“The Risks Are Building To The Downside”: IMF Cuts Global Growth Forecast After Warning Global Debt To Hit $100 Trillion

The International Monetary Fund lowered its global growth forecast for next year and warned of accelerating risks from surging debt, to global wars to trade protectionism, even as it credited central banks for taming inflation without sending nations into recession.

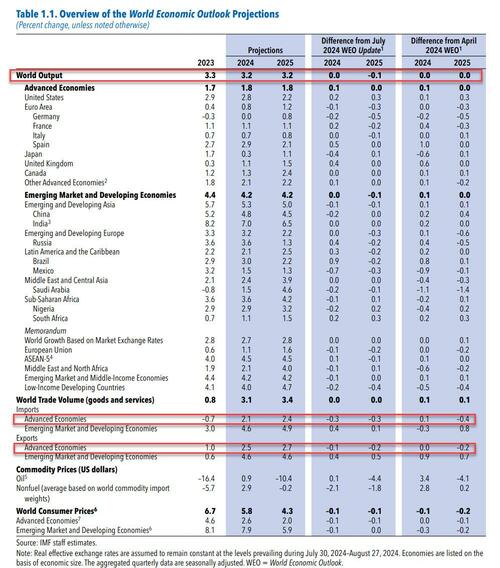

In its World Economic Outlook report published on Tuesday morning, the IMF forecast global output will expand 3.2%, 0.1 percentage point slower than a July estimate It left the projection for this year unchanged at 3.2%.

In terms of next year’s outlook, the IMF forecast for the euro area was downgraded to 1.2%, 0.3% lower than in July, due to persistent weakness in manufacturing in Germany and Italy. On the other end, the US forecast for 2024 and 2025 was upgraded to 2.8% and 2.2%, up by 0.2% and 0.3% respectively, due to stronger consumption, but really because of the endless Biden-admin stimulus in the form of a wartime-level budget deficit which is now at 6% of GDP, and which has led to an exponential surge in US debt issuance.

The projection for Mexico was cut for this year by the most among major economies, as well as for next year, based on the impact of monetary policy tightening. China’s growth outlook for this year was cut to 4.8% from 5% previously on weakness in the real estate sector and low consumer confidence, with the 2025 forecast maintained at 4.5%.

The IMF now forecasts that global inflation will slow to 4.3% next year from 5.8% in 2024, both estimates reduced by 0.1% from July. At the same time the IMF slashed its global import and export forecasts for advanced economies for 2024 and 2025, by 0.3% and 0.2% respectively, while boosting expectations for emerging markets.

The fund has been cautioning for years that the world economy is likely to expand at its current mediocre level in the medium term — too little to give nations the resources they need to reduce poverty and confront climate change.

“The risks are building up to the downside, and there is a growing uncertainty in the global economy,” Chief Economist Pierre-Olivier Gourinchas said in a briefing. “There is geopolitical risk, with the potential for escalation of regional conflicts,” that could affect commodity markets, he said. “There is a rise of protectionism, protectionist policies, disruptions in trade that could also affect global activity.”

Bloomberg also notes that while the IMF forecast doesn’t explicitly mention the US election, the November 5 main event looms over annual meetings that will see finance ministers and central bankers from almost 200 nations gather at the IMF and World Bank headquarters in Washington, just three blocks from the White House. Bloomberg recently found that Donald Trump’s vow to impose 60% tariffs on imports from China and 10% duties on those from the rest of the world would likely spur inflation and pressure the Federal Reserve to raise interest rates. The analysis also completely ignored that Trump may simply be using the threat of tariffs as a negotiating tactic meant to spark more beneficial terms of trade.

The global growth forecast comes one week after the IMF flagged its mounting concern about global public debt, which is expects to reach $100 trillion, or 93% of world gross domestic product, by the end of this year. The surge is driven by the US and China, of course.

The fund is urging governments to make tough decisions to stabilize borrowing. With little political appetite to cut spending amid pressures to fund cleaner energy, support aging populations and bolster security, the “risks to the debt outlook are heavily tilted to the upside,” the IMF said.

The IMF applauded central banks for slowing inflation without tipping economies into recession, which Gourinchas called “a major accomplishment” based on expectations for the necessary steps expected a couple of years ago to achieve disinflation.

Still, the world faces risks from monetary policy hitting growth more than intended, worsening sovereign debt pressures in emerging and developing economies, and renewed spikes in food and energy prices due to climate shocks, war and geopolitical tensions, the IMF said.

Tyler Durden

Tue, 10/22/2024 – 09:55

Share This Article

Choose Your Platform: Facebook Twitter Linkedin