Printer Go Brrrr? Economists To Debate Money Tonight On ZH

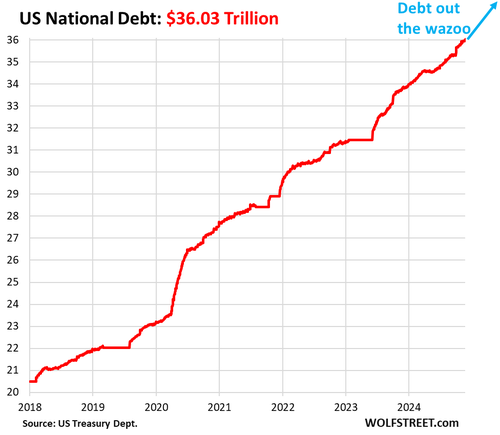

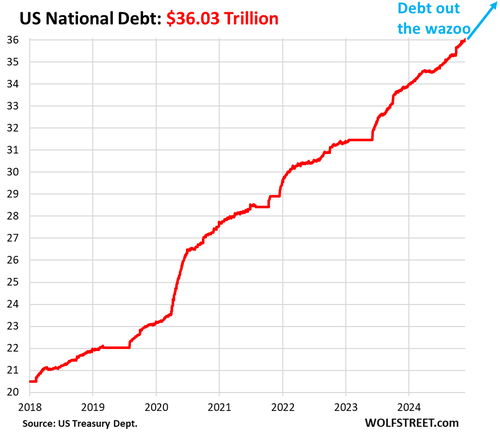

In 2024, the U.S. government eclipsed $36 trillion in national debt. It is, afterall, the price we pay to live in a civilized society… and to destroy Iraq, Libya, Somalia… but tonight on ZeroHedge we will not be discussing how the money was spent but the nature of the expenditure itself.

Is the debt a “ticking time bomb” or do we “owe it to ourselves”? Are deficits little more than ledger entries between the Fed and the Treasury or do they have the power to make civilizations rise and fall?

Questions like these form the rift between the Austrian School of economics — Hayek, Mises, Rothbard — and the Modern Monetary Theorists — Mosler, Wray, Kelton — and are the focus of this evening’s ZH Debate.

Representing the Austrian School will be Bob Murphy, senior fellow at the Mises Institute. His counterpart, Fields Institute researcher Nathan Tankus, will make the case for MMT. Moderating the discussion will be Jack Farley, a macro aficionado who founded the Real Vision Daily Briefing and now runs his own show Monetary Matters.

Tune into the ZeroHedge homepage or X channel at 7pm ET tonight to watch LIVE. Premium and professional users may submit questions in the comment section below to be asked to the debate participants.

Below are brief summaries of each debater’s positions to help you prime for the debate.

Tankus’s (MMT) View:

-

A monetarily sovereign country like the United States with debts denominated in its own currency and a floating exchange rate cannot “go broke”. (source)

-

The only limit on government spending is inflation. (ibid)

-

Major role of taxes is to help offset demand rather than generate revenue. (ibid)

-

Government policy with a “focus on balancing the federal budget” has misguidedly “handicapped fiscal policy [Treasury spending]”. (source)

-

The Federal Government already finances itself through money creation… it is erroneous to not consolidate The Federal Reserve System with the Federal Government. (source).

Tankus is offering a special discount (73%) for ZeroHedge readers to his econ newsletter Crisis Notes. The discount may be accessed here: http://crisesnotes.com/zerohedge.

Murphy’s (Austrian) View:

-

MMT’s view that “Government Budget Deficit = Net Private Saving” is misleading at best, and downright false at worst…. You don’t need the government in order to save. (source)

-

To demonstrate this, Murphy provides an analogy: If a castaway stranded on an island collects 10 coconuts per day, only eats 8 (consumption) and keeps 2 (savings). Then, while subsisting on his saved coconuts, takes time away from collecting to create a tool for faster collection (investment), we see the basic concepts of economic activity without any government needing to exist.

-

-

The MMTers concentrate on accounting tautologies that do not mean what they think. (ibid)

-

The common MMT claim that “US Treasury doesn’t need to have money before spending it” is false. This view is demonstrated in this quote by Stephanie Kelton explaining defense spending: “The US Treasury instructs its bank, the Federal Reserve, to carry out the payment on its behalf. The Fed does this by marking up the numbers in Lockheed’s bank account. Congress doesn’t need to ‘find the money’.” (source)

-

Murphy demonstrates with another analogy: When I write a personal check for $100 to Jim Smith who also uses my bank, we could explain what happens like this: “Murphy instructed Bank of America to simply add 100 digital dollars to the account of Jim Smith.” Notice that this description is exactly the same thing that Kelton said about the Treasury buying military hardware in the block quotation above

-

Bob – a committed analogy generator – summed up his views on the entirety of MMT with a rather humorous analogy below during his debate with Warren Mosler, the man largely credited as MMT’s founder:

— ZeroHedge Debates (@zerohedgeDebate) January 15, 2025

Tune in tonight at 7pm ET for the economist showdown. Sign up for professional or premium now to submit a question below.

Tyler Durden

Thu, 01/16/2025 – 11:05

Share This Article

Choose Your Platform: Facebook Twitter Linkedin