South Korea Slaps Travel Ban On President; Goldman Shows Possible Transition Scenarios

South Korean equities slid, and the won approached its weakest level since 2009 on Monday, following last week’s political turmoil when President Yoon Suk Yeol briefly declared emergency martial law.

President Yoon survived Saturday’s impeachment motion, but the Justice Ministry banned him from traveling overseas on Monday morning as investigations into his brief declaration of martial law begin.

Justice Ministry official Bae Sang-up told a parliamentary hearing that the president was prohibited from leaving the country following requests by police, prosecutors, and an anti-corruption agency.

AP News cited a senior National Police Agency officer who told reporters at a briefing that police can detain Yoon if conditions are satisfied.

Yoon’s martial law speech last Tuesday called parliament a “den of criminals” for “attempting to paralyze” the government, adding to eliminate “shameless North Korea followers and anti-state forces.”

The prospect of a prolonged constitutional crisis appears elevated as the main opposition party, already failing once, will likely push another impeachment vote against the president this week.

Making sense of the uncertainties over the country’s leadership and potential transition pathways, Goldman’s Goohoon Kwon and Andrew Tilton shed more color on the situation for clients on Monday morning:

At this stage, the most likely scenario appears to be an orderly transition to an early presidential election, as indicated by the joint press conference.

That said, more clarity is needed on duration, scope and details (especially, cabinet members) of such transitional arrangements.

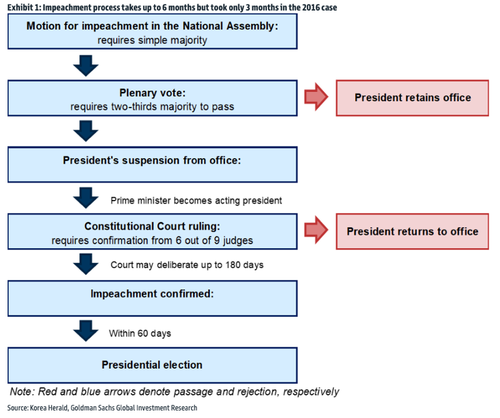

Another potential scenario is an eventual passage of a further impeachment motion with 200 votes out of 300 parliamentary seats, which would trigger an immediate suspension of the current presidency. The whole impeachment process, including a verdict by the Constitutional Court, could take about three months as was the case in 2016 although the process could be shorter this time or could be extended up to 6 months (Exhibit 1).

Once confirmed by the Constitutional Court, the presidential term would end immediately, with the Constitution requiring that the Prime Minister should become the acting president until a new president is elected following an early election within 60 days after a Court decision. In either scenario, a new government could be formed by early summer 2025 or earlier. Conversely, if denied by the Constitutional Court, the current presidency would be restored.

Possible Transition Scenarios

The analysts warned of a third scenario:

A third scenario is a muddling through in a political gridlock. Without much progress in the first two scenarios, major parties could agree to discuss potential constitutional amendments that could end the current presidency without impeachment. The latest press reports suggest that a small group of the Conservative Party prefers constitutional changes (shortening the current presidency and changing the future presidency to two 4-year terms from a one 5-year term) to supporting the impeachment motion driven by the opposition coalition. That said, the odds for this scenario appear low so far, since discussion of constitutional amendments could open another long and complicated political process and, more importantly, the opposition coalition has not shown interest in an alternative way of ending the current presidency.

The unfolding political turmoil was enough for the analysts to maintain a below-consensus growth forecast for South Korea of 1.8% in 2025, with “risks increasingly skewed to the downside …”

Here is the context of past impeachment cases in South Korea and their impact on economic growth:

The two impeachment cases in 2016 and 2004, where political instability did not weigh meaningfully on growth, do not provide a good benchmark, in our view. The Korean economy in the previous two cases was supported by external tailwinds from China boom in 2004 and a strong upturn in the semiconductor cycle in 2016. Conversely, in 2025, Korea together with other export-oriented economies in the region face external headwinds from China slowdown and US trade policy uncertainties.

They pointed out that the central bank and government have “sufficient policy room for monetary and fiscal policy” to sustain macroeconomic stability as political turmoil flares up.

In markets, the benchmark Kospi Index fell 2.8%. The small-cap Kosdaq Index tumbled 5% to its lowest level since April 2020. The won fell about 1% against the dollar, moving toward levels last seen in the immediate aftermath of the martial law last week.

In a separate Goldman note, analysts pointed out that Ishares MsciSouth Korea ETF (EWY) “dominated activity within single-country exposures with our desk skewing better to buy – EWY faced its largest volume day on record.”

Spot the divergence between KOSPI and MSCI World Index….

Meanwhile, Graham Ambrose, managing director of Goldman’s equity franchise sales team in London, told clients at the end of last week that potential buying opportunities in Seoul could be nearing.

Goldman Sees “Buying Opportunities” In South Korean Stocks After Martial Law Turmoil https://t.co/MOqqMNaAHO

— zerohedge (@zerohedge) December 3, 2024

In a separate note, Lee Kyoung-Min, a strategist at Daishin Securities, told clients, “The possibility of the worst-case scenario for the Kospi has increased, adding, “Even at a small development, the Kospi can wobble because of accumulated fatigue, disappointment, extremely dented investor sentiment and supply and demand situations.”

Tyler Durden

Mon, 12/09/2024 – 15:00

Share This Article

Choose Your Platform: Facebook Twitter Linkedin