Maybe Third Time Isn’t The Charm

By Benjamin Picton, senior macro strategist at Rabobank

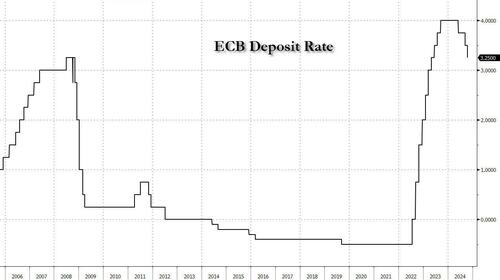

The European Central Bank surprised nobody by cutting its deposit facility rate to 3.25% yesterday. OIS futures were virtually fully-priced for the outcome, and all 65 analysts surveyed by Bloomberg (including our own Bas van Geffen) predicted the 25bps cut, the third of the current easing cycle. The futures market now has 37.7bps worth of cuts priced for the December meeting as Christine Lagarde highlighted concerns over the growth outlook, particularly in the manufacturing sector where rising energy costs, competitive pressures and weaker growth in export markets (China) continues to hurt.

Manufacturing isn’t the only concern. Rabo Research’s Head of Macro Strategy Elwin de Groot and Senior Economist Maartje Wijffelaars recently highlighted perceptions of a ‘catching down’ effect whereby services indicators are following manufacturing lower. Rabo Research argues that softening services indicators are primarily due to weakness in consumer demand, rather than spillover effects from manufacturing. Lagarde confirmed that the ECB has been surprised by this weakness, highlighting that spending had been expected to pick up as growth in wages remains brisk and disinflation continues.

Rabo Research still believes that the conditions exist for a pickup in consumer demand as the high household savings rate normalizes, real wages continue to grow and further monetary easing is delivered. To-date, this has not happened and it has created a divergence between European and American consumers that was illustrated by yesterday’s strong US retail sales report for September. The report confirmed that control group sales rose by 0.7% month-on-month versus expectations and a prior read of +0.3%, prompting the Atlanta Fed’s GDP Nowcast to rise from 3.2% to 3.4%. US initial jobless claims figures released on the day were also stronger than the market expected, printing at 241k versus a consensus estimate of 259k.

The US Treasury curve bear-steepened as 2-year Treasury yields rose by 3.2bps and 10-year yields climbed 7.7bps. By contrast, the German Bund curve also steepened as long-end yields rose, but the dovish message out of the ECB combined with a slightly softer-than-expected CPI print earlier in the day to prompt short end yields to fall and European stocks to rise sharply.

Fed-dated OIS now has just 42.7bps worth of cuts priced in for the two remaining FOMC meetings in 2024. A 25bps cut at each meeting is Rabo Research’s forecast and a popular view in the market following the strong forward guidance issued by Jerome Powell at the NABE conference in late September. The recent run of stronger than expected data has alloyed with comments from the Fed’s Daly and Bostic suggesting that the Fed could skip a cut at one of the upcoming meetings to lift the front end of US rates curves.

Consequently, the S&P500 closed 1 point lower after beginning the day with a firmer tone. The NASDAQ was also broadly unchanged, while the less rate-sensitive Dow Jones gained 0.37% and Bitcoin fell 1%. Brent crude prices rose modestly and are slightly bid in early trade today following news that Israel has eliminated Hamas leader and October 7 mastermind Yahya Sinwa, and an announcement by Hezbollah of “a new and escalatory phase in the confrontation with the Israeli enemy”. Perhaps unsurprisingly, spot gold has set another fresh all-time-high at $2,693/oz.

Turning back to macro, the Australian Bureau of Statistics yesterday released its labor market report for the month of September. The Aussie labor market has been on a bit of a hot streak recently with monthly employment numbers routinely exceeding consensus estimates by orders of magnitude since April. September continued the run as Australia minted 64.1k new jobs against a consensus estimate on the Bloomberg survey of +25k. The unemployment rate held at 4.1% after the August figure was revised down by 1-tick. This was despite the participation rate and the employment to population ratio both rising to new highs.

So, it’s fair to say that the Australian labor market remains remarkably resilient and is not providing any signals to the Reserve Bank that favour a near-term rate cut. Rabo Research has been more hawkish than most in sticking to our forecast that the first cut won’t arrive until May next year. Other analysts had been clustering on the February RBA meeting as a likely date, but the OIS futures now imply a probability of a 25bps cut in February at just ~67%.

Those odds could shift again when the third quarter CPI report is released the week after next. But then again, maybe the third time won’t be the charm for inflation either?

Tyler Durden

Fri, 10/18/2024 – 10:50

Share This Article

Choose Your Platform: Facebook Twitter Linkedin