OPEC+ Switches Strategy To Defend Market Share

By John Kemp, senior energy analyst

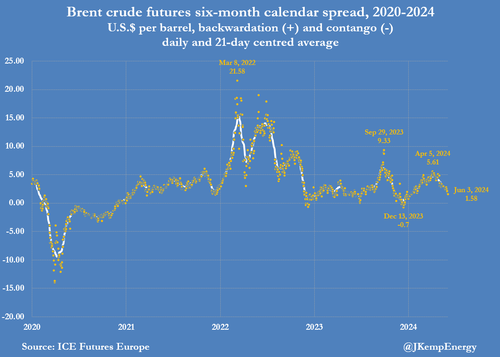

Oil futures prices have fallen to the lowest level for four months and calendar spreads have slumped after OPEC⁺ ministers signalled their intention to start increasing production from the fourth quarter of 2024.

Front-month Brent futures closed at $78 per barrel on June 3, the first day of trading following the OPEC⁺ ministerial meeting held on June 2, up just $2 per barrel compared with the same time last year.

Brent’s six-month spread slumped to a backwardation of $1.50 per barrel (56th percentile for all months since 2000) from an average of $2.85 (78th percentile) in May and $4.86 (95th percentile) in April.

Inter-month spreads for the remainder of 2024 and through 2025 have all softened as traders anticipate increasing OPEC⁺ production will eliminate any threat of shortages or a fall in inventories.

Following a hybrid meeting held in Riyadh and online, OPEC⁺ announced voluntary output cuts amounting to 2.2 million barrels per day (b/d) would be extended until the end of September 2024. But the cuts will then be gradually phased out on a monthly basis over the final quarter of 2024 and the first three quarters of 2025.

The planned production increases are subject to the caveat it can be “paused or reversed subject to market conditions”, ministers said. But it is nonetheless an enormous increment – equivalent to roughly 18 months of normal growth in global oil consumption.

Inevitably, prices have fallen.

STRATEGY SHIFT

The scheduled production increases mark a change of strategy by OPEC⁺, led by Saudi Arabia, which had previously focused on depleting excess inventories and driving prices towards $100 per barrel.

Instead, the group has switched its focus to stabilising, or even regaining, some of the market share it has lost in the last two years to rival producers in the United States, Canada, Brazil and Guyana.

Repeated official and voluntary production cuts by Saudi Arabia and other OPEC⁺ members have failed to lift prices (though they probably averted a more severe decline).

Instead they have thrown a lifeline to higher-cost producers in the western hemisphere, encouraging them to maintain and even increase output.

Dwindling OPEC⁺ market share has simply become too painful and contentious to sustain; it brings uncomfortable reminders about Saudi Arabia’s role as a swing producer in the early 1980s.

The scheduled increases are intended to signal there is a limit to how far Saudi Arabia and its closest allies will cut production on their own to support prices and they do not accept cuts are permanent.

To stabilize and recapture market share, OPEC⁺ needs slower growth in rivals’ output and faster growth in consumption. Both imply lower prices to enforce a slowdown in drilling, stimulate fuel use, and make room for more OPEC⁺ crude.

Extra production also implies inventories will be higher than previously anticipated, explaining the sudden slump in spreads.

The Brent spread for the fourth quarter of 2024, when the first production increases are scheduled, slid to 89 cents per barrel on June 3 from $1.58 on May 28 and as much as $2.51 at one point in April.

The spread for the whole period between September 2024 and September 2025 slid to $3 on June 3 from $5 on May 28 and more than $8 in early April.

ROOM FOR MORE OIL

For OPEC⁺ to pump more, others must pump less, other things equal, and that requires lower prices to force a production slowdown, especially in the price-sensitive and short-cycle U.S. shale sector.

Pre-announcing increases in OPEC⁺ production is intended to forestall further increases in output by the U.S. shale sector, partly through signalling and partly through lower prices themselves.

By deferring the first production increases until October, and making them conditional on future market conditions, OPEC⁺ ministers have given themselves some flexibility.

Scheduled production increases can be deferred again if oil consumption growth fails to accelerate, inventories remain comfortable and prices stay under pressure.

But OPEC⁺ has signalled an important shift in the direction of policy. Having repeatedly thrown the shale sector a lifeline in 2023, OPEC⁺ is preparing to squeeze it again in 2025.

Tyler Durden

Tue, 06/04/2024 – 21:10

Share This Article

Choose Your Platform: Facebook Twitter Linkedin