The Danger To The Dollar Isn’t The Euro Or Yuan

Authored by Mike Shedlock via MishTalk.com,

Russia GDP is now estimated at +3.8 percent, topping the US, despite sanctions. What’s going on?

Russia’s War Economy

Eurointelligence discusses Russia’s War Economy

It is worth looking at the autumn forecast for Russia by the Vienna Institute for International Economic Studies, one of the best sources of economic information for central and eastern Europe. They upgraded their growth forecast for this year by 0.6pp to 3.8%. Russia is outgrowing all western economies, including the US. Growth is forecast to slow down to 2.5% next year because of the impact of a 19% interest rate. It is clear that Russia’s economic expansion is a classic case of a wartime Keynesian effect.

It is also interesting to contrast Russia’s economic development with that of Ukraine’s main supporters in Europe, which have entered into synchronised austerity, first in Germany, and now in France and the UK.

Russia’s fiscal stability is perhaps the biggest surprise. Defence spending is on trajectory towards 6% of GDP. And yet, the 2024 budget deficit is projected at 1.5%, falling to 1% in 2025.

Vasily Astrov, the Russia expert at WIIW, concludes that Putin will have money for the foreseeable future to continue financing the war against Ukraine. A rise in income and corporate tax has meant that Russia’s state finance will become less dependent on energy.

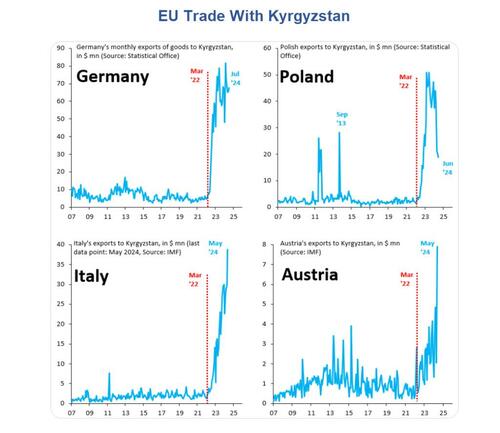

Financial sanctions are ultimately not as successful as their advocates once believed because money is not a natural global monopoly. International banks are certainly susceptible to US dollar sanctions. But not all banks in the world operate in dollar markets. The use of secondary sanctions has become a first-order instrument in the US’s diplomatic toolkit in this century. But it falls into the category of instruments which lose their value the more you use them. Even amongst US economists, we see a lot of complacency about this. It was friction combined with network effects that favoured the emergency of a single dominating currency – the pound sterling, the dollar later. The danger to the dollar is not the euro, or renminbi. It is that micro-channels are becoming viable as technology reduces the frictions.

Lessons of the Day

The more you depend on sanctions, the less they work.

That’s the real risk to the dollar.

Here’s a Repeat Lesson on Why Sanctions Fail

On September 26, I commented To Those Hard of Learning, Here’s a Repeat Lesson on Why Sanctions Fail

In that post I refuted a claim that sanction failures are due to a lack of political will.

Also see my September 19, 2023: Lesson of the Day: Sanctions Don’t Work Because They Create New Markets

A person who touted a buyer’s cartel sanction success, now complains the buyers cartel leaks like a sieve.

Finally, please see How China Gets Around US Sanctions on Semiconductors

US sanctions backfire again. China is stronger as a result.

Russia’s GDP shows just how badly misguided and overused sanctions have worked.

Tyler Durden

Sun, 10/20/2024 – 18:40

Share This Article

Choose Your Platform: Facebook Twitter Linkedin