Yields Spike To Session High After Subpar 7Y Auction

After two very ugly auction on Tuesday, moments ago the Treasury completed the sale of the week’s final coupon auction when it sold $44BN in 7Y bonds (far from the record $62BN hit during the covid crisis), in what was another very subpar auction if perhaps not quite as ugly as yesterday’s duo.

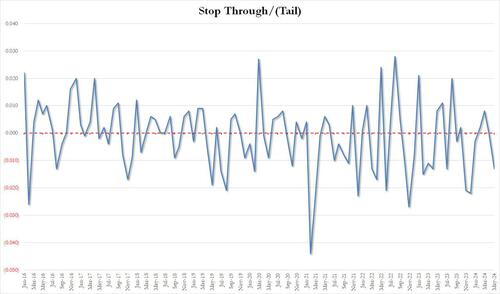

The high yield of 4.65% was below last month’s 4.716% but it tailed the When Issued 4.637% by 1.3bps, the first tail since January and the biggest tail of 2024.

The bid to cover was also ugly, sliding from 2.481 to 2.427, the lowest since April 2023, and well below the six-auction average of 2.53.

The internals were fractionally better, with Indirects taking down 66.9%, up from 65.1% last month and on top of the 66.8% recent average; and with Directs awarded 16.1%, Dealers were left holding 17.0%, the most since November.

Overall, this was another subpar auction, and while it was disappointing as can be seen by the spike in yields to session highs after news of the break…

… it was not nearly as ugly as some in the bond market were certain it would be after yesterday’s horror show.

Tyler Durden

Wed, 05/29/2024 – 13:23

Share This Article

Choose Your Platform: Facebook Twitter Linkedin