‘Trump Trade’ Goes Turbo: Crypto Rips, Gold Dips, Small Caps Best Week Since COVID

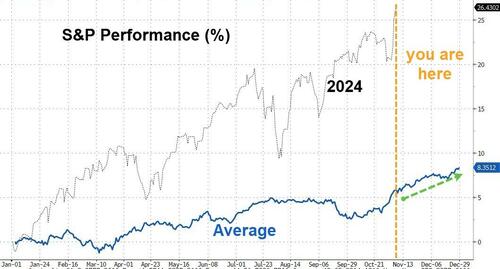

The S&P 500 topped 6,000 for the first time ever this week (and its 50th record high of the year) as all the US majors exploded higher the election. Small Caps had their best week since the COVID lockdowns (and liquidity surge) in April 2020…

Market volumes remain extremely elevated, on track for the third consecutive session above 15B shares and the seasonals are still with the trend…

Source: Bloomberg

Goldman issued a Franchise Flow Alert:

thru yesterday, aggregate LO demand has been a massive +$12B, after having sold -$10B last week into year-end for 22% of MFs and ahead of the election.

Today that number is coming down a bit as the entire franchise tilts for sale, but the Mutual Fund squeeze remains the most violent flow dynamic in the market (and, when coupled with Corporate demand – remember Nov/Dec is the busiest 2 months for this cohort – this should be a tailwind for stocks).

Energy and Financials outperformed this week (deregulation)…

Source: Bloomberg

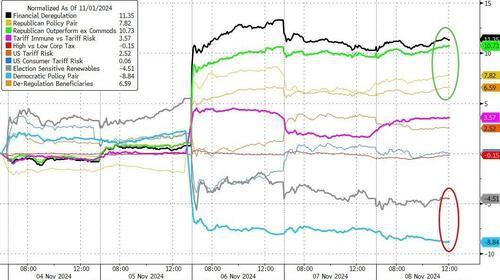

…but overall it was the “Trump Trade” that exploded higher…

Source: Bloomberg

Election-sensitive baskets moved dramatically this week…

Source: Bloomberg

TSLA tore back above $1 trillion market cap this week and NVDA continued to push to new record territory, now considerably larger than AAPL…

Source: Bloomberg

Small Caps were helped by financials but the ‘most shorted’ stocks basket seeing a massive squeeze helped a lot…

Source: Bloomberg

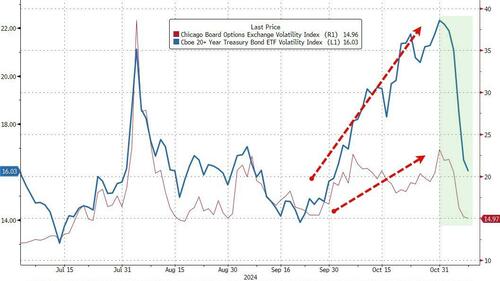

Vix was clubbed like a baby seal as all those hedges were lifted as stocks ripped higher…

Source: Bloomberg

Both stock and bond vol was eviscerated this week (after the election and FOMC)…

Source: Bloomberg

It was a massive week for bonds though (even as vol fell) with Treasury yields spiking and dumping to end with a very much flatter yield curve. Only the short-end of the curve is higher on the week…

Source: Bloomberg

2s10s tumbled back towards inversion once again…

Source: Bloomberg

The dollar rose for its sixth straight week to its highest weekly close in 5 months…

Source: Bloomberg

What the dollar gained, gold lost this week (worst week since May)…

Source: Bloomberg

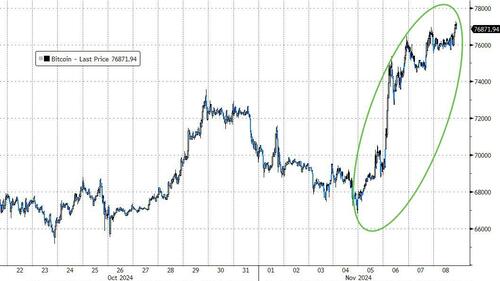

Bitcoin surged to its second best week of the year, smashing through record highs, topping $77,000 after Trump was elected…

Source: Bloomberg

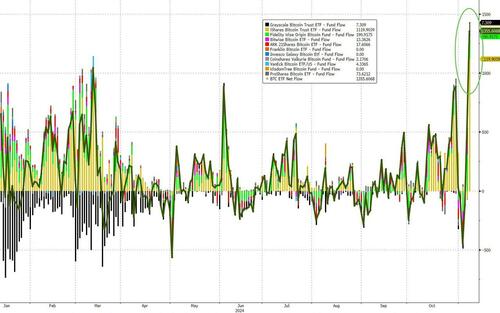

BTC ETF inflows exploded higher this week…

Source: Bloomberg

This week also saw Ethereum surge to its best relative performance against BTC since May as DeFi boom hopes are reignited…

Source: Bloomberg

Crude prices ended the week unchanged, back up at pre-plunge levels from last week’s Iran-Israel non-attacks…

Source: Bloomberg

And finally, while pundits panicked, global markets rallied in relief of not four more years of Bidenomics…

Source: Bloomberg

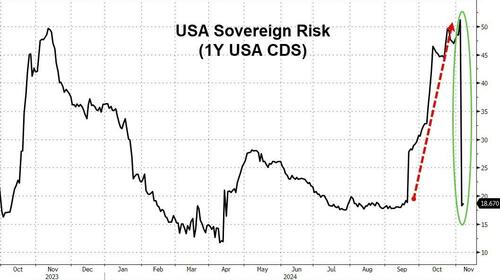

USA sovereign risk has collapsed since Trump’s Red Sweep – not exactly the signal of the stagflationary hellscape that ’51 noble prize winning economists’ predicted.

Tyler Durden

Fri, 11/08/2024 – 16:00

Share This Article

Choose Your Platform: Facebook Twitter Linkedin