China Planning 10 Trillion Yuan In Extra Debt For Fiscal Stimulus; Oil, Commodities Rebound

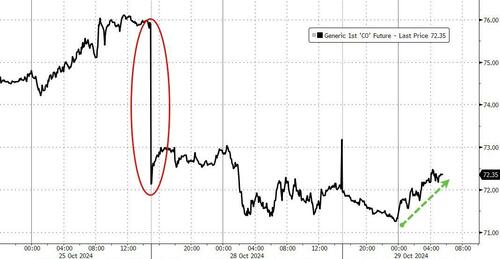

After suffering its biggest drop in two years after the latest iteration of the performative “war” between Israel and Iran ended with yet another dud, oil has rebounded and is 1.4% higher after a Reuters report that China is considering approving the issuance of over 10 trillion yuan ($1.4 trillion) in extra debt in the next few years to revive its fragile economy, a fiscal package which is expected to be further bolstered if Donald Trump wins the U.S. election.

Citing two sources with knowledge of the matter, Reuters said that China’s top legislative body, the Standing Committee of the National People’s Congress (NPC), is looking to approve the fresh fiscal package, including 6 trillion yuan which would partly be raised via special sovereign bonds, on the last day of a meeting to be held from Nov. 4-8. The 6-trillion-yuan worth of debt would be raised over three years including 2024, said the sources, adding the proceeds would primarily be used to help local governments address off-the-books debt risks.

The planned total amount, to be raised by issuing both special treasury and local government bonds, equates to over 8% of the output of the world’s second-largest economy, which has been hit hard by a protracted property sector crisis and ballooning debt of local governments.

Oil prices climbed along with industrial metals on the Reuters report; WTI was up 1% near $68 a barrel while copper rises 0.9%.

The Reuters report was the first confirmation of speculation among financial analysts, who have said in recent weeks they expect Beijing to consider a 10 trillion yuan stimulus.

The spending plans suggest that Beijing has switched into a higher stimulus gear to prop up the economy although it’s still not the 2008-like bazooka that some investors have been calling for. That said, after starting with a bang in late September, all subsequent Chinese stimulus reports have been whimper after whimper as Beijing failed to provide much needed details or clarity for what is actually coming, resulting in a sharp unwind of the 30% surge in Chinese stocks observed at the end of Q3.

Which may explain why the Reuters sources cautioned that the plans are not finalized yet and remain subject to changes; i.e., yet another dud may be on deck for a country which desperately needs trillion in stimulus yet has shown unprecedented restraint in actually putting money where its money is.

As part of its latest fiscal package, the NPC Standing Committee is also expected to greenlight all or part of up to 4 trillion yuan worth of special-purpose bonds for idle land and property purchases over the next five years, said the sources. Local governments would be allowed to raise that amount on top of their usual annual issuance quota, which mainly funds infrastructure spending. The quota stood at 3.9 trillion yuan this year and 3.8 trillion in 2023.

The latest move is aimed at enhancing local governments’ ability to manage land supply, and alleviate liquidity and debt pressures on both local governments and property developers, they added. Special-purpose bonds are a tool for off-budget debt financing used by Chinese local governments, with the proceeds raised typically earmarked for specific policy objectives, such as infrastructure expenditures.

Should the NPC Standing Committee approve these issuances in full instead of in stages, it could increase the total stimulus size to over 10 trillion yuan, they added. An average of 2 trillion yuan in new central government debt annually underscores an urgency in Beijing to shore up the economy. Late in 2023, China issued 1 trillion yuan in sovereign bonds to bolster flood-prevention infrastructure and meet its roughly 5% economic growth target.

China’s top legislative body generally holds its meeting every two months – in the second half of even-numbered months. As per the parliament’s 2024 work agenda, released in May, a standing committee session was planned for October. The forthcoming meeting was initially planned for late October before being rescheduled to early November, said one of the sources.

The meeting’s timing, which coincides with the week of the U.S. presidential vote on Nov. 5, offers Beijing greater flexibility to adjust the fiscal package including the total size, based on the election outcome, said the sources.

Reuters notes that Beijing may announce a stronger fiscal package if Trump wins a second presidency as his return to the White House is expected intensify the economic headwinds for China. Trump, who has gained in recent polls to erase much of the early advantage of Kamala Harris, has vowed to impose 60% duties on imports from China.

Beijing started this year with plans to issue 1 trillion yuan in special sovereign debt already in place, but that sum is widely expected to be increased as growth has been drifting off target and economists said a longer-term structural slowdown could be in play. All the same, the planned fiscal spending falls short of the firepower deployed in 2008, when Beijing’s 4 trillion yuan in fiscal stimulus in response to the global financial crisis accounted for 13% of GDP at the time.

The extra money fueled a property market frenzy and led to unfettered lending to local government financing vehicles, which municipalities used to get around official borrowing restrictions.

As part of the overall fiscal spending, China is also considering approving other stimulus initiatives worth at least one trillion yuan, such as a consumption boost including trade-in and renewal of consumer goods, said the sources. Another trillion yuan could also be raised via special treasury bonds for capital injection into large state banks, said one of the sources and another source with knowledge of the matter.

At the end of the day, however, even the 10 trillion yuan package may be insufficient to kickstart the economy. The reason, as explained in “Why China’s Rally Won’t Have Legs“, is that China’s peak credit impulse – the all important reflationary variable that propagates across the global economy – has dwindled, and so has the boost to growth.

In other words, to achieve the same level of stimulus as a % of GDP, China would need to inject tens of trillions more. And since it can’t do that, at least not without its middle class kicking and screaming (literally), China’s house price will continue to slide, having recently tumbled by a record YoY amount…

… and so on, until one day Beijing will have no choice but to unleash a real bazooka, one which will spark a reflationary tidal wave across the globe.

Tyler Durden

Tue, 10/29/2024 – 09:15

Share This Article

Choose Your Platform: Facebook Twitter Linkedin