdles

-

Restricting Market Access

-

Pressure Big Tech With Cybersecurity & Data Laws

-

Limiting Cultural Imports

-

Selling U.S. Treasuries

The trade war might be far from over…

Tyler Durden

Tue, 04/15/2025 – 14:42

Share This Article

Choose Your Platform: Facebook Twitter Linkedin