Walgreens Shares Spike Off 28-Year Lows On Private-Equity Interest; Report

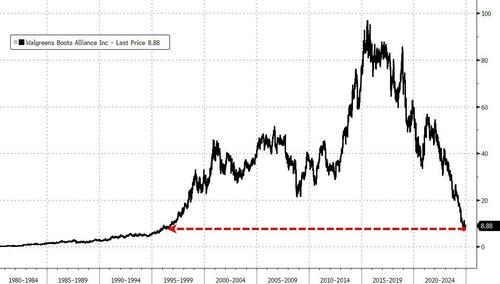

Having plunged from over $105 billion market cap in 2015 to less than $8 billion currently (amid mounting pressures on both its pharmacy and retail businesses), it appears Walgreens Boots Alliance (WBA) has got cheap enough to spark private equity interest.

The Wall Street Journal reports that WBA is in talks to sell itself to a private-equity firm in a deal that would take the pharmacy chain off the public market after its shares have been on a downward slide for nearly a decade.

WBA and Sycamore Partners have been discussing a deal that could be completed early next year, assuming talks don’t fall apart, according to people familiar with the matter.

WBA shares are soaring on the news (after an initial halt for volatility). WBA is up 25%, just shy of October’s highs…

And judging by the massive short-interest, it could go dramatically higher…

Any deal would be a big bite for Sycamore, a New York-based firm that specializes in retail and consumer investments and more recently is better known for smaller deals. The firm would likely sell off pieces of the business or work with partners, one of the people said.

WSJ reports that Walgreens has long been seen as a potential private-equity target, though for many years its size seemed to put it out of reach.

Private-equity firm KKR made a roughly $70 billion offer for the company in 2019, Bloomberg and the Financial Times reported at the time. Walgreens’s market value was then over $50 billion, which would have made it one of the largest take-private transactions ever had it come to fruition.

Private-equity appetite for buying retailers has waned since high-profile flops including Toys “R” Us made financing such transactions much more difficult. In the past few years, only a handful of sizable retailers have been sold to private-equity firms, though many have attracted takeover interest.

One of Sycamore’s last major deals was when it bought office-retailer Staples for almost $7 billion in 2017. It was among the suitors for Kohl’s in 2022. In September, Sycamore announced a small deal for the restaurant chain Playa Bowls.

Sycamore’s current investments include several clothing brands including Ann Taylor Loft and Aéropostale as well as the department-store chain Belk.

Tyler Durden

Tue, 12/10/2024 – 12:44

Share This Article

Choose Your Platform: Facebook Twitter Linkedin