OPEC+ Could Jolt Oil Higher, Confounding Bearish Speculators

Authored by Grant Smith via Bloomberg,

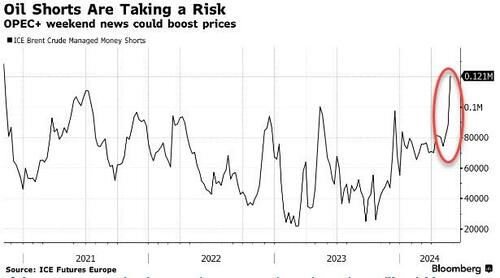

Bearish oil speculators have been out in force this month, building up their biggest short position in Brent since the depths of the pandemic in late 2020. But with a busy agenda of OPEC+ news scheduled for this weekend, history suggests that they should probably tread carefully, as the alliance could jolt prices higher.

The OPEC+ ministerial meeting is due June 2, when Saudi Arabia and its partners are widely expected to prolong roughly 2 million barrels-a-day of output curbs into the second half. While this news is largely priced in already, confirmation of the decision can always give futures some extra lift.

The other likely fixture is that the kingdom looks set to formally launch a secondary offering of shares in state champion Aramco, in a deal that could raise more than $10 billion. While there may be no direct link with the OPEC+ decision, it’s hard to imagine the world’s top crude exporter taking steps to undermine prices while the share sale is taking place.

Then there’s the possibility, flagged by veteran analyst Paul Horsnell at Standard Chartered, that OPEC+ could augment its extension with an additional “twist” — some subtle tweaks to the length or volume of the supply curbs in order to scare off those short-sellers.

Speculative bearish bets have reached the kind of levels that Riyadh has chosen to repel in the past. Just last year, when Brent shorts were heading towards 100,000 contracts — lower than current levels — Riyadh led a new wave of supply curbs specifically aimed at punishing bearish speculators.

If the OPEC+ extension is agreed as expected, crude traders will quickly turn their attention to what it means for global oil market balances in the second half. International Energy Agency data indicates the curbs would engineer a moderate supply deficit and deplete inventories, which JPMorgan believes would set Brent on track towards the $90-a-barrel mark. Given that Brent is languishing around $83 today, taking on additional short positions heading into the weekend looks like a rather brave bet.

Tyler Durden

Thu, 05/30/2024 – 08:25

Share This Article

Choose Your Platform: Facebook Twitter Linkedin