Porsche Taycan’s Values Plunge; Mercedes, Stellantis Pause EV Battery Factory On Sliding Demand

Troubling news for the electric vehicle market emerged from Europe on Tuesday. The first was the collapse of Porsche Taycan prices, and second, a battery plant owned by Stellantis and Mercedes-Benz halted development. All of this signifies sliding EV demand across the EU.

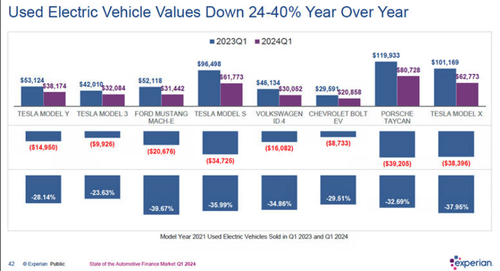

Let’s begin with a new Bloomberg Intelligence report titled “Taycan’s 33% Value Drop Makes Even Tesla Owners Cringe,” highlighting that the high-end luxury EV market is experiencing “significant declines in value as demand decreases.”

The report, citing Experian data, found Porsche Taycan values in the first quarter sank 33% compared to the same period one year ago. This was an even more significant drop than the Tesla Model Y’s 28%.

Sliding EV demand has also forced European auto battery manufacturer ACC, co-owned by Stellantis, Mercedes, and TotalEnergies, “to pause development of a site in Germany’s Kaiserslautern,” according to Bloomberg, citing local media outlet Rheinpfalz newspaper.

“Europe’s drivers aren’t ready in large numbers to exchange their old car for a new electric one,” ACC’s General Secretary Mathieu Hubert told Rheinpfalz.

Hubert pointed out that before more investments are completed, “We need to be sure what battery cell technology the market requires.”

Across the Atlantic, Tesla recently reported an 8.5% drop in year-over-year vehicle sales in the first quarter. Sales growth across the EV space has slowed, and Tesla is locked in a price war with manufacturers worldwide.

Following Tesla’s earnings release in April, Deepwater Asset Management analyst Gene Munster wrote on X, “The excitement around EVs has cooled, which further dampens sales.”

Ugly March delivery number for $TSLA, down 8.6% YoY, vs. consensus of up 2%. I believe the reason is a combo of high interest rates impacting EV’s that tend to be 10% more expensive than the average gas vehicle. Also, the excitement around EV’s has cooled, which further dampens…

— Gene Munster (@munster_gene) April 2, 2024

A combination of higher interest rates, lack of robust positive real wage growth, and consumer slowdown amid stagflationary threats is weighing on demand for vehicles, especially EVs.

Tyler Durden

Wed, 06/05/2024 – 06:55

Share This Article

Choose Your Platform: Facebook Twitter Linkedin