Momentum Cools Just As Indexes Hit Record Highs

By Jan-Patrick Barnert, Bloomberg Markets Live reporter and strategist

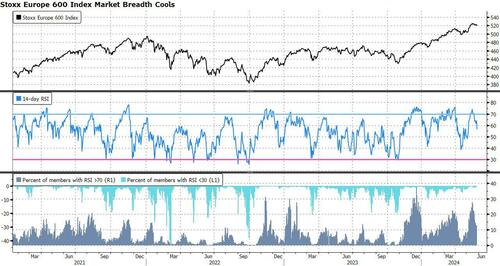

After a surprisingly speedy return to all-time highs this month, upward momentum for European stock indexes is once again cooling.

While market internals are still positive, the Stoxx 600 went overbought again in mid-May. Europe’s benchmark hasn’t been close to oversold territory since late October, which is an unusual pattern compared to the past two years. It suggests that investor risk appetite isn’t going away.

But in terms of momentum, the situation isn’t that rosy. The monitor below is showing some weakness across many major benchmarks, which fits the market pattern of January and April, where momentum weakness was followed by a sideways to mild downturn phase for several weeks.

Inflation data from Germany is due on Wednesday and could further foster the case for interest rate cuts in Europe, which is key for stocks. The European Central Bank is widely expected to decide on its first easing in June, while the path thereafter remains unclear. In fact, investors have recently pared back bets on how much easing it’ll deliver this year, while the economic framework and corporate earnings still look healthy.

As the economy picks up again — especially in Germany — it’s becoming less likely that the 2% inflation target will be achieved or for price growth to fall below it, notes Merck Finck’ chief strategist Robert Greil. He adds however that “even a slight increase in inflation will hardly stop the ECB from making its first key interest rate cut at its June 6 meeting.”

Worth keeping in mind that trading volume, both in Europe and the US, was very weak as of late. This suggests that the latest wave of buying the dip wasn’t accompanied by outright confidence, and gains might stand on shaky ground should the rates narrative shift again.

Last Thursday’s share trading, where the S&P 500 Index was sold hard from top to bottom and volatility rebounded from a multi year low, can act as a warning about how positioning is behaving at the moment and how the chase for upside exposure isn’t as lively as it was earlier this year.

“What I think this sets up for in the medium- to long-term is a price-action that looks more like either a grinding move higher but also one too where we have actual conditions to crash-down,” says Nomura’s Charlie McElligott. He notes that investors’ long exposure has been rebuild to such a degree that it’s creating actual downside hedge demand.

Option skew as a measure of risk-sensitivity in the market is rising further, as is VVIX, as investors are positioned to benefit from a rise in volatility at such low levels. The only problem is that hedges haven’t paid out this year in absence of a real bearish catalyst.

Beyond inflation and economic data, politics may become a risk factor in Europe, both locally and for the wider market. With the UK heading to the polls as well as the European Parliament being elected, there is always a chance for negative surprises. Usually stocks don’t care much, yet near all-time highs, sensitivity might be a bit heightened. With US elections also entering their hot phase soon, it’s worth noting that VIX futures are already reacting with some sensitivity and rather early to this topic.

“It is becoming increasingly apparent that this year’s elections may be more significant than usual,” says Stephen Auth, Chief Investment Officer for equities at Federated Hermes. Firstly, polls are very close for both the US House and the Senate. Furthermore, the economic policy differences between the two presidential candidates are very large, especially on issues such as tax policy, regulation and trade, he says.

Tyler Durden

Wed, 05/29/2024 – 06:30

Share This Article

Choose Your Platform: Facebook Twitter Linkedin