Palladium Soars After US Seeks Sanctions On Russian Exports, Goldman Warns Of Gamma Squeeze

Three weeks ago, when the world was still enthralled by China’s latest attempt to stimulate the economy, we pointed out that one commodity that stood to gain the most should China’s momentum accelerate, was palladium which unlike gold and silver had barely moved in recent years and was trading around $1000 after rising as high as $3500 in early 2022, a time when it was called the “meme stonk” of the commodity market.

Last time China fired the stimulus bazooka, palladium hit $3000 pic.twitter.com/8NnfqmLtrJ

— zerohedge (@zerohedge) October 2, 2024

To be sure it wasn’t just China that would server as an upside catalyst: at roughly the same time, we learned that Russia’s Federal Budget outlined plans to significantly add to its holdings in precious metals over the coming years, including buying gold, platinum, silver and yes, palladium.

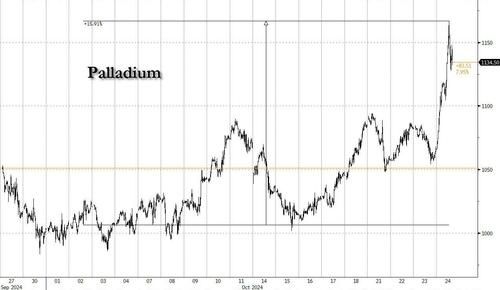

Fast forward to today when Palladium soared as much as 16% higher since our original observation, outperforming both gold and silver over the time period…

… only instead of renewed pricing in of Chinese stimulus or even buying by Russia, the news that sent the metal sharply higher was a Bloomberg report that the US has asked G7 members to consider sanctioning Russian Palladium.

As we noted last night, the reason for the powerful spike is that Russia produces 38% of the Palladium in the world (25% of total supply if you take recycling into account), while China is the biggest source of demand. Remove the biggest supplier while stimulating the biggest buyer and well you get a price surge.

So what does this mean for further price gains, and is a repeat of the 2022 meltup – when palladium doubled in price in just a few months – possible?

For the answer we go to Goldman commodity trader Gerald Tan who writes this morning that “short covering started during the second half of the summer but Palladium remains quite short and sensitive to headlines per the extreme moves we saw at the beginning of this year.“

Now one of the reasons why the shorts haven’t panicked yet, and sent the price surging far higher, is because is Palladium is relatively easy to transport and store – Russia produce 2.7mm ounces or 85 MT of Palladium which only represents 7m3 – making it one of the easiest and cheapest commodity to ship and store. Additionally, while the LPPM removed Russian-produced metal from its good deliver list in April 2022, the market reaction was similar at the time but we saw no evidence of tightness in the subsequent months following this announcement.

That may change this time if the G7 indeed follows through with Russian palladium sanctions.

And while we wait, the Goldman trader notes that flow wise while his desk had seen a renewed interest from the bank’s investor franchise, consumers haven’t reacted yet: “Vols are up 10v in the front and forwards are 50 bps tighter across Cal25.”

The bottom line: Goldman is watching the 1-year highs at $1225 where dealers are short some gamma and Rhodium as a proxy for non-spec reaction and genuine tightness.

In other words should palladium rise another 8% from here, we may see the next massive gamma squeeze…

More in the full Goldman note available to pro subs.

Tyler Durden

Thu, 10/24/2024 – 11:20

Share This Article

Choose Your Platform: Facebook Twitter Linkedin