That Escalated Quickly: Goldman Cuts PC Shipment Outlook As Memory Prices Go Parabolic

Well that escalated quickly.

Goldman analysts led by Allen Chang have revised down global PC shipment forecasts for 2026-28, citing a sharp spike in memory prices as data centers worldwide soak up the supply of high-bandwidth memory.

Before diving into Chang’s note, here’s a quick recap of what’s unfolded so far:

-

“Entered New Era”: SK Hynix To Build $13 Billion Memory Plant As Nvidia CEO Says AI Demand Soaring

-

“Market That Never Existed”: Nvidia CEO Sparks Frenzy In Memory Stocks

-

Soaring Memory Costs Sink Nintendo Shares; Goldman Says Selloff Is Buy-The-Dip Opportunity

-

UBS Says Soaring Memory Chip Prices To “Turbo-Charge” Samsung Earnings

-

First Victims Of ‘Great Memory Crunch’ Emerge As Data Centers Soak Up Global Supply

We’ve followed the historic price spike for months.

Update: two months later https://t.co/Q4TPIrpzxV pic.twitter.com/O3KTKxZOVE

— zerohedge (@zerohedge) December 22, 2025

Amazon price-tracking website CamelCamelCamel shows a parabolic price surge in Crucial Pro DDR5 64GB RAM, rising from $145 to $790 in just six months. Anyone building a gaming PC to power a trading station must be furious, as the greatest memory crunch of our time is now underway and could worsen in the months ahead.

Now, soaring memory prices will undoubtedly pressure consumers to put off a new PC and squeeze margins for device makers. This prompted Chang to revise his desk’s estimates for global PC shipments:

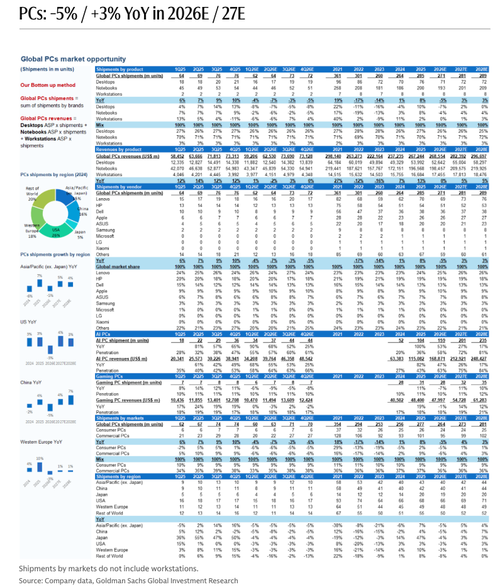

We revised down global PC shipment estimates for 2026-28E amid increasing memory price, flattening replacement cycle after Windows 10 End of life, and demand pull-ins into 4Q25. We expect global PC shipments to see -5%/ +3% YoY in 2026E / 27E (vs. +3% / +3% previously), to reach 271m / 281m units.

AI PCs will continue to be the growth drivers. We model AI PC shipments to be 159m / 201m in 2026 / 27E (+53% / +27% YoY), representing 58% / 72% penetration (largely unchanged from 58% / 71% previously). Gaming PCs shipment will reach 28m / 32m in 2026 / 27E (-7% YoY / +11% YoY), in our view, impacted by the rising memory price.

Our updated PC TAM model is based on the latest GS forecasts for key suppliers including Apple, Lenovo, HP, Dell, ASUS, Samsung, Microsoft, LG, Xiaomi and Gigabyte. Details within. We also downgrade Gigabyte to Neutral (from Buy) relative to coverage on softer PC related demand and a fair valuation.

Global PC shipments forecast:

What’s next …

First, AI came for my RAM

Next, it came for my video card pic.twitter.com/ic09CoO8i6— zerohedge (@zerohedge) January 21, 2026

A lot more color into Chang’s global PCs shipment forecast can be found in the usual place for ZeroHedge Pro Subs.

Tyler Durden

Fri, 01/23/2026 – 09:05Read More

Share This Article

Choose Your Platform: Facebook Twitter Linkedin