US Signals Defense Guarantees To Saudis As Iran’s Crosshairs Could Be On Abqaiq Refinery

Wall Street analysts have been on edge for weeks over the scope of Israel’s planned retaliation strike after Iran’s large-scale missile barrage on Oct. 1, which may include F-35 stealth fighter jets striking Iran’s nuclear facilities, missile sites and or oil infrastructure. The geopolitical risk premium for Brent crude has faded in recent weeks as US Secretary of State Antony Blinken runs around the Middle East to ensure that IDF jets hold off on any strikes against Iran until after the US presidential elections.

HRH Crown Prince Mohammed bin Salman receives U.S. Secretary of State Antony Blinken. pic.twitter.com/SrFnXoT9mI

— Foreign Ministry 🇸🇦 (@KSAmofaEN) October 23, 2024

Israel has considered a slew of retaliatory options, reportedly including fighter jets striking Islamic Revolutionary Guard Corps’ high-value military targets, as well as Iran’s leadership, financial networks, oil infrastructure, and nuclear program sites.

About a week ago, Axios reported the leak of a highly classified US intelligence report that revealed new details about Israel’s plans for retaliation against Iran. This leak delayed IDF’s strike.

Leaked US Intelligence Documents Related To Israel’s Attack Preparations On Iran Appear Online https://t.co/LXp8X3CI4m

— zerohedge (@zerohedge) October 19, 2024

IDF’s most strategic move would be to dismantle the IRGC’s command and control networks and centers by targeting key officials, missile sites, and then financial networks. Also, paralyze Tehran’s ability to export crude via dark tanker fleets to China (source of revenues). All while trying to avoid a humanitarian crisis. This will be very challenging for Israel.

There is no doubt that after IDF strikes Iran, IRGC will respond in a tit-for-tat effort…

“The Iranian Foreign Minister’s ongoing diplomatic flurry in the Gulf notwithstanding, Iran will have little choice but to follow up on its threats to strike Gulf energy infrastructure once Iran’s own energy facilities come under attack and it becomes clear – again – that Iran lacks the ability to cause commensurate damage in Israel…This is easy to envision before the end of the year,” Scott Modell, CEO at Rapidan Energy Advisors, wrote in a statement.

Bloomberg noted Friday morning that people familiar with the matter indicate Biden admin officials have signaled to Saudi Arabia they’re on standby and ready to defend the Kingdom against an attack by Iran or its proxies.

Here’s more from the report:

The tacit offer, made in the past few weeks, has given Saudi Crown Prince Mohammed bin Salman and other Gulf Arab leaders some comfort as they await Israel’s response to Iran’s Oct. 1 missile attack, said the people, asking not to be identified discussing sensitive issues. Gulf states fear any escalation of the conflict could severely hurt their economic and security interests, the people said.

In all fairness to Bloomberg journalists, the US doesn’t really have any other option to signal otherwise.

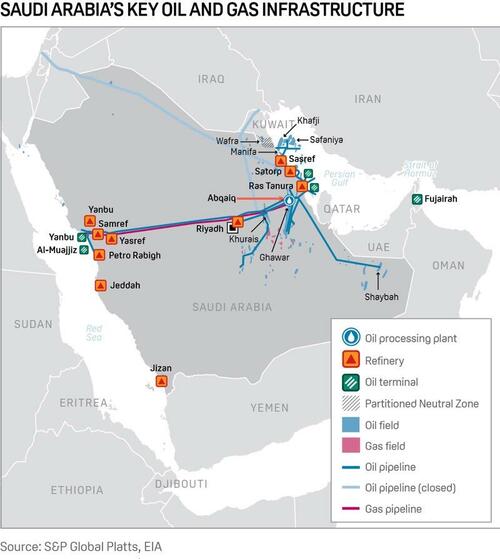

The vulnerability we see is precisely what Iran demonstrated in its drone and missile attacks at Abqaiq (the largest crude oil stabilization plant in the world) and Khurais in Saudi Arabia in 2019.

VIDEO: Aramco footage from security cameras at the #Abqaiq processing centre of the attack earlier this month — via @60Minutes | #OOTT #SaudiArabia #oil pic.twitter.com/IFng8g1sqF

— Javier Blas (@JavierBlas) September 30, 2019

This Abqaiq refinery attack back then briefly shuttered 5% of the global oil supply.

There’s a very real risk that the next evolution of conflict could be IRGC striking oil assets in Saudi Arabia, or even causing trouble in the maritime chokepoint of the Strait of Hormuz – all in an effort to weaponize crude oil markets against the West and spark a financial shock. We’ve highlighted this potential scenario since early March in a note titled “The Weaponization Of Crude Could Trigger The Next Financial Shock.”

Tyler Durden

Fri, 10/25/2024 – 19:40

Share This Article

Choose Your Platform: Facebook Twitter Linkedin