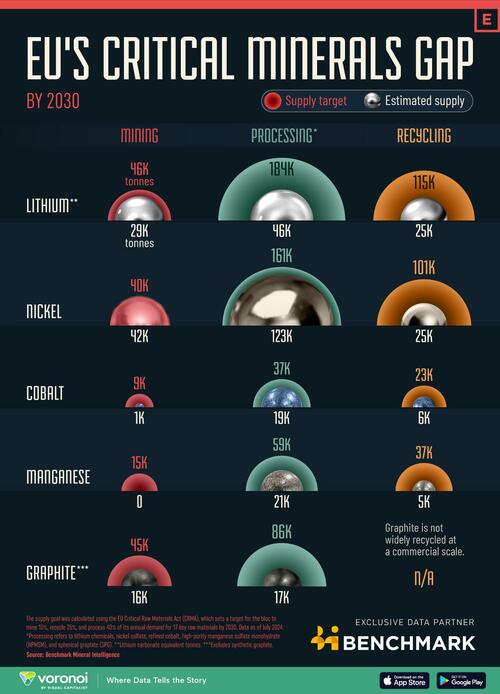

Visualizing The EU’s Critical Minerals Gap By 2030

The European Union’s Critical Raw Material Act sets out several ambitious goals to enhance the resilience of its critical mineral supply chains.

As Visual Capitalist’s Bruno Venditti details below, the Act includes non-binding targets for the EU to build sufficient mining capacity so that mines within the bloc can meet 10% of its critical mineral demand.

Additionally, the Act establishes a goal for 40% of demand to be met by processing within the bloc, and 25% through recycling.

Several months after the Act’s passage in May 2024, this graphic highlights the scale of the challenge the EU aims to overcome. This data comes exclusively from Benchmark Mineral Intelligence, as of July 2024. The graphic excludes synthetic graphite.

Securing Europe’s Supply of Critical Materials

With the exception of nickel mining, none of the battery minerals deemed strategic by the EU are on track to meet these goals.

Graphite, the largest mineral component used in batteries, is of particular concern. There is no EU-mined supply of manganese ore or coke, the precursor to synthetic graphite.

By 2030, the European Union is expected to supply 16,000 tonnes of flake graphite locally, compared to a domestic mining target of 45,000 tonnes.

The bloc is projected to produce 29,000 tonnes of lithium carbonate equivalent (LCE), compared to a 46,000 tonnes target.

In terms of mineral processing, the bloc is expected to process 25% of its lithium requirements, 76% of nickel, 51% of cobalt, 36% of manganese, and 20% of flake graphite.

The EU is expected to recycle only 22% of its lithium needs, 25% of nickel, 26% of cobalt, and 14% of manganese. Graphite, meanwhile, is not widely recycled on a commercial scale.

If you enjoyed this post, be sure to check out this graphic, which visualizes the total cobalt supply from the top 10 producers in 2030.

Tyler Durden

Fri, 10/25/2024 – 04:15

Share This Article

Choose Your Platform: Facebook Twitter Linkedin