Is US Copper Sowing The Seeds Of Its Own Return To Earth?

Authored by Simon White, Bloomberg macro strategist,

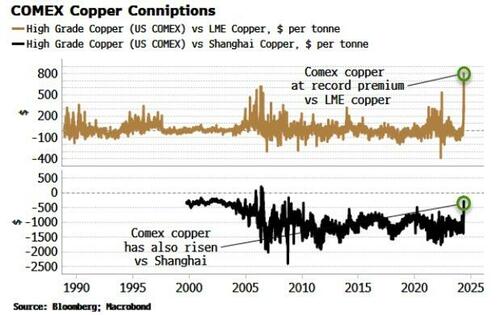

Copper’s recent rally has been most pronounced in the US, taking the futures curve there into extreme backwardation. That typically precedes a supply response and lower prices. Nonetheless, the long-term bullish case for copper is intact.

Copper trades in three main exchanges:

Comex in the US,

the London Metal Exchange and

the Shanghai Futures Exchange.

It has risen globally in recent weeks, but the rally at Comex has eclipsed the other two.

While stocks in Shanghai have risen sharply this year, and in London they have fallen but remain well above zero, at Comex warehouses they have fallen to near zero. This has led to massive short squeeze in US copper, with the metal trading at its highest ever premium to LME copper at over $800 per tonne (and much higher on an intraday basis).

This has pushed the Comex copper futures curve into massive backwardation, i.e. spot prices trading well above futures prices.

However, this often eventually leads to a self-correction. High spot prices encourage more supply to come on to the market, depressing the spot price and normalizing the curve. Today’s level of backwardation suggests this could be more pronounced than normal.

It’s ironic this comes at a time of ultra-bullish copper calls. Even though the thesis is sound – there is likely to be huge demand for copper from AI and green capex (with plenty of global fiscal stimulus as support – there will probably be a better time to start to set longs.)

Also, as noted Thursday, copper might face medium-term headwinds from the US economy potentially looking more recessionary, although this should be taken in consideration with China’s recovery, which is finally gaining some momentum.

Tyler Durden

Fri, 05/17/2024 – 08:50

Share This Article

Choose Your Platform: Facebook Twitter Linkedin