Microsoft Shares Waver After Top- & Bottom-Line Beat, Cloud Growth Slowed

Microsoft shares are rising after hours after beating top-and bottom-lines in Q1 earnings:

Revenue was $65.6 billion and increased 16%, estimate $64.51 billion

Diluted earnings per share was $3.30 and increased 10%, estimate $3.11

Breaking down the revenue lines, it was (almost) a beat across the board with only personal computing disappointing…

Microsoft Cloud revenue $38.9 billion, BEAT estimate $38.11 billion

Intelligent Cloud revenue $24.09 billion, BEAT estimate $26.74 billion

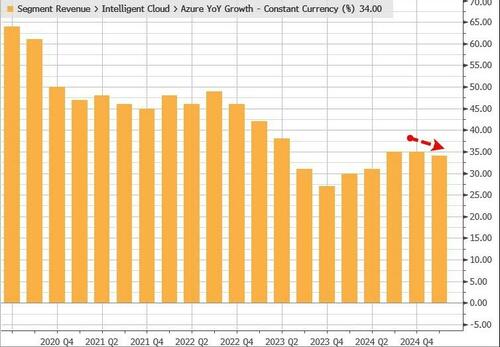

Azure and other cloud services revenue Ex-FX +34%, BEAT estimate +30.4% (slowing slightly from the 35% last quarter).

Productivity and Business Processes revenue $28.32 billion, BEAT estimate $22.88 billion

More Personal Computing revenue $13.18 billion, MISSED estimate $14.23 billion

AI reportedly contributed 12pts to Azure revenue growth in Q1:

“Strong execution by our sales teams and partners delivered a solid start to our fiscal year with Microsoft Cloud revenue of $38.9 billion, up 22% year-over-year,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

MSFT also beat on operating income and its CapEx was higher than expected…

Operating income $30.55 billion (up 14%), BEAT estimate $29.21 billion

Capital expenditure $14.92 billion, BEAT estimate $14.55 billion

Satya is all bulled up:

“AI-driven transformation is changing work, work artifacts, and workflow across every role, function, and business process,” said Satya Nadella, chairman and chief executive officer of Microsoft.

“We are expanding our opportunity and winning new customers as we help them apply our AI platforms and tools to drive new growth and operating leverage.”

The market’s reaction was insane to be frank – an initial puke was followed by a surge which was quickly sold for a modest 2%-ish gain as we write…

For such a big beat, this is not the kind of reaction we would expect (unless of course everyone and their pet rabbit is already long).

“People are shifting from just talking about artificial intelligence and testing and piloting artificial intelligence to actually putting it into production,” said Jackson Ader, an analyst at Keybanc.

Ahead of the earnings report, Wedbush Securities analyst Daniel Ives said investors are looking for signs of adoption of Microsoft’s Copilot AI services.

“Investor sentiment around the Microsoft story over the last few months has shifted more neutral/cautious with shares underperforming the Nasdaq 100, with concerns around the pace of Copilot adoption and increasing competition in the AI ecosystem from other Big Tech players,” he said in a client note Tuesday.

He added, “This is a ‘gut check quarter’ for Microsoft with many on the Street starting to grow skeptical of the pace of this AI/cloud growth story in Redmond.”

MSFT share are now back to unchanged after hours ahead of the earnings call.

Tyler Durden

Wed, 10/30/2024 – 16:17

Share This Article

Choose Your Platform: Facebook Twitter Linkedin